How Developing a Car Insurance App Impacts the Industry: Latest IT Insights

02 Nov 2023

20 Min

465 Views

The leading companies in the vehicle insurance domain strive to stand out of the crowd and seek strategies for attracting and retaining clients. That's why many car insurance businesses have begun providing their services through mobile applications as a convenient incentive for clients to remain engaged.

Based on our 11+ years of experience creating insurance software solutions, we’ve prepared a comprehensive guide on what you should know while planning your car insurance app development. You will consider the core feature set for a car insurance app, examples to inspire, cost challenges, use cases, and many more.

Business Issues Car Insurance Mobile App Development Solves

A car insurance app is a solution created for car insurance agencies, companies, or affiliates to help them prevent fraud activity and streamline quotes, as well as claims management.

Such solutions are helpful for insurance providers because of the following reasons:

- Vehicle insurance apps give more security for client data. This includes essential information about each customer's business transactions with the help of built-in data privacy protocols.

- Car insurance systems improve collaboration among teams. It allows insurers and agents to work with multiple insurance firms and plans more efficiently, as well as enables them to compare prices and strategies effectively.

- These systems boost insurance companies' performance. The insurance claim management software improves efficiency by streamlining the claim process, saving time, and reducing errors.

- Car insurance software enhances client satisfaction. Routine sales activities, such as follow-up messages, can be automated using custom insurance software designed for insurance companies. Staff members can utilize the integrated features of these software systems to evaluate individual consumer requirements.

- Vehicle insurance software ensures better storage and reduce fraudulence. The insurance software system detects fraud quickly with the help of proactive analysis based on stored information. Additionally, it stores and safeguards significant volumes of data in a centralized system.

Looking at the numerous benefits of vehicle insurance solutions, companies strive to build car insurance app for their business. Thus, as IBISWorld data mentions, the market share of the vehicle insurance domain currently exceeds more than $348.9 billion. According to a PR Newswire report, the industry’s market share is forecasted to increase to $1,620.2 billion by the end of 2028.

Considering the stats and the benefits of such a solution for vehicle insurance industry, you can see that the potential of the car insurance app creation is quite wide. So, that’s the time to think out its development for your company.

Know more about insurance app development on the whole from our very particular guide!

Popular Car Insurance Apps List

Before developing a mobile app for car insurance services rendering, it’s always great to learn more about the competitors’ solutions to get valuable insights on what functionality to include in your digital product.

We give a list of apps you can be inspired by while planning to build a car insurance app for your business.

Geico Mobile

Geico offers a mobile app for more than 28 million vehicles in the US, Germany and the UK. The solution allows policyholders to manage their insurance policies, report claims, pay bills, and access roadside assistance, providing convenience through features like virtual ID cards. Moreover, this app includes a Digital Glovebox feature, which helps users organize their important car documents, including insurance cards and registration.

Esurance

Esurance vehicle insurance app from Allstate works on the iOS platform and offers a user-friendly app for managing policies, making payments, and filing claims. Developing a car insurance app, the Esurance company planned it for users from India and the US to get instant quotes.

The Esurance app offers DriveSense telematics as a killer feature that assists you in keeping driving habits on track and provides discounts based on safe driving practices. Moreover, the app also allows you to look through insurance claims and monitor their status in real time. This transparency keeps you informed about the progress of your claim and any necessary actions.

State Farm Pocket Agent

State Farm's car insurance app allows users to manage their policies, file claims, and access helpful resources for safe driving. It also provides access to a local agent for personalized support.

As a killer feature, the app includes Drive Safe & Save functionality for potential discounts based on driving behavior and a Steer Clear program for young drivers to improve their driving habits. The total revenue the app gets for rendering its services was $89.3 billion in 2022.

Must-Have Feature Set to Create a Car Insurance App

We've outlined a comprehensive list of must-have features in a car insurance app, ensuring a seamless and efficient interaction between policyholders and insurance providers.

The solution includes two roles:

- Customer side

- Insurer role

Car insurance app features for customer role

The customer side of a car insurance mobile app serves as a user interface for policyholders to interact with their insurance provider and access various features and services related to their auto insurance policy. Let’s discover the major functionality of the customer side of the app.

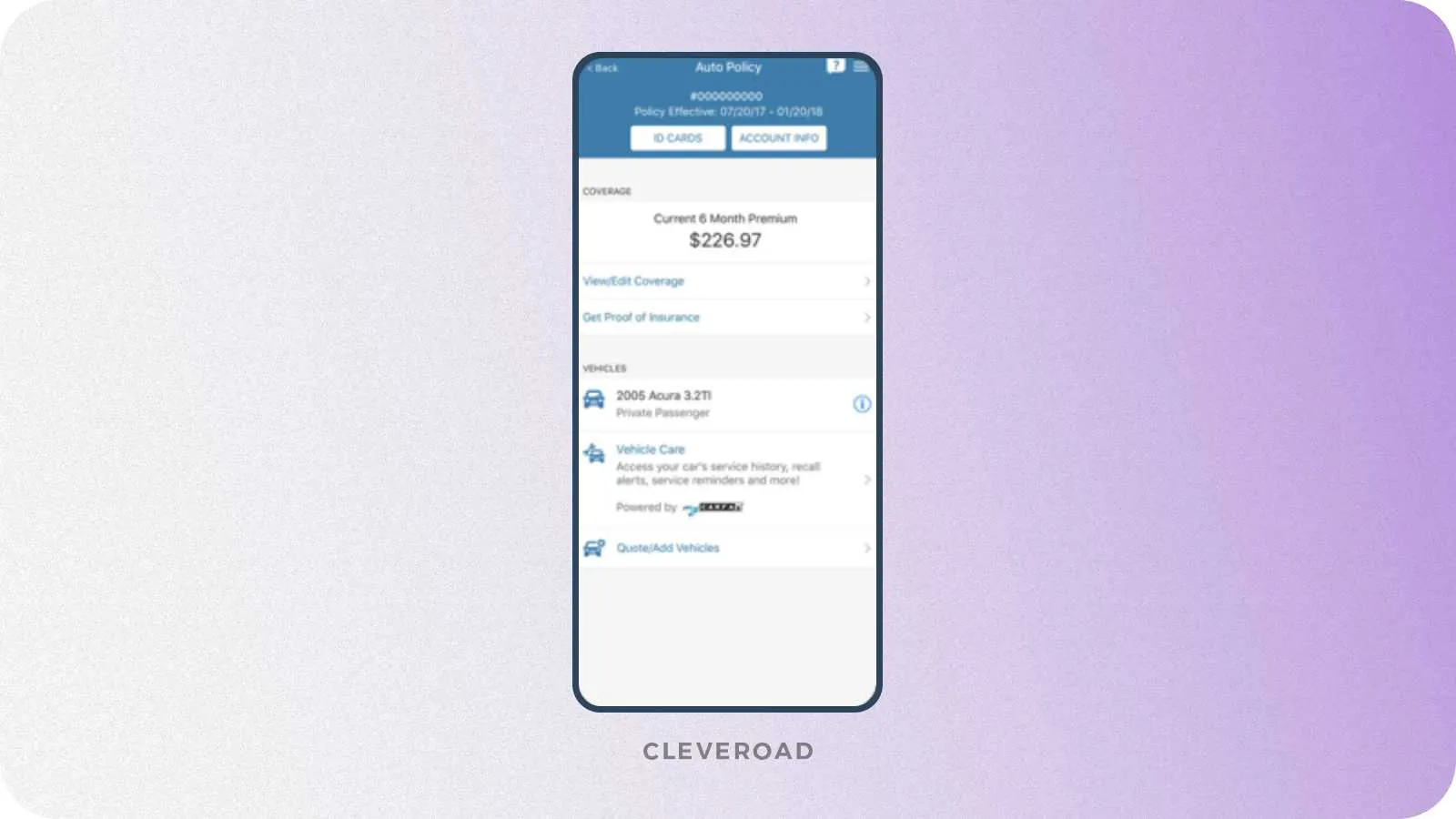

The policy management feature empowers you to have complete control and visibility over the insurance policies, from understanding coverage to making necessary adjustments and payments and staying up-to-date with renewals and policy documentation.

The claims handling functionality streamlines reporting accidents, submitting claims, and tracking their progress. It ensures that your claims are handled with the utmost care and speed, helping you navigate challenging situations with confidence and ease.

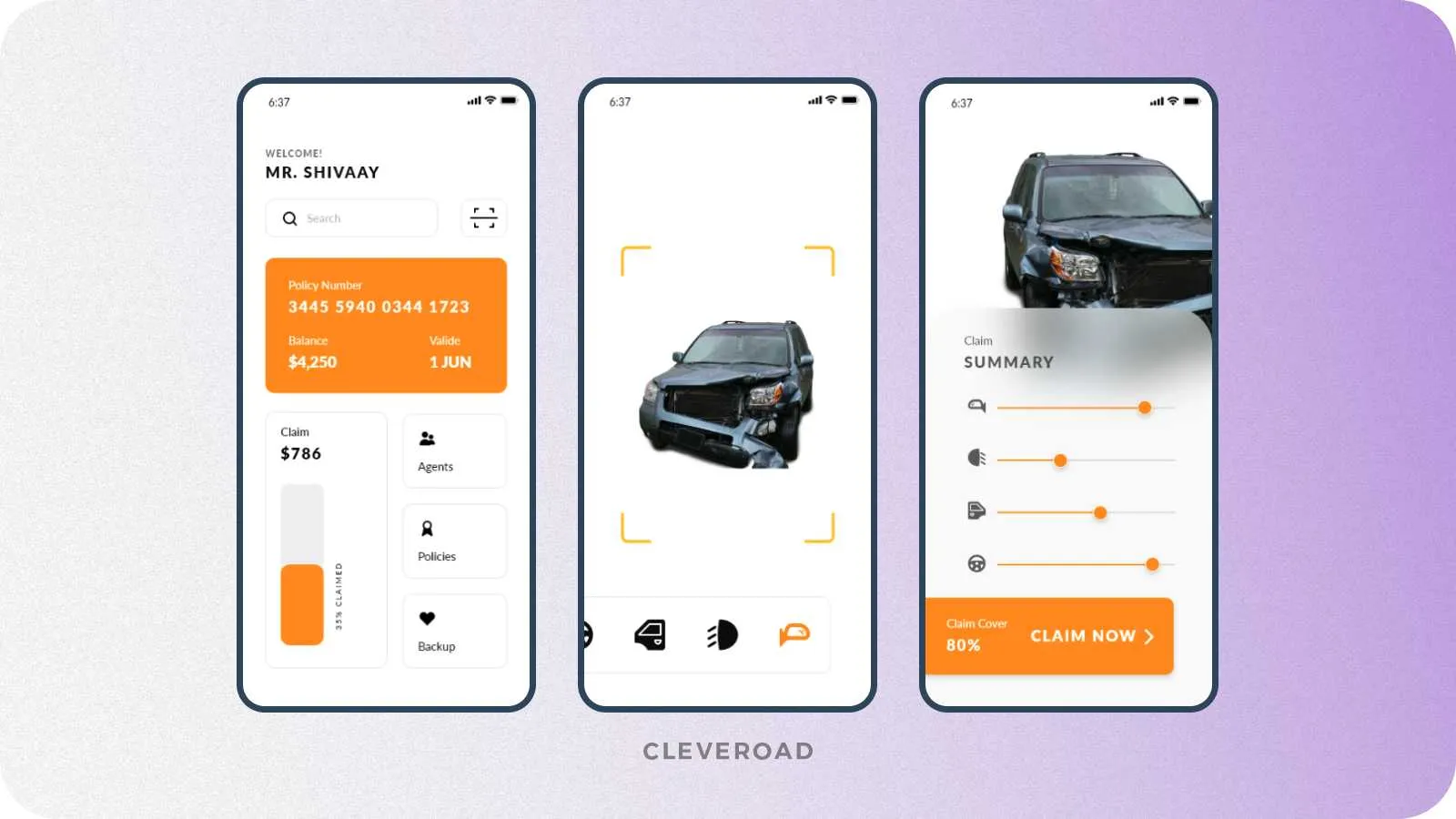

Claims management functionality example (source: Uplabs)

The digital assistance feature provides a valuable resource for obtaining information, requesting help in emergencies, and navigating the complexities of vehicle insurance.

The quotes and coverage customization gives you control of your insurance choices by providing transparency, flexibility, and a wealth of information about coverage options and their associated costs.

The document management functionality simplifies your insurance-related document organization, ensuring that your information is easily accessible and secure. It also streamlines interactions with law enforcement, repair shops, and other involved parties.

The telematics and safe driving feature allows you to monitor and improve driving habits actively, ultimately leading to safer roads, potential cost savings, and a more rewarding insurance experience. While you build a car insurance app, it's a valuable tool for promoting responsible driving and benefiting both policyholders and insurers alike.

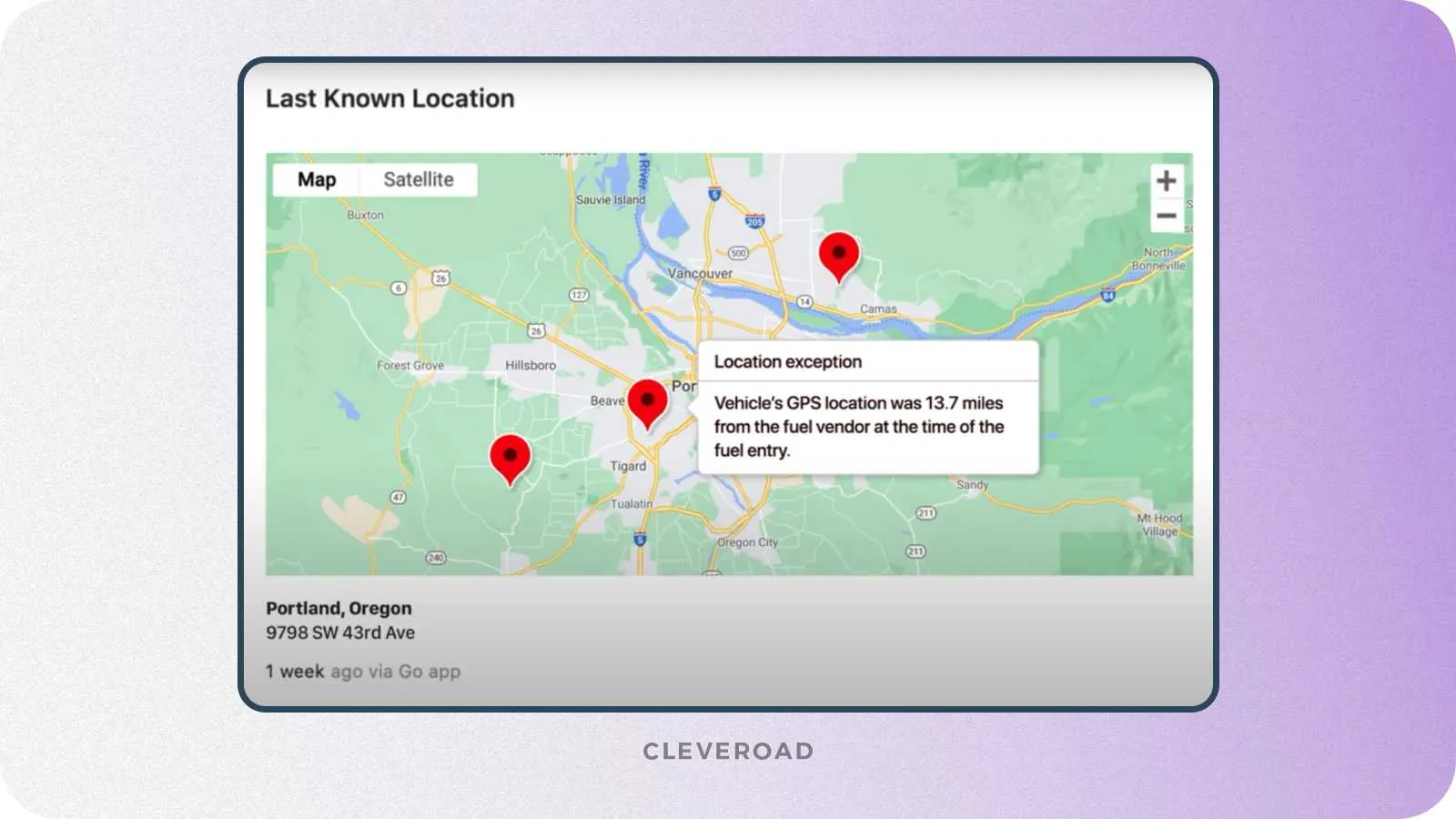

Telematics feature example to monitor your vehicle (source Youtube/Fleetio)

The discounts and rewards feature is a powerful tool for encouraging and rewarding good driving behavior while maximizing cost savings through the car insurance app. It doesn’t not only help you save on insurance premiums but also provides valuable insights and incentives for safe and responsible driving.

The communication and alerts functionality simplifies interactions with the insurer, streamlines document sharing, and ensures that you have the information and support you need at your fingertips.

Vehicle insurance app functionality for insurer role

The insurer side of a car insurance mobile app is designed to facilitate the operations and services offered by the insurance company to its policyholders. It typically includes a set of responsibilities enabling the insurer to effectively manage policies, provide support, and offer various services to clients.

The policy management feature for insurers is essential to streamline their role in creating, updating, and managing policies. It provides insurer users with a centralized platform for operating with customers’ guidelines, viewing policy details, handling endorsements and renewals, and ensuring customers receive the coverage they need.

The policy management feature (source: Geico)

The telematics and risk assessment feature allows the insurers to analyze telematics data and to evaluate customer driving behavior. It also helps the specialists identify opportunities to provide risk-reduction recommendations to customers.

The claims processing functionality helps the insurers work with customer policies, creating or updating them and managing the existing ones. Moreover, they can view policy details, coverage terms, and premium payments. The feature also allows the insurers to handle policy endorsements and renewals.

The claims processing feature (source: Geico)

Customer engagement is helpful for vehicle insurance givers to communicate with customers through secure in-app messaging or chat and send alerts or policy updates. Furthermore, the insurers can offer personalized discounts and rewards based on customer behavior.

The document management feature empowers insurers to efficiently organize, secure, and manage policy and claims documents. It also ensures accessibility for customers and internal staff while supporting document sharing and submission. With robust search capabilities and version control, insurers can effectively handle document-related tasks and provide a seamless experience for customers.

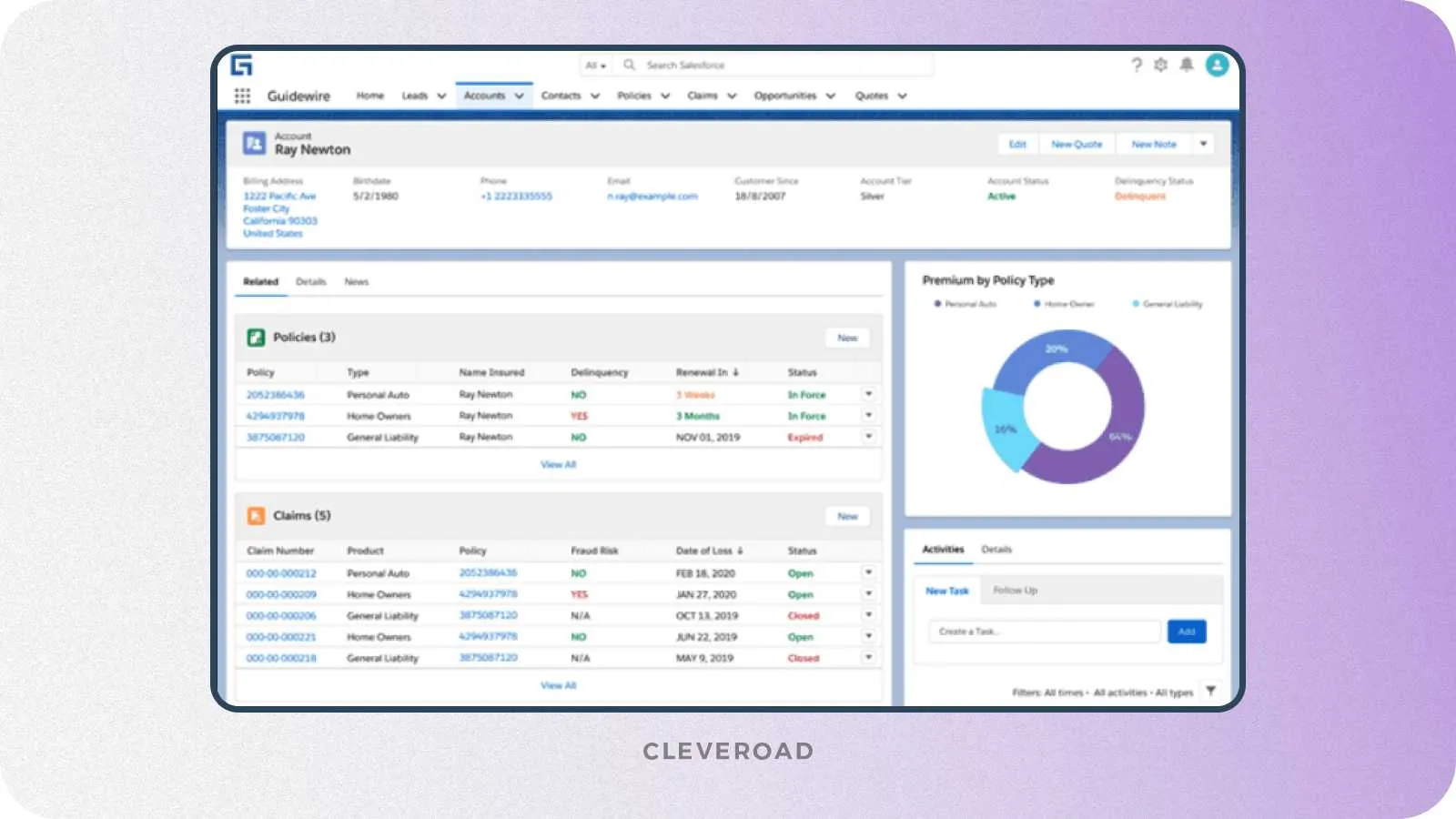

The analytics and reporting allow insurers to make data-driven decisions, enhance underwriting and claims processing, and continuously improve their services. Moreover, this feature supports informed risk assessment, performance monitoring, and compliance reporting, ultimately contributing to more efficient and customer-centric insurance operations.

Insurance analytics feature example (source: Datapine)

The sales and underwriting tools feature enables insurers to evaluate and underwrite policies accurately, provide competitive quotes, and promptly issue guidelines. Implementing this functionality guarantees consistent risk assessment, improving efficiency and accuracy in the underwriting and sales processes.

Moreover, the car insurance solution should have an Admin panel that will allow you to manage the business performance of all of your employees. The admin panel will give advanced analytics reports to you and your administrators about your clients and workers (e.g., number of claims, earning statistics).

This is the list of the core features you can apply to during the car insurance app development process and use as a vehicle insurance app customer or insurer. Please note that it’s not an ultimate feature list and can be changed according to your current business situation and company requirements. Feel free to book a 30-minute call with our Solution Architect and define the entire functionality of your car insurance app, fully applying your business needs!

Car Insurance App Development Process Step-By-Step

Developing a car insurance application for your business could lower claim processing costs and improve customer convenience. If you have goals like the ones above, you can learn how to create a customer-centric product for your car insurance business.

Do homework on your side

Before you create a car insurance app, first make some preparations. For starters, think out your future solution’s target market, its business aims, and how they are connected to your company. Decide on who will use your product: a client or an insurer. It’s essential as the user role will determine the peculiarities of the feature set you may prepare.

Moreover, in order to facilitate your car insurance app creation, you should find a skilled IT vendor that offers insurance software development services. The provider’s specialists will help you build robust and compliant software for vehicle insurance step-by-step.

Let’s look at how the insurance app development passes from the tech side on the example of Cleveroad Software Development Lifecycle (SDLC).

First contact

You can start our collaboration by opening our site and submitting a request where you should point out the essence of your insurance software concept. Then, our Senior Business Delivery Manager will study your request and contact you back to clarify its details.

Solution design stage

Our Solution team, including Solution architect, business analysts, UI/UX designers work with you to define the project scope and create a list of features for your future car insurance app. The specialists will do it based on your business goals and constraints like timelines, budget, and collaboration preferences. As a result, you will be provided with a rough cost estimate for car insurance mobile app development and a proposal.

Discovery stage

Cleveroad's discovery phase services will help you convert car insurance project requirements into a clearly defined plan. Our team will outline the business procedures and the previously gathered needs, including the platforms to be covered (e.g., web, iOS, Android), the feature list, the third-party services (e.g., Google Maps), technologies best applicable for your car insurance app, etc. The specialists document the technical and business demands in the Software Architecture Document. Based on the deliverables from the Discovery phase, our professionals develop a detailed project cost estimate.

Additionally, we assemble a team of IT specialists to build a car insurance app based on your specific requirements. At the same time, the UI/UX designers start working on the future interface of your product. Per your request, we also offer tech consulting services to clarify all your issues connected to your business software creation.

Product development and Quality Assurance

To develop your insurance solution and succeed, we use the Agile software development methodology. Our team works on your project iteratively, from sprint to sprint — two-week intervals when the specialists must do a certain amount of work under the supervision of our Project Manager. The following two weeks' work scope is decided upon by you and the development team.

The development team builds the pre-defined functionality during the car insurance mobile app development process. QA engineers work on your car insurance system project until it is released, testing the functionality built throughout each sprint. Particularly, they test the front-end and back-end simultaneously and provide results that software developers may use to address bugs.

How the insurance management software is being developed? Discover the details in our guide!

Release, maintenance, and support

The team is prepared to launch your car insurance software. Initially, the QA team conducts smoke tests to determine the stability of the product. When significant issues are found, developers are required to make hotfixes. Afterward, we assist with the insurance solution’s release and deployment of your system in your business environment.

If necessary, we can continue to refine the insurance software based on user feedback and ensure the ongoing maintenance of your solution, including enhancements and the addition of new features.

How Car Insurance App Benefits the Insurance Industry: Use Cases

Let’s discuss the examples of successful integration of a car insurance app into business workflow and find out how companies take advantage of such a solution.

OBI+

OBI+ is a Danish technology company that provides accessible connected car services to its clients. However, this business faced difficulties with accessing and handling vehicle data. It was hard for them to integrate such data, give maintenance, and deal with other things not being a software development company.

That’s why they decided to solve these issues and create a business solution allowing their customers to access the dashboard to overview the data and start using it as a service. Due to their business solution, they could enhance their data operations and make their insurance services more secure and streamlined.

Zurich

Zurich is an insurance company from Switzerland offering their services globally. While rendering their services throughout the pilot project in Germany, they were thinking about enhancing the customer experience and making their insurance services convenient for their clients. Particularly, they needed to facilitate the complex claims processes, as well as to automate the related processes, and enhance the transparency of communication with their customers.

The solution was found in developing a car insurance software for Zurich’s business. Connected car data provides insurers with real-time information, aiding in incident assessment. This step is crucial in starting the claims process and sets the foundation for the entire claim. Furthermore, Zurich receives up-to-date information regarding car accidents through its app, which utilizes standardized multibrand-connected car data. When analyzing a collision, it is essential to consider factors such as the car's speed, the direction of impact, and the severity of the crash.

Based on this information, Zurich can accurately evaluate the legitimacy of a claim and provide policyholders with a damage estimate. These tools can help improve claims decisions, customer support, and the overall claims experience by making them faster and more accurate.

CARUSO digital solution

It has become increasingly challenging for emergency responders to provide sufficient assistance to traffic accident victims in recent years, particularly for firefighters. Various tools need to be used and brought to the accident site, depending on the car's technology.

The data provided by the CARUSO Dataplace, including information on vehicle type, engine coolant temperature, and doors and lock status, can be readily accessed by the rescue team while en route to the crash site. By using this technology, they can save time and arrive at the crash site with crucial information, making the rescue operation more accessible and safer.

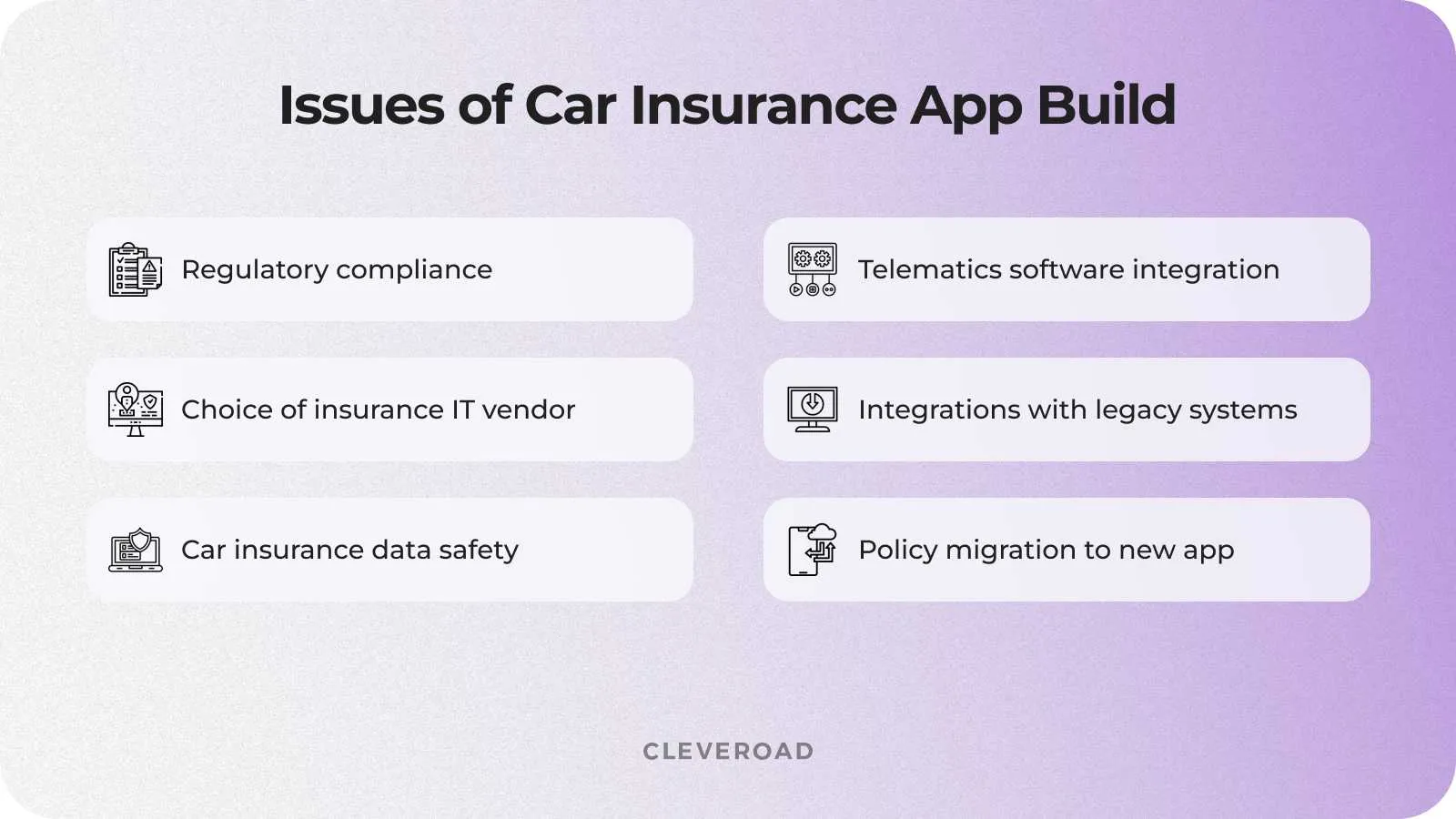

Common Challenges of Developing a Car Insurance App

Here are common problems customers always face in planning a car insurance application building and potential solutions for each issue.

Compliance with regulatory requirements

The insurance industry is heavily regulated, and non-compliance can result in legal penalties, loss of customer trust, and damage to a company's reputation. We’ve prepared a list of standard regulations to consider while developing a vehicle insurance solution.

| Regulation | Why and where essential |

Customer Protection Act | Controls the US business practices |

Payment Card Industry Data Security Standard (PCI-DSS) | Required for vehicle insurance vendors allowing payments through credit cards |

Prudential Regulatory Authority | Regulates and protects car insurance in the UK |

GDPR | Controls the car insurance data handling in EU |

Financial Services Regulatory Authority | Oversees Canadian insurance startup operations and promotes fair premiums |

This is not the ultimate list of regulations your vehicle insurance solution should comply with: the proper regulation choice depends on your target market country. A skilled tech partner knows them and can give you a hint as to the regulatory compliance needed in your particular business case.

Making the right choice for auto insurance IT vendor

Selecting the right IT vendor is crucial for successfully developing a car insurance application. The wrong choice can lead to various problems, including cost overruns, project delays, etc. To mitigate such consequences, you should focus on the following points:

- Seek IT vendors with a proven proficiency in car insurance app development, showcasing expertise in the intricacies of vehicle insurance, like underwriting, claims processing, and policy management.

- Look through vendor references (professional platforms like Clutch are perfect for it) and check the previous clients feedback to gain insights into their experiences, work quality, and whether their expectations were met.

- Evaluate vendor methodologies and ensure they employ industry-standard practices, can handle Agile development, and maintain a quality assurance framework for reliable and secure software.

- Confirm the vendor's adaptability to your needs, recognizing the uniqueness of your insurance company's requirements and operational processes.

- Conduct thorough interviews with potential vendors to assess their communication skills, problem-solving capabilities, and grasp of your project, fostering a productive working relationship.

Since 2011, the Cleveroad team have been helping insurance organizations and coverage providers develop solutions for automating insurance policy management and claims processing, as well as reducing routine tasks. We have an entire team of desktop experts that can be quickly customized to suit your requirements. If needed, you can scale the composed team up and down according to your business needs.

Data safety of your car insurance app

The problem lies in the potential risks associated with data breaches, unauthorized access, and privacy violations. Failing to address these issues can result in substantial financial and reputational damage, legal ramifications, and loss of customer trust.

How to deal with it? When you build car insurance app, implement robust data encryption protocols to protect data at rest and in transit. Use industry-standard encryption algorithms to ensure that even if data is accessed, it remains unintelligible to unauthorized parties. You can also provide an access control implementing Role-Based Access (RBAC) permissions to limit exposure to data on a need-to-know basis.

Integration of your car insurance app with telematics software

Telematics data integration poses a significant challenge when developing a car insurance app, as it encompasses information related to driving behavior, vehicle location, and other real-time factors. These data sources provide valuable insights for risk assessment and personalized insurance pricing, but they can also be complex to collect, process, and analyze effectively within your application.

To start transportation telematics system development and then integrate it with your car insurance solution, you should partner with an experienced tech provider who specialize in data collection and analysis. The vendor can offer pre-built systems, APIs, and expertise to simplify the integration process and ensure data accuracy.

Car insurance solution’s integration with legacy systems

Legacy systems, often built on outdated technologies, house critical data and processes that must be seamlessly connected to your new application. Failure to address this challenge effectively can result in operational inefficiencies, data inconsistencies, and service disruptions.

Solution: You can start solving this issue by formulating a comprehensive integration strategy that outlines the goals, methods, and timeline for connecting the new application with legacy systems. Moreover, you can consider the legacy software modernization services to update your existing software with new features and the latest technologies, making it more streamlined and robust.

Policy migration to a new car insurance application

Migrating existing insurance policies from legacy systems to a new car insurance application is a complex endeavor. It involves transferring vast amounts of critical data, including policyholder information, coverage details, premium calculations and claims histories. Failing to handle this transition can lead to data discrepancies, customer dissatisfaction, and operational disruptions.

You can succeed with this task during car insurance app development by following a well-structured data migration plan with a focus on data cleansing, staged migrations, extensive testing, staff training, and the use of automated tools.

Common challenges of car insurance app development

How Much Does It Cost to Create a Car Insurance App?

The car insurance software costs from $60,000 to $180,000+. The final price can only be determined by a bunch of factors considered by a tech partner while preparing a detailed estimate:

- Number and complexity of functionality

- Platform choice

- Design

- Security

- Regulatory requirements

- Integrations (e.g., claims management software, CRMs, data analytics tools, etc.)

- Team composition and location

The above range of car insurance software development cost is given only for your awareness. The accurate numbers will be mentioned by the specialists when they study your insurance app concept to build and consider the project requirements.

Moreover, the expenses for the development team are one of the essential cost-forming factors for your ultimate insurance software development. That’s why let’s see what specialists you need in your team to create a solution for rendering vehicle insurance services:

- Project manager

- Business analysts

- Solution architect

- Developers

- DevOps engineers

- QA engineers

- UI/UX designers

For example, you can apply to outsource car insurance app building to the IT company in the CEE region (Estonia in particular). It will help you streamline costs for creating a solution for vehicle insurance, start the project launch quickly and obtain the qualitative software in response.

Estonian skilled software developers’ services are available for $50-70 for an hour of work, one of the lowest wages for IT services throughout the outsourcing regions. Estonian IT specialists also work with the latest technologies (e.g., AI, Machine Learning, IoT integration) to make your vehicle insurance solution a cutting-edge one.

Let’s sum up the reason: why is car insurance software development necessary for your vehicle insurance business?

- Vehicle insurance is a promising industry to enter: PR Newswire forecasts that the industry market share will grow to $1,620.2 billion by 2028.

- The car insurance app creation is perfect to ensure your business data security, as it is developed regarding the appropriate regulatory requirements of your destination country

- Creating car insurance mobile app is essential to streamline complex processes like policy issuance, premium billing, etc.

Car Insurance App Development Company: Cleveroad Expertise

Experienced providers bring expertise in the insurance industry, technical proficiency, and cost efficiency. For example, our company can ensure security, compliance, and quality, allowing your organization to focus on core business activities while our experts handle the tech aspects of the app.

Cleveroad is an insurance software development company from the CEE region, particularly Estonia. We have been on the market for 11+ years now, offering app engineering and IT consulting services for insurance agencies and policy providers. Our solutions help insurance companies stay resilient and scalable and boost their operational performance.

Moreover, the benefit of working with us will give you:

- Receiving a robust and secure car insurance app fully satisfying your business needs and developed in terms of your time and budget

- A full team of competent insurance software engineers skilled in insurance policy management as well as claims automation through the proper solution development

- Insurance legacy systems modernization services to meet the latest standards of interoperability, usability, and security of the systems interconnected with new insurance app

- Detecting and preventing claims fraud with the help of our specialists caring about the proper security measures

- On-demand IT services: mobile app creation from scratch, UI/UX car insurance app design services, IT consulting services, and so on.

We would like to share with you one of our successful car insurance app development projects we've delivered - Online Services Ecosystem for Managing Auto Insurance. Our customer is the vehicle insurance company from the USA that had an inefficient company app that doesn't allowed their business to scale. We required to replace the obsolete car insurance web app to a completely new system offering qualitative and convenient services from insurers and their employees. Moreover, our team needed to develop a mobile app for the better insurance experience of our customer's clients

As a result, the customer has obtained the brand-new platform matching their business needs and letting them to receive a revenue by offering their services online. Moreover, they have received a robust web app and a user-friendly mobile app to facilitate online connections and attract new clients to their insurance business.

We are ready to help you create reliable and robust vehicle insurance software that will help you effectively automate your day-to-day insurance operations and render your services more effectively. Let’s start our cooperation to provide maximum value to your business and secure your insurance data!

Need car insurance IT experts’ assistance?

Book a call with our IT insurance experts to develop a robust and resilient bespoke car insurance app optimizing your claim management flows

Yes, they are! They give more security for client data and improve collaboration among teams. Moreover, they boost companies' performance. And finally, car insurance software enhances client satisfaction.

First you should think out your future insurance solution and find an outsourcing car insurance expert to collaborate with. Then, you can entrust the solution’s development to the hands of a vendor controlling them and approving the prepared pieces of functionality or making your corrections.

The car insurance software costs vary from $60,000 to $180,000+. The the final price can only be determined by a bunch of factors (e.g., feature list, tech stack, team composition, design) considered by a tech partner’s specialists while preparing a detailed estimate.

When you build car insurance app, implement robust data encryption protocols to protect data at rest and in transit. Use industry-standard encryption algorithms to ensure that even if data is accessed, it remains unintelligible to unauthorized parties. You can also provide an access control implementing role-based access (RBAC) permissions to limit exposure to data on a need-to-know basis.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article