How to Create an Investing App in 2025: Must-Have Features and Cost

Updated 22 Apr 2023

9 Min

5415 Views

Information technologies have revolutionized the stock trading area. A few decades ago, the investment seemed to be complicated and required special education. Still, today with investment app development, it has become so simple that even teenagers can easily manage it. In the past, you had to call your broker to invest or trade your stocks. Today you can just use your mobile phone for making business transactions.

Mobile app development for the stock market is a potentially successful idea for both startups and existing enterprises. Let's consider the main reasons to build an investment app like Acorns for the stock market.

If you are going to build a mobile app for investors, you should scrutinize your target audience. Micro-investments gained their popularity simply because 69% of Americans have less than $1,000 in their account.

This guide will discuss how to build an investment app, must-have features, and monetization models.

Market Overview of Investment Apps

Investment apps have changed the way people invest money. A lot of people choose mobile-friendly solutions since they are easy to use. Robinhood claims that there were 13 million active users in May 2020, and this number is constantly growing.

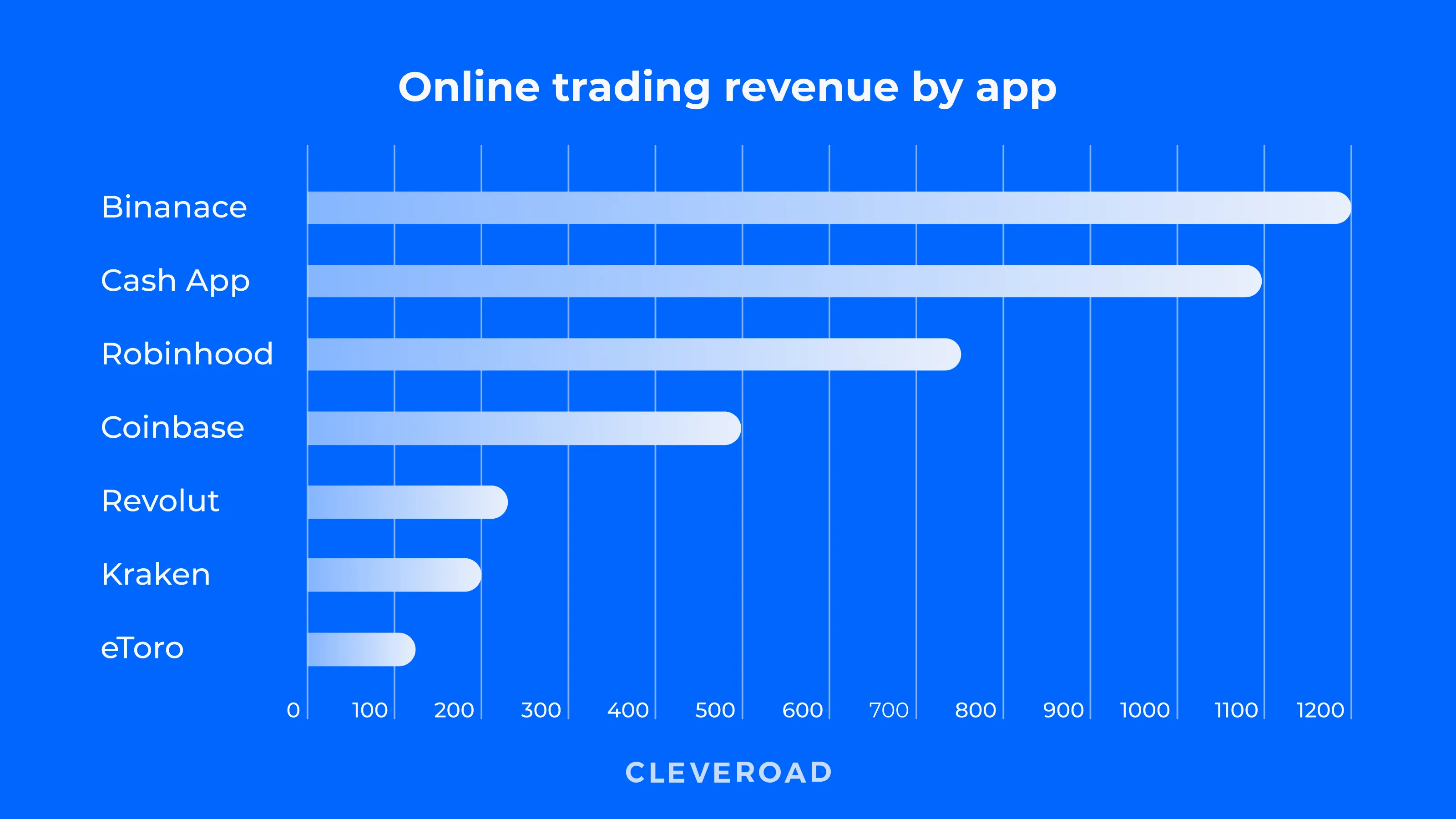

Online trading apps raise their profit, as you can see on the chart below.

Trading app revenue

Types of Investment Apps

Investment app development requires preparations. It’s better to decide on the application type beforehand since the chosen type determines the required feature. There are three widespread types of investment apps:

Banking apps

These apps focus on providing customers with a user-friendly opportunity to fulfill their banking needs and requirements.

Example: Ally Bank, Bank of America, Capital One

Investing apps

They tend to simplify the investing process for the users via the brokers’ unification. Investing apps usually offer advisory services.

Example: Acorns, Invstr, Betterment

Exchanged-traded funds apps

Exchange-traded funds allow users to participate in stock trading.

Example: Robinhoods, E-TRADE, Vanguard

Best Examples of Investment Apps

Before launching your project, it’s better to consider existing solutions on the market. How to build an investment platform which will be successful? It requires attention to detail, so there are top four services for you to take a look at.

Invstr

Invstr is an investment app that focuses on beginning investors. It offers fantasy stock games with $1 million virtual money. There’s also the app’s social network and news feed for the users to get ideas.

Wealthfront

Wealthfront is one of the top investment solutions on the market with a robo-advisor. It helps manage money for a tiny fee ( 0.25% advisory fee). Opening the Wealthfront account, every user gets $5,000 managed for free.

Acorns

Here would like to specify what is Acorns app. The app is oriented for millennials that don't have spare money for investment. Acorns offers to invest in small steps. The app is tracking purchases of your credit and debit card and rounds off every purchase from them to a round sum. The margin is put away in the investment portfolio.

Betterment

Betterment is also an investment app with a robo-advisor. This solution offers professionally managed portfolios with a selection of ETFs. Betterment has reasonable fees — 0.25% for the basic account or $25 annually for $10,000 the user has invested.

Widespread investment apps

How to Create an Investment App: Steps to Follow

Investment app development requires preparation and time. There are several steps you should consider to create an investment app and not fail.

- Step #1. Do a market research

- Step #2. Consider the compliances

- Step #3. Hire a development team

- Step #4. Make a feature list

- Step #5. Create an attractive UI/UX design

- Step #6. Pick the technologies

- Step #7. Develop your app

- Step #8. Deploy your investment app

Let’s discuss the details of every step.

Step #1. Do Your Homework

To create a successful solution, you need to define customers’ pains and requirements. It’s better to study your target audience, their age, income level, place of residence, and more.

Doing market research, you should find answers to the questions like:

- What are the goals of your investment app?

- Who is your target audience?

- What are the customers’ needs and pains?

- What features can solve their problems?

- How to monetize your solution?

Analyzing the collected information, you can make a list of must-have features. After that, you can share desirable features with a development team and find out the tech solution for your project.

Step #2. Comply with Regulations

Investment app development requires attention to every detail since the app collects, processes, and store users’ personal data. Your solutions should comply with General Data Protection Regulation (GDPR). You have to ensure that your business is legal and financially ‘pure’. The regulations can vary depending on the region.

We’ve already covered the ways to comply with GDPR in 2025.

In the United States, the fintech industry follow:

- The rules of the Federal Trade Commission (FTC)

- The laws of the Consumer Financial Protection Bureau (CFPB)

To create an investment app in the UK, it’s better to apply to the Financial Conduct Authority (FCA).

Step #3. Cooperate with a Qualified Development Team

The modern IT market offers two options to hire software engineers — create an in-house development team or pick a reliable outsourcing company. Each option has pros and cons.

An in-house team is perfect for existing solutions when you’ve already released the product and got some profit. Such a team is usually more involved in the project and is perfect for improving your tech solution.

Additionally, in-house software development tends to be more expensive in comparison to the outsourcing company.

Outsourcing becomes more popular due to affordable hourly rates, experienced software engineers, and the high quality of the final product.

Mind that developers’ rates can change depending on the region. For example, by hiring a software development team from Ukraine (Eastern Europe), you can reduce project costs.

| Specialist/Region | North America | Australia | Western Europe | Eastern Europe | Asia | South America |

Front-end developers | 130-150 | 100-110 | 61-80 | 50-60 | 35-55 | 45-80 |

Back-end developers | 130-150 | 100-110 | 61-80 | 50-60 | 35-55 | 45-80 |

iOS developers | 130-250 | 80-150 | 120-175 | 50-80 | 30-75 | 80-120 |

Android developers | 150-170 | 110-120 | 120-175 | 45-75 | 30-75 | 80-120 |

UI/UX designers | 50-150 | 50-150 | 50-100 | 25-50 | 20-49 | 50-150 |

QA engineers | 50-150 | 50-150 | 50-99 | 25-50 | 20-49 | 50-99 |

DevOps engineers | 100-149 | 100-149 | 100-149 | 25-49 | 29-29 | 50-99 |

Step #4. Draw Up a List of Features

It’s common to divide features into two categories — MVP and advanced. Basic or must-have features mean essential functionality that satisfies users’ basic needs. It’s better to start with developing an MVP and release your solution. After getting some feedback, it’s possible to add more advanced features.

All you need to know about building an MVP in our guide ‘How to build an MVP: Steps, Examples, Benefits.’

How to build an investment app and gain a lot of users? You should add useful features. To give you a hint, there’s a list of must-have features of the investment app.

- Registration. It’s better to offer several ways to register and log in. For example, you can implement sign in via accounts like Apple ID or Google. Additionally, you can add email and password, phone number and password signups. Mind that the ‘Forget password’ feature makes your app more user-friendly.

- Linking bank account. Since you create an investment app, users need an opportunity to link their bank accounts and see the list of their banks.

- Payments. A secure payment gateway is a must for any investment app. Users need to have several options like Stripe or PayPal.

- Dealing with stocks. Users need an opportunity to sell or buy stocks. Moreover, they need to search and sort stocks.

- Personal profile. To manage and add personal data, users need a personal profile. They can set a sum to withdraw or add bank information here.

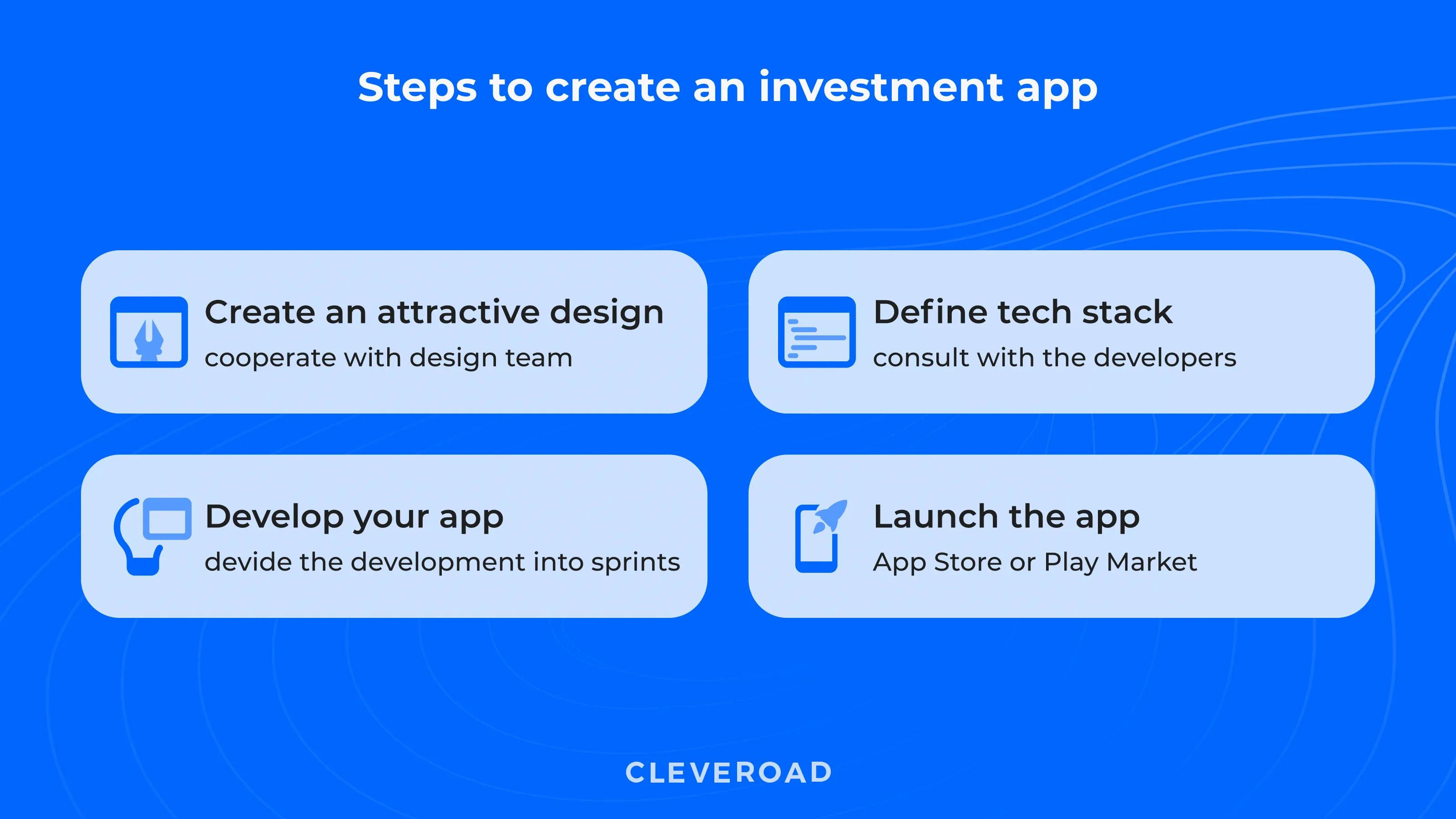

Investment app development: Steps to follow (Part 1)

Step #5. Create an Attractive UI/UX Design

Let’s face it — customers don’t use unattractive or unclear applications. Investment app development requires qualified UI/UX design services to create all the required screens and their conditions for your iOS and Android investment apps.

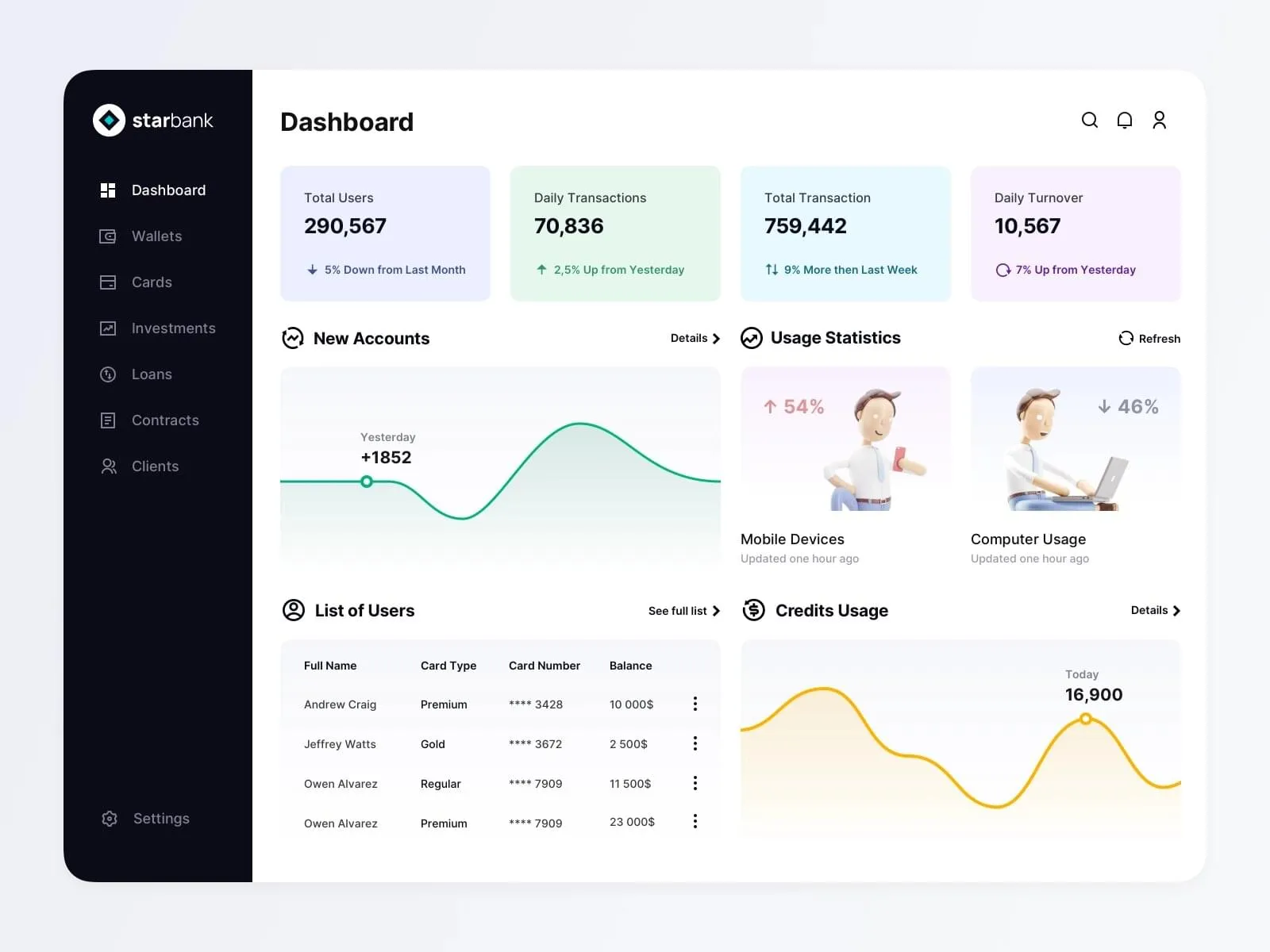

Investment app concept (Source: Dribbble)

Step #6. Choose the Right Tech Stack

The chosen technologies ensure your project stability and scalability. If you want to improve your app later, you should consider app architecture and technologies beforehand.

The tech stack always depends on your project needs and requirements. It’s better to consult with a development team to pick the appropriate tech stack.

To give you a hint, there’s a common tech stack for app development.

iOS

- Programming language: Swift

- Networking: Alamofire

Android

- Programming language: Kotlin

- Networking: OkHttp 3

Back-end

- Programming language: Node.js

- Framework: Express 4

- Database: MySQL

- API: Swagger

Tools

- Signup: Amazon SES, Amazon SNS

- Payment: Braintree

- Push notifications: FCM

- Storage: Amazon S3

Step #7. Create an Investment App

It’s time to move on with the investment app development.

Development tends to be the longest stage. To make the process more structured, it’s common to divide the development into several parts (called sprints). Each sprint usually takes two weeks (ten working days).

During this period, software engineers implement the required part of app functionality, and Quality Assurance engineers test your investment app to find bugs.

Step #8. Release Your Solution

The last step of investment app development is launching your product. You need to release the application to App Store (iOS) or Play Market (Android).

Usually, the development team helps you release the apps.

Investment app development: Steps to follow (Part 2)

Cost of Investment App Development

Our specialists have prepared an estimate of the investment app.

In the table below, you can find an approximate development time by modules. Software engineers require at least 1,538 hours to create an investment app (iOS or Android).

Remember that every investment app is unique. Please contact our team to get a custom estimate for your solution.

| Modules | Features | Approximate time, iOS or Android (hours) | Approximate time, back-end (hours) " |

Landing page |

| 55 (front-end included) | |

Singup |

| 44 | 24 |

Complete registration |

| 46 | 32 |

Bank account |

| 90 | 116 |

Home screen |

| 46 | 100 |

Payment method |

| 70 | 48 |

Stocks |

| 202 | 114 |

Sell stocks |

| 19 | 30 |

Cart |

| 27 | 41 |

Profile |

| 50 | 72 |

Total development time, iOS or Android | 1226 hours | ||

Total development time, iOS and Android | 1820 hours | ||

The investment app also requires a thoughtful admin panel. Using the admin panel, you can manage users and their transactions. Mind the admin development cost while calculating investment app development cost.

| Module | Feature | Approximate time, backend included (hours)" |

Signup |

| 20 |

User management |

| 96 |

Transaction |

| 96 |

Withdraws management |

| 74 |

Messages from 'Contact Us' form |

| 26 |

Total development time | 312 hours | |

In the table above, you can see that to create investment apps (iOS and Android) and an admin panel, software developers need at least 2,132 hours. Having divided development time into smaller parts (called sprints), we get seven development iterations.

Investment app development requires the following development team:

- Front-end developer - all sprints

- Back-end developer (2X) - all sprints

- iOS developer (2X) - all sprints

- Android developer (2X) - all sprints

- UI/UX designer - sprint 1-5

- Business Analyst - sprint 1-5

- Project Manager - all sprints

- QA engineer - all sprints

- DevOps engineer - all sprints

- Team lead - all sprints

With this team composition and development time, investment app development cost will approximately $137,700. As a software development company, we can guarantee high product quality within deadlines only if there's entire team composition.

How to Monetize an Investment App

How to make an investment app profitable?

You should consider the monetization strategies before starting the development. Here are some popular ways:

Fees from various transactions

Most investment apps charge fees for depositing, withdrawing funds, or purchasing or selling assets. Robinhood, Ellevest, and Coinbase follow this monetization model.

Premium subscription

Users have to subscribe to start buying or selling stocks. Usually, apps offer monthly or annual subscriptions.

Advertising

It’s as simple as it sounds. Users see the advertisement to keep the app free.

Monetization models for an investment app

How Cleveroad Can Help You

Cleveroad is a software development company located in Eastern Europe, Ukraine. We have expertise in various industries, including FinTech, Healthcare, and Retail. Our software development team has worked on several FinTech projects. Unfortunately, we can’t share the details since these projects are under NDA.

Feel free to look through our portfolio and ask about technical staff. Fill in this short contact form, and we’ll get back to you within 24 hours.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

1 commentsthank you keep it up but cab get more videos thank you