How to Build an Accounting Software and Make a Go of It

Updated 22 Aug 2023

19 Min

11522 Views

The right approach to monetary issues means a lot. And when companies control their income and expenditures wisely, they will always be aware of the current financial situation. But today we cannot rely on our brain only, and digital technologies like accounting software can greatly help with financial management. Still, not all existing software works for different types of business. That’s why many companies are looking for more advanced solutions like building accounting software specifically for their needs.

In our guide, we will reveal how to create accounting software and you will find a detailed review of custom software, types of accounting software systems, their features and much more. Let’s get started.

Business Challenges the Accounting Software Solves

Why do companies build accounting software? For a start, it’s simply impossible to do business without accounting. Web-based accounting software helps with tracking all incomes and expenditures. And data received by the accounting department makes it possible to determine how well the business is running. Accounting department collects information, strikes balances and analyzes financial data of an enterprise.

See how to build a subscription management software. Read How to create a subscription manager app for saving money?

Accountants always use special applications, and there is a wide range of solutions accounting software developers work on. They can be applied to both small businesses and large enterprises. But what specific problems can accounting software solve? Here they are.

Save time

As a fact, finance and accounting software helps not only with saving money but also time. Even if companies have an accounting department with high-skilled specialists, it’s impossible to keep in mind all the nuances of financial activity. The software can automate many financial processes and make them flowing continuously without accountants watching over them.

Process data faster

It’s very important to process data in a fast and high-quality way. Business owners don't have time to wait when accountants will process all papers. They need to get information about the financial situation timely. And that is what financial accounting software does — it allows users to get quick access to important information.

Prevent human errors

Unfortunately, sometimes even best specialists make mistakes. But we can’t say the same about software. It always does calculations and processes operations accurately. So after accounting system development, organizations should no longer worry about calculations accuracy.

Double efficiency

Another reason why companies build accounting software is the need to store a large amount of data. This software memorizes all changes easily and allows accountants to operate with all necessary information.

That is the list of main advantages of creating your own accounting software. Of course, there is no universal solution that can be adapted for all types of business. But custom applications can help your company to simplify financial operations and speed them up.

Now let's take a short look at the main accounting software types.

Types of Accounting Software

Before you create accounting software for your business you need to choose a type of software that will suit best to your goals and needs. There are different types of accounting software, and we can divide them as follows:

Spreadsheets

This is the simplest type of accounting software. Microsoft Excel and Google Spreadsheets are it's best examples. In fact, these are tables using which accountants can input all necessary data (figures, text, numbers, etc). Spreadsheets make it possible to calculate data, create lists, and put everything in order. It’s a very good solution for managing simple tasks, but it won’t be an asset for middle and large-sized business.

Commercial software

Small and middle-sized companies can benefit from commercial applications. The software offers it's users a set of the most widespread features to perform accounting tasks. Accountants prepare tax reports using this software, send them, check for new changes in law, or manage auditing process. Sage Business Cloud Accounting (formerly Peachtree) is one of the most famous commercial software examples.

Software for Enterprises

By developing accounting software, large enterprises can organize their workflow more effectively. These companies deal with a huge amount of information, so they need software that is capable of processing it. Also, customized accounting software for enterprises serves as an ERP solution offering planning features, workflow optimization, integration with other required financial systems, and so on.

Personal accounting software

This type of accounting software may be helpful for tracking personal finances and spending. It is often utilized for purposes like investing, budgeting, bill tracking, retirement planning, etc. Usage of such software on a daily basis may significantly simplify dealing with financial aspects and sometimes improve financial situation due to a strict systematization.

Also, accounting software can be sorted by the development type:

Ready-Made Services

If you intend to build accounting software, this type is definitely not for you. Ready-made solutions have a common set of features and they rarely can be customized according to specific needs. In addition, they have lots of limitations. There can be a range of features you don't need, and third-party systems are rather difficult to deal with. This implies difficulties in personnel training which slows down the business processes and leads to financial losses.

So, let’s sum up all pros and cons of off-the-shelf accounting software.

Pros:

- No additional expenses like designing, developing, testing and so on.

- Lots of learning material that supports the onboarding process.

- Fast implementation due to the help of vendor’s personnel.

Cons:

- No flexibility, limited customization, and need to adapt your workflows to new accounting software.

- Risk to pay for the features you don’t need.

- Update issues since vendors can change their products as they see fit, and updates can be either good or bad for you.

Custom Software

If you don't want to puzzle out how third-party services work, then it’s better to create accounting software from scratch. Custom accounting software is developed according to business needs and helps staff to be more productive. These systems are easy to use, they are usually well-designed and fast-running.

Let’s overview the pros and cons of developing such a solution from scratch:

Pros:

- Customization. Developing a software solution according to your special requirements and demands and taking full control over the process should not be underestimated since this can define your accounting software future.

- Scalability. While developing software, it is crucial to realize its future abilities. Developing it from scratch gives you flexibility, which is a key factor in creating a solid architecture capable of handling massive data loads, traffic, and further expansion.

- Security. By building bespoke software , you can set elaborate security measures that will be strong enough to protect data. This makes sense, especially if you plan to work on a solution directly operating on highly sensitive financial data.

- Long-term cost savings. Yes, at first custom-made solutions may require significant investments. However, from a long-term perspective, it will become beneficial. Brand new solution eliminates unnecessary features maintenance, licensing fees and helps you avoid the ongoing need for customization.

Cons:

- Time and cost. Developing a solution from scratch definitely requires particular investments in terms of finances and time. To create every feature accurately and reliably, highly-qualified specialists are also needed, which means more spending compared to a pre-built solution.

- Tech challenges. Such a way to build app requires a lot of detailed work, which may cause certain issues. Your team must handle all software aspects, including security, scalability, and compatibility. This may require additional effort and research.

- Difficulties in reusability. Creating a customized niche solution is harder to reuse as a cortex for other projects. Rebuilding it for other purposes appears to be inefficient and time-consuming.

Learn how to arrange offshore software development wisely. Read a comprehensive guide to offshore software development

Existing types of accounting software

Now, let’s highlight all pros and cons of custom accounting software.

Pros:

- Software made to comply with your business needs, goals and workflows.

- Faster onboarding due to tailoring the software specifically to the workflows of your company.

- You can lay down the foundation of future scaling when building your own accounting software.

Cons:

- Development process will take time.

- Support and maintenance completely lie on your shoulders.

As you see, Cleveroad provides you with strong reasons why you need a custom accounting software and how it can help your future users simplify and speed up their work. Cleveroad developers can create a high-quality accounting software for you according to your requirements.

How to Develop an Accounting Software Step-By-Step

When you’ve picked the type of accounting software you plan to build, it’s important to think over all the necessary steps. Usually, developers divide the accounting software development process into the following stages:

Step 1. Research

The development process starts with the team finding out everything about the future software. First, developers and their clients should discuss each point concerning accounting software design and functionality. Then developers conduct research finding out all strong and weak sides of the solution.

Step 2. Solution design

This step implies collaborating with the Solution Team to define the cortex and business aim of your project. This helps to receive a deeper understanding of the project’s purposes and to clear up and systematize requirements. This process includes determining the following:

- A work scope

- Business goals

- Basic quality attributes

- Main & concerns

If you feel the need to still clarify some aspects you can schedule an additional meeting with a team. After all details are established, the Solution Team can present you with a rough estimate and approximate timelines for building an accounting system.

Step 3. Discovery phase

Discovery phase helps to transform your requirements into a well-structured plan. Here all demanded features, functionality, a platform of launch, and cooperation with third-party services are taken into account. Also, this stage covers aspects like:

- Creation of a detailed features list

- All essential business processes analysis

- Building of a visual concept, etc.

Step 4. Estimation and Design

When the estimation of the project is completed and the budget is drawn up, it’s time to work on wireframes and prototypes. By the way, the cost of accounting software development services mostly depends on the number of features the client needs.

Creating an authentic visual concept will be one of the key aspects of promotion for your project. UI/UX designers will help you to decide what will suit your project’s purpose best, and how to apply this correctly while working on design.

When creating first sketches of software, it helps both you and developer understand how the software will look. At this stage, you can provide feedback regarding the design, recommend what to add and what to remove. When the skeleton of the software and it's potential design are approved, you’re moving to the most important part – the development itself.

Discover more about the UI/UX design process in our detailed guide.

Step 5. Software Development and QA

Accounting software development process is rather complex, and it takes hundreds of hours to create a high-quality product. Developers start with creating a functioning version of accounting software. If necessary, accounting software can be developed using test-driven development approach. It means that developers and QA engineers write test cases for software before it's actual development. It helps with avoiding possible bugs in the future.

During this stage, one of the most important decisions is made - where to host the software. There are 3 options to choose from, each with its own pros and cons:

- On-premises solution. This option is one of the most popular. However, it requires additional costs and a solid infrastructure to manage the accounting software effectively. Another weakness of this solution is that local solutions are much more difficult to update and maintain. And the more complex the update is, the higher the price tag will be for this process.

- Web-based software. This option’s main idea is that there are separate hosts that provide space on their servers for your software. Hosting your software on a remote server you need to pay a certain fee which is required by the hardware provider. A huge plus of this option is that the Web-based accounting software is many times more flexible and easy to customize and update. And the easier it is for you to maintain the software, the fewer costs will be spent on this process.

- Cloud hosting. The last hosting option slightly changes the vector of your software. Cloud-hosted accounting software is delivered as a service to end-users, eliminating the need for expensive infrastructure investments and overheads. In addition, such software has excellent scalability, which allows you to modify it so that the software always meets the current business requirements.

Step 6. Maintenance

If you want your platform to run for years, you should consider it's maintenance. Since your product is accounting software, it needs to be updated from time to time due to new changes in the accounting market. The software should always be under control of experienced devs if something is to be changed.

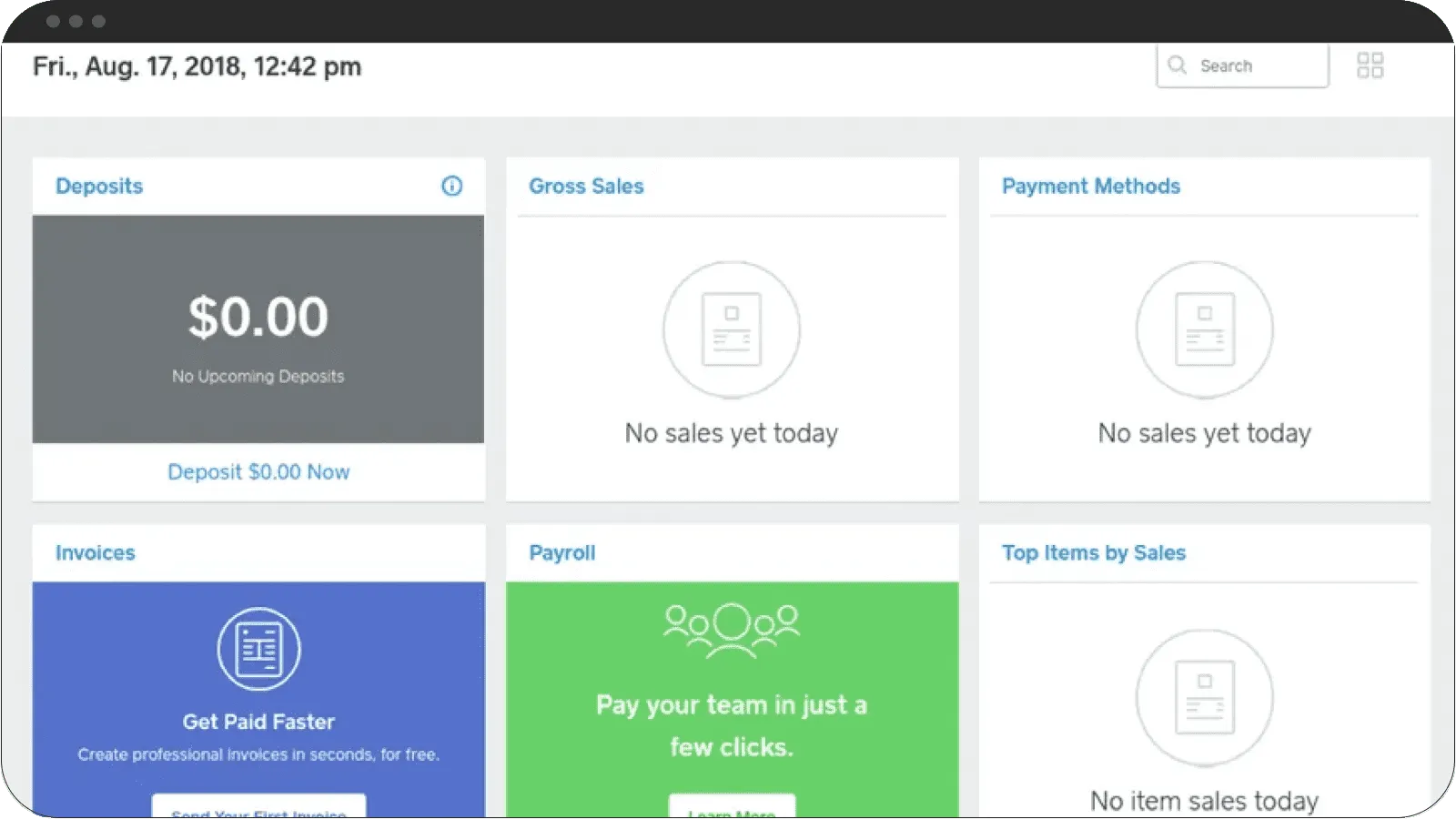

Basic Features of Accounting Software

If you’re wondering how to build accounting software specifically for your needs, create a list of MVP features first. We hope that our list of basic features can help with this process.

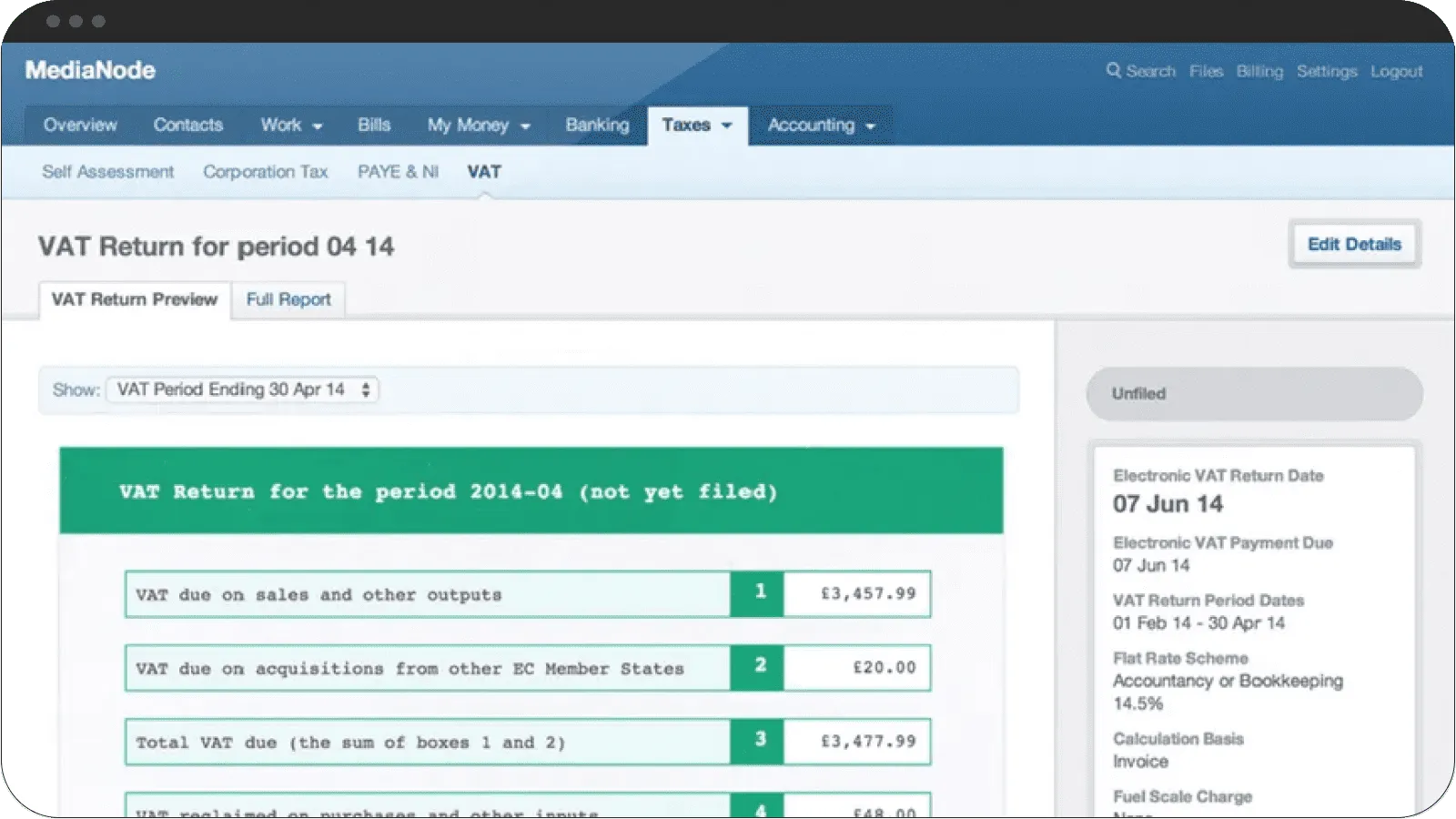

VAT calculations

Accounting software should undoubtedly calculate all VAT payments after each tax period. It saves accountants’ time and helps to avoid mistakes.

VAT calculations

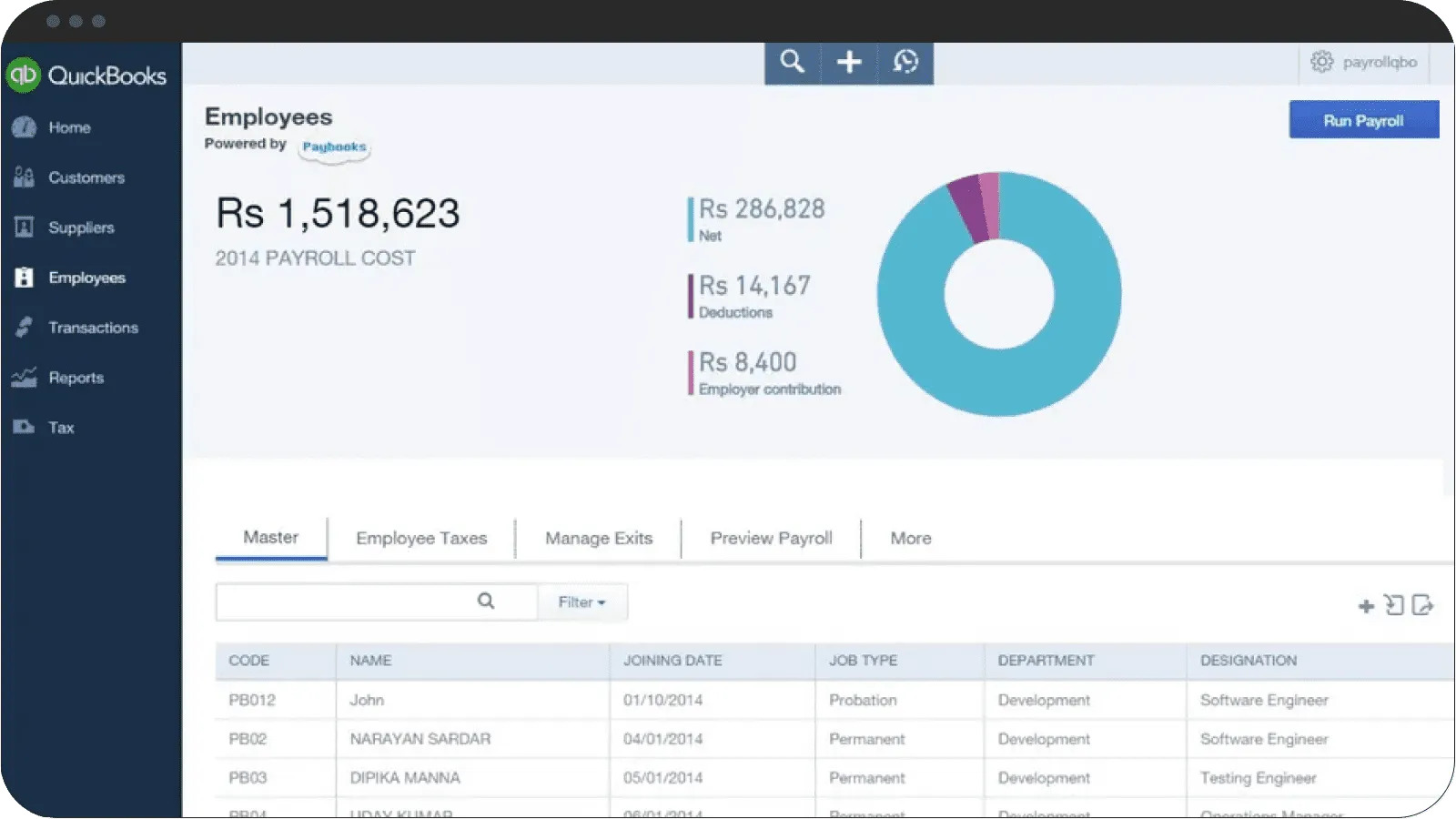

Payroll processing

All companies have employees whose salaries should be monitored and managed. Accountants can input the required salary amount per day or per month for each employee. The software will help with calculating the total pay for the indicated time period including bonuses and taxes.

Payrolls processing

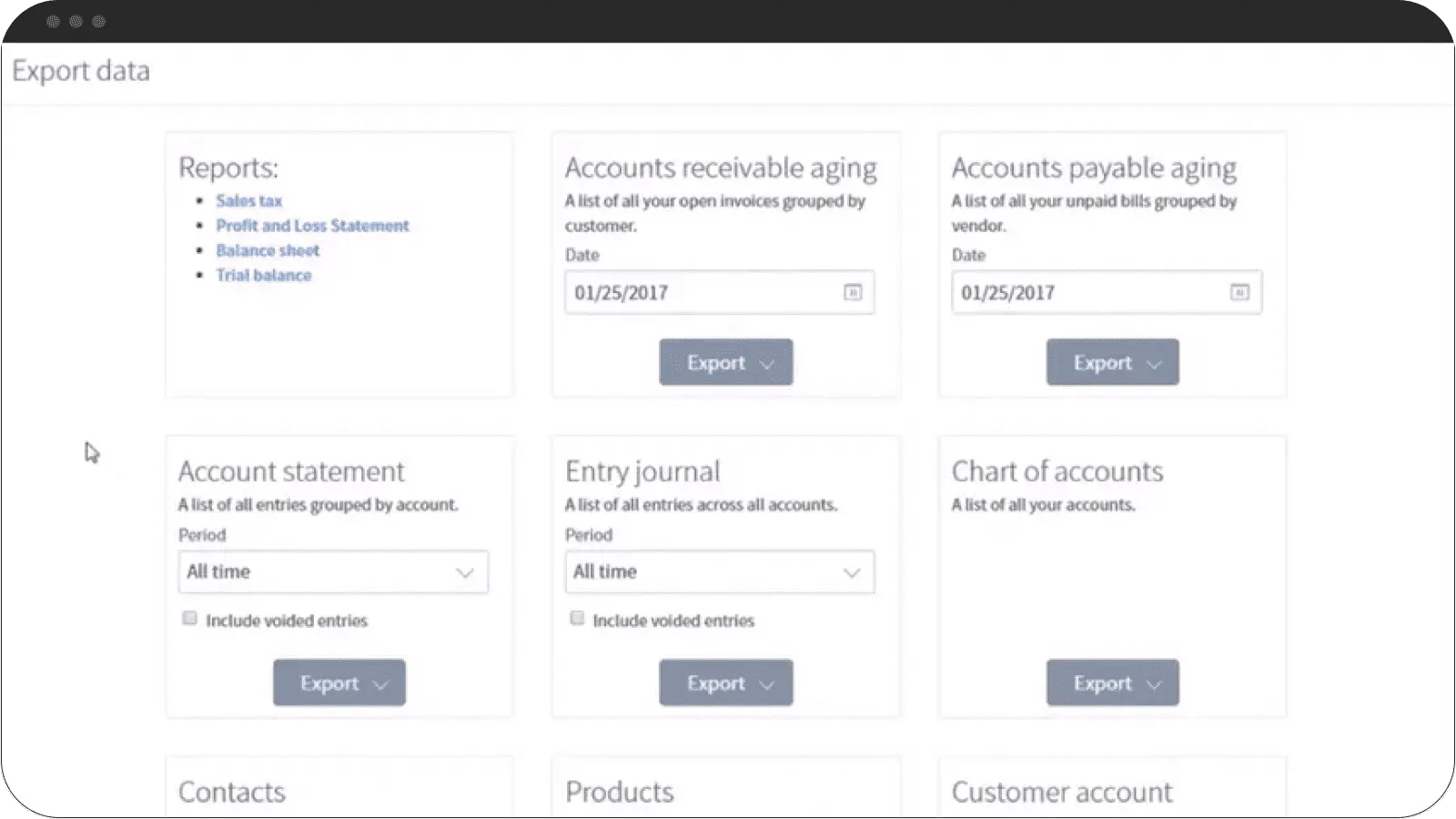

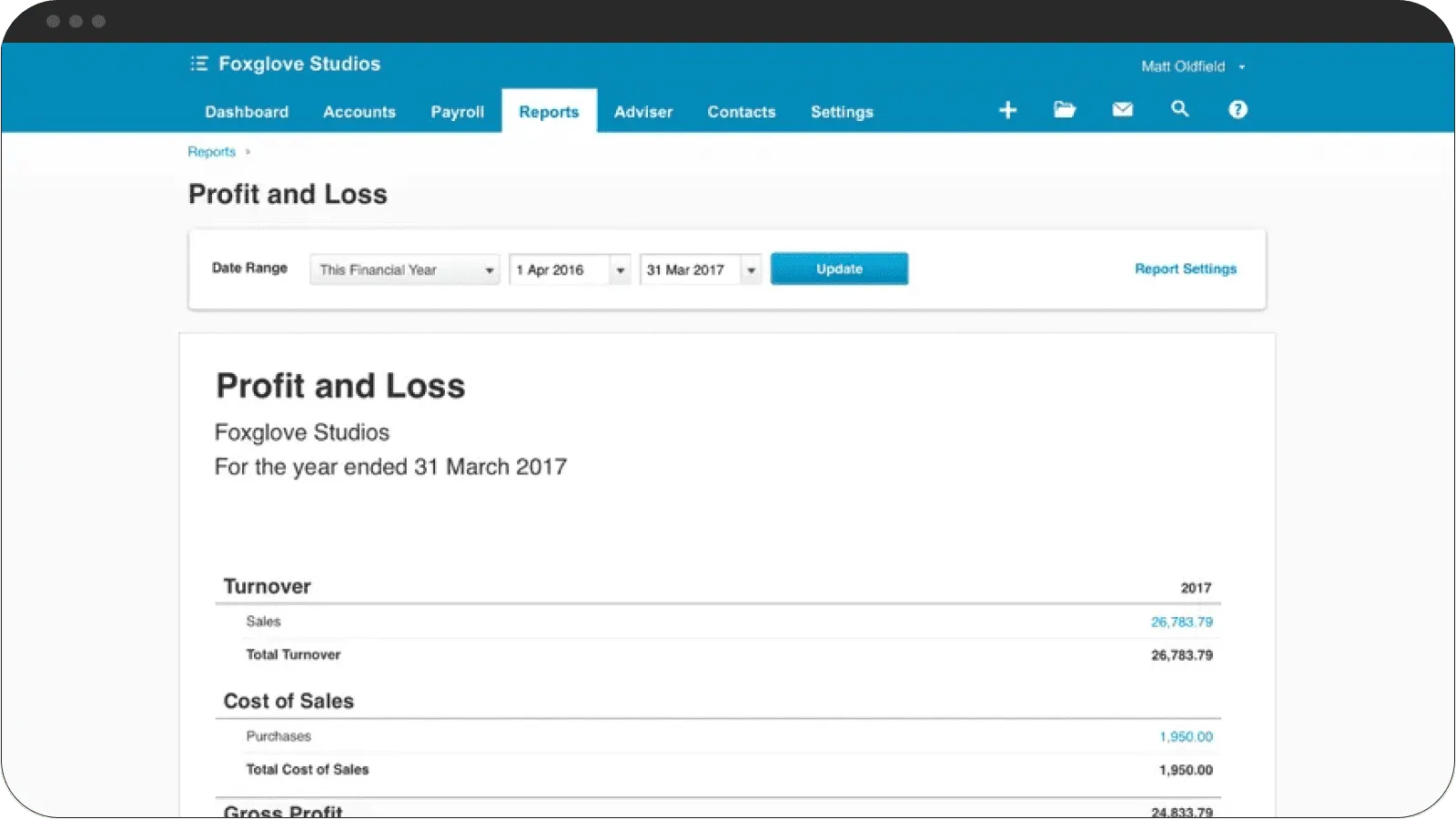

Reports

When you decided to create accounting software for your business, you shouldn’t forget about the reports feature. All accountants must create monthly, quarterly and annual reports (the number depends on business area) and send them to tax service. Accounting software for medium-sized or large businesses allows specialists to automate this process, making it much faster. This feature is aimed at improving the financial activity of enterprises since it allows to draw up accounting reports and process them faster. Then, accountants can easily send reports to tax service.

Creating reports in just a few clicks

Discover more secrets about right insurance app development. Read Insurance mobile app development

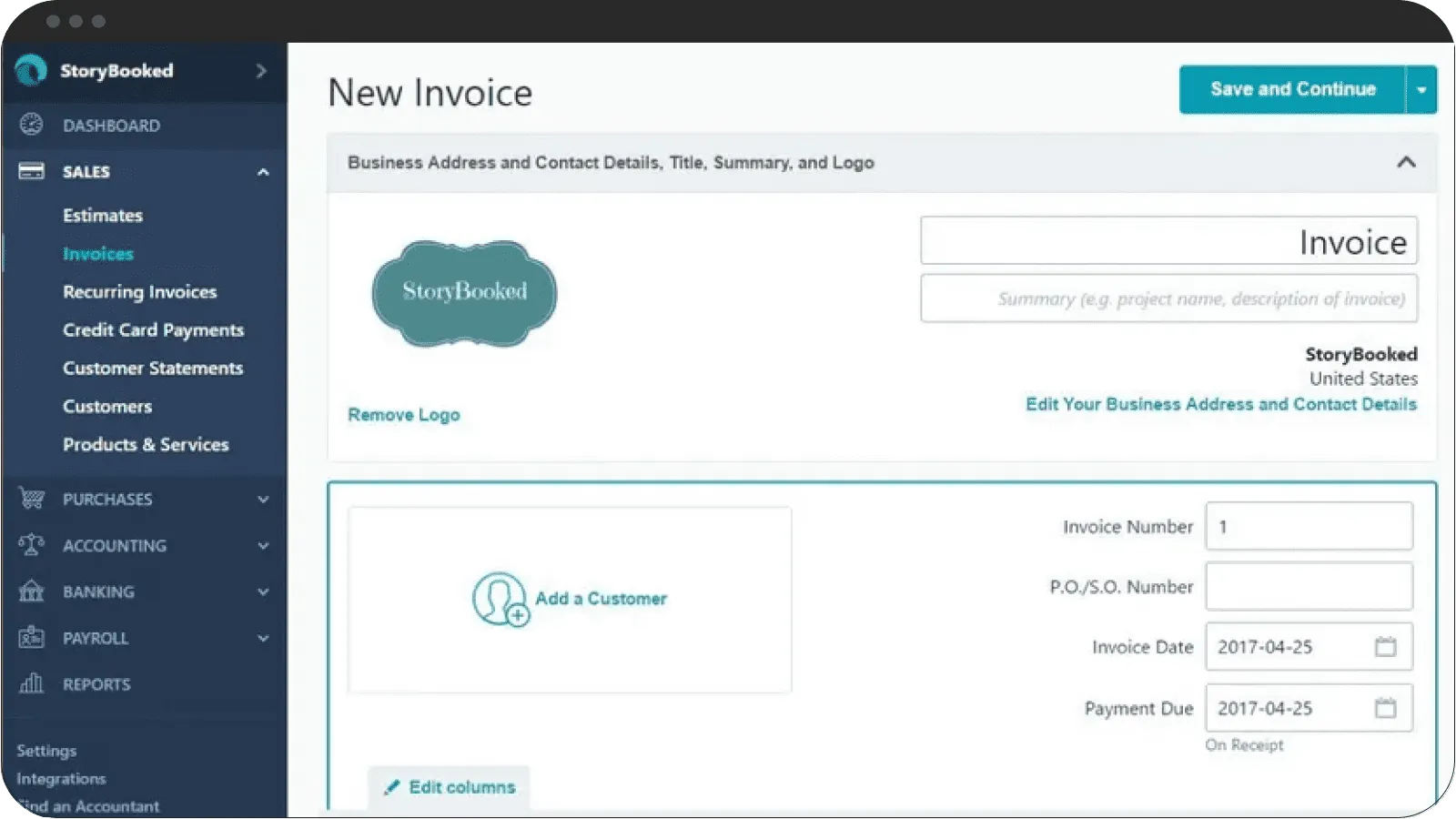

Processing of invoices

Accounting software makes it possible to deal with invoices. It lets users easily handle all invoices and put them in order. You may also add the Print button to print invoices. Using software, specialists can simply send invoices through the app itself. In addition, advanced accounting software stores all customers names, addresses and other details.

Handling invoices in an accounting platform

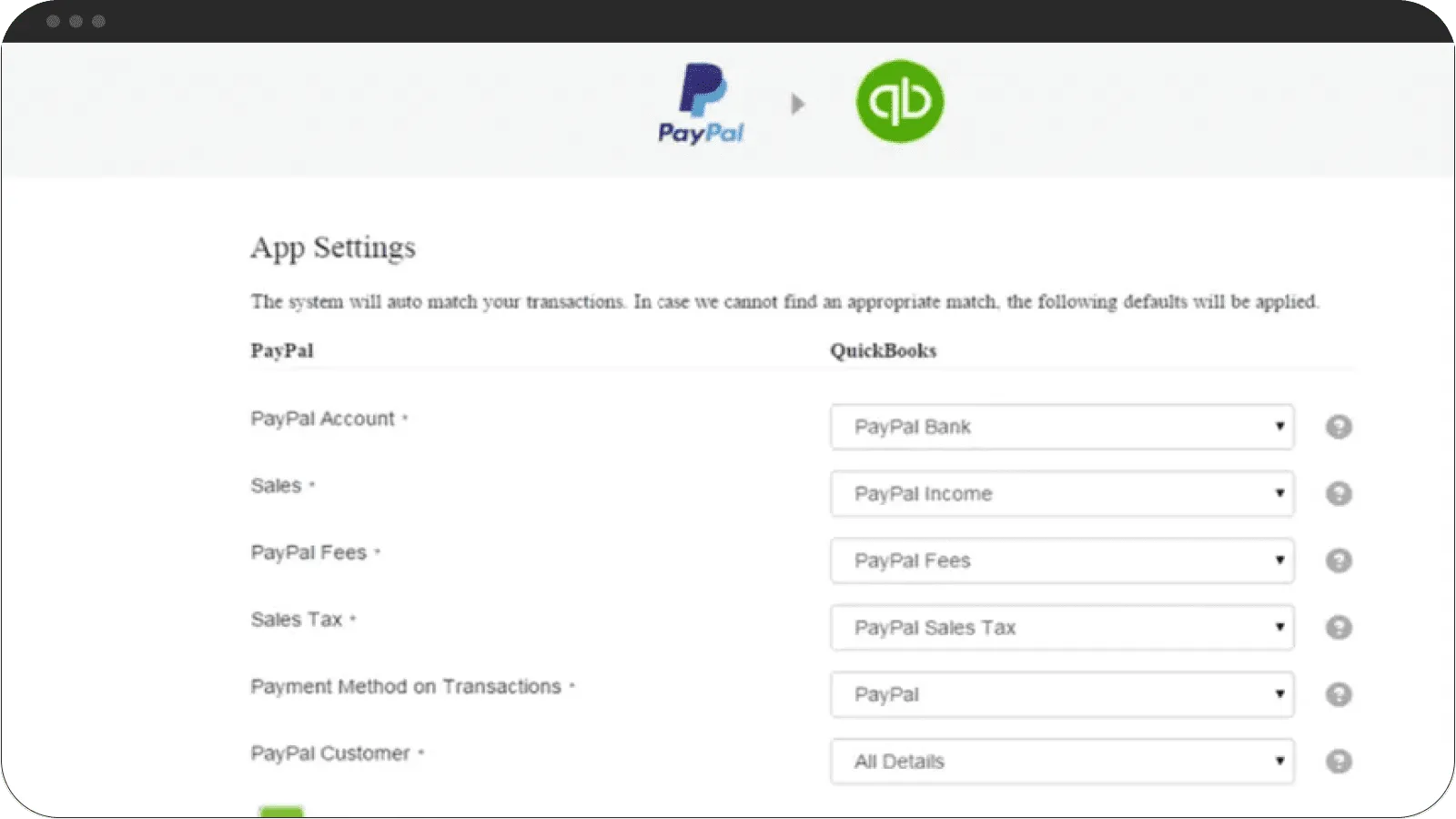

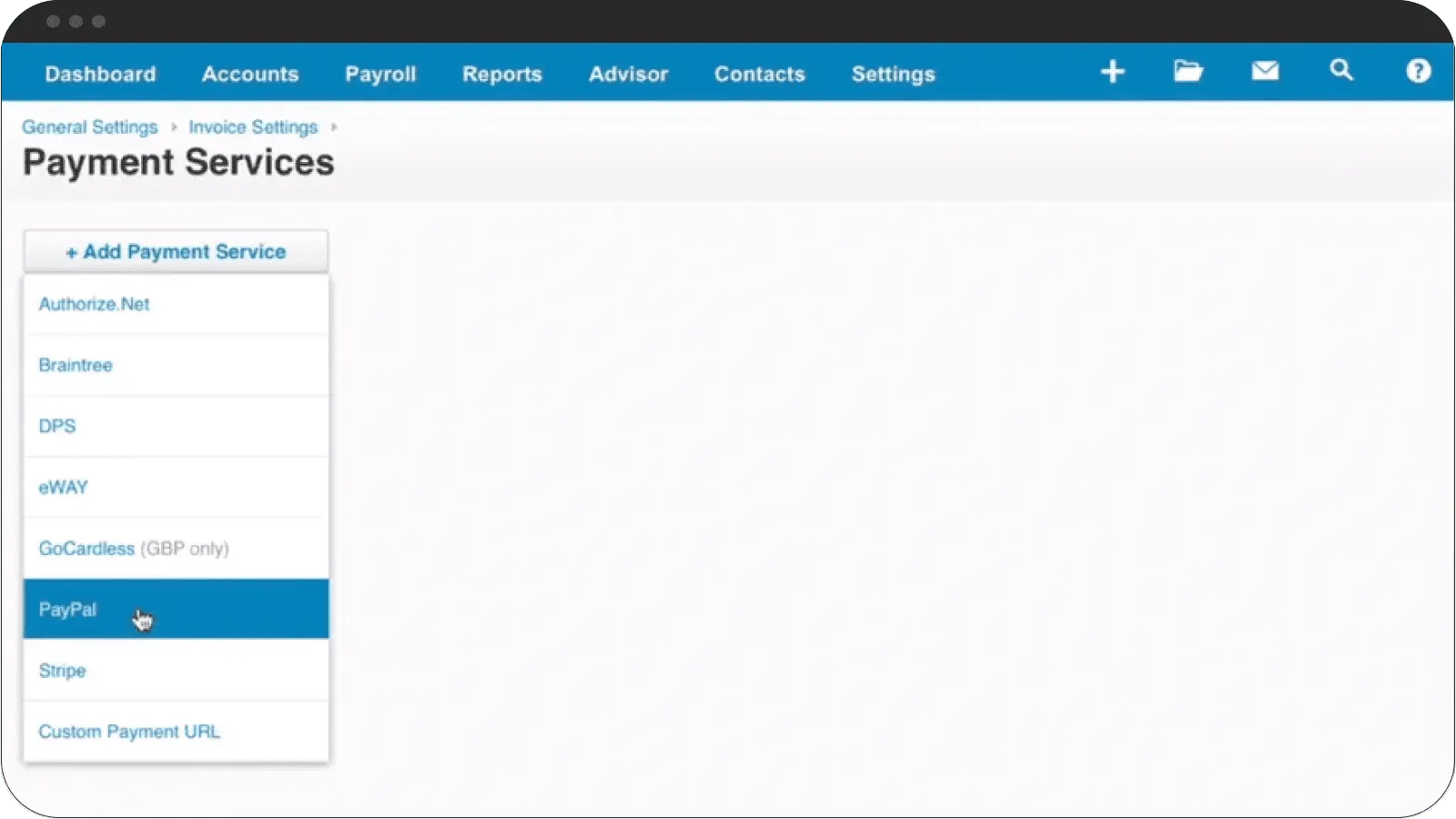

Electronic payments

We live in a time of high technologies and digital payment. Thus, your system should allow electronic payments (via credit card or PayPal) Customers will pay directly from their bank accounts.

Pay with e-wallets right from the software

Credit monitoring

This feature helps enterprises control the credit limits of their customers. It comes handy for P2P lending apps owners. Credit monitoring option makes it possible to control customer debts and send reminders automatically.

Credit monitoring feature interface

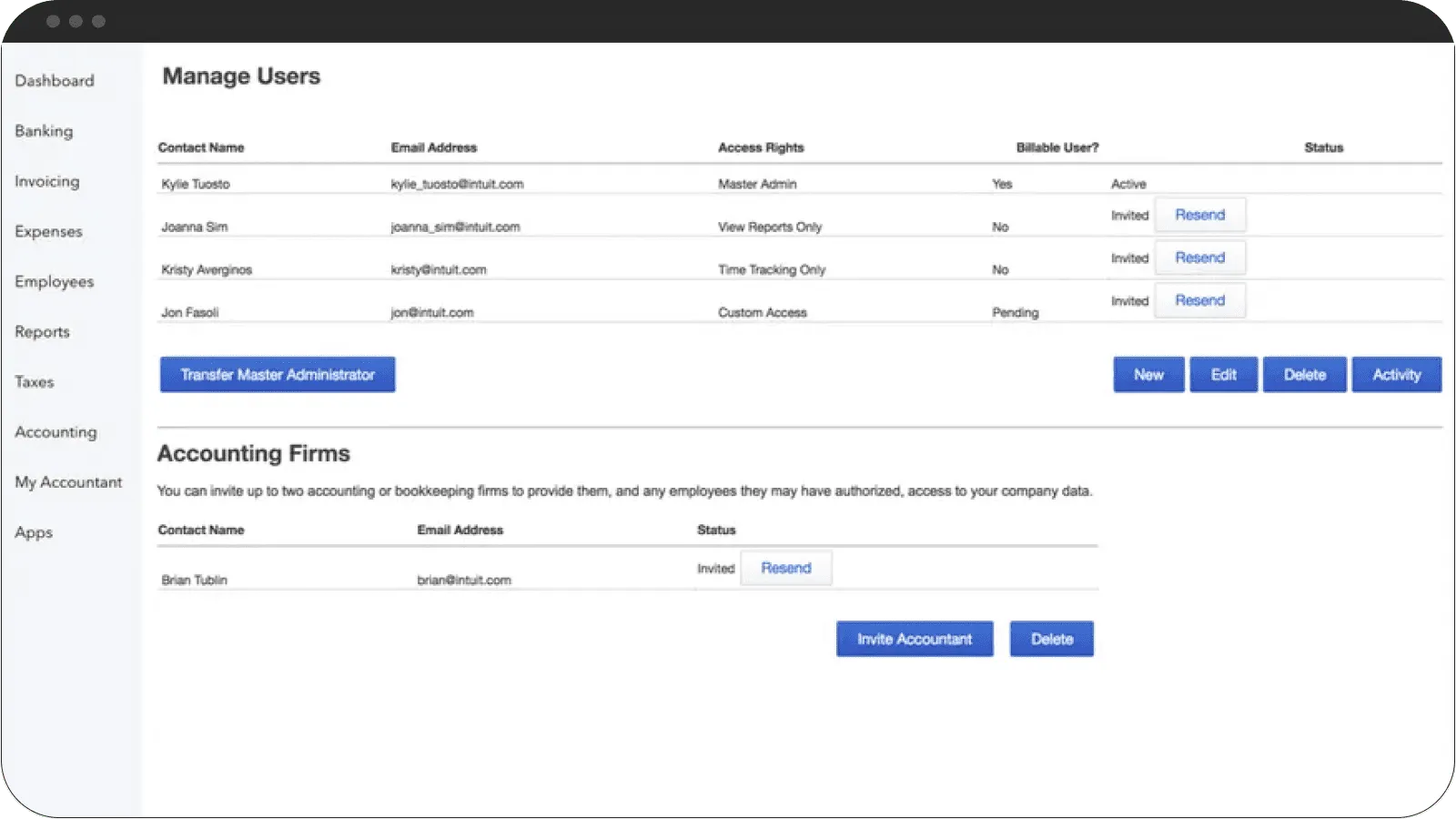

Multiple access levels

Security is twice as important when you want to create accounting software. Usually, devs create few access levels like ‘admin’, ‘manager’ and ‘accountant’. Still, we suggest developing a more flexible system with more than 2-3 access levels. It greatly works for large companies with hundreds of employees and allows to delegate different rights according to their position.

Employees have different access rights

Integration with other systems

Middle and large-sized companies rely on multiple programs like CRM or e-commerce platforms to run their business. Even if you’re wondering how to develop a simple accounting software mind that it should not be isolated from other software. Accounting systems are usually compatible with online banking services and electronic filing systems. It also simplifies the accountants’ workflow.

Add the payment methods you need

Expenses tracking

Business can be successful only when all expenses are controlled. So accounting software should make it possible to put all receipts in order, calculate expenses on the basis of regular payments and so on.

Control all your expenses

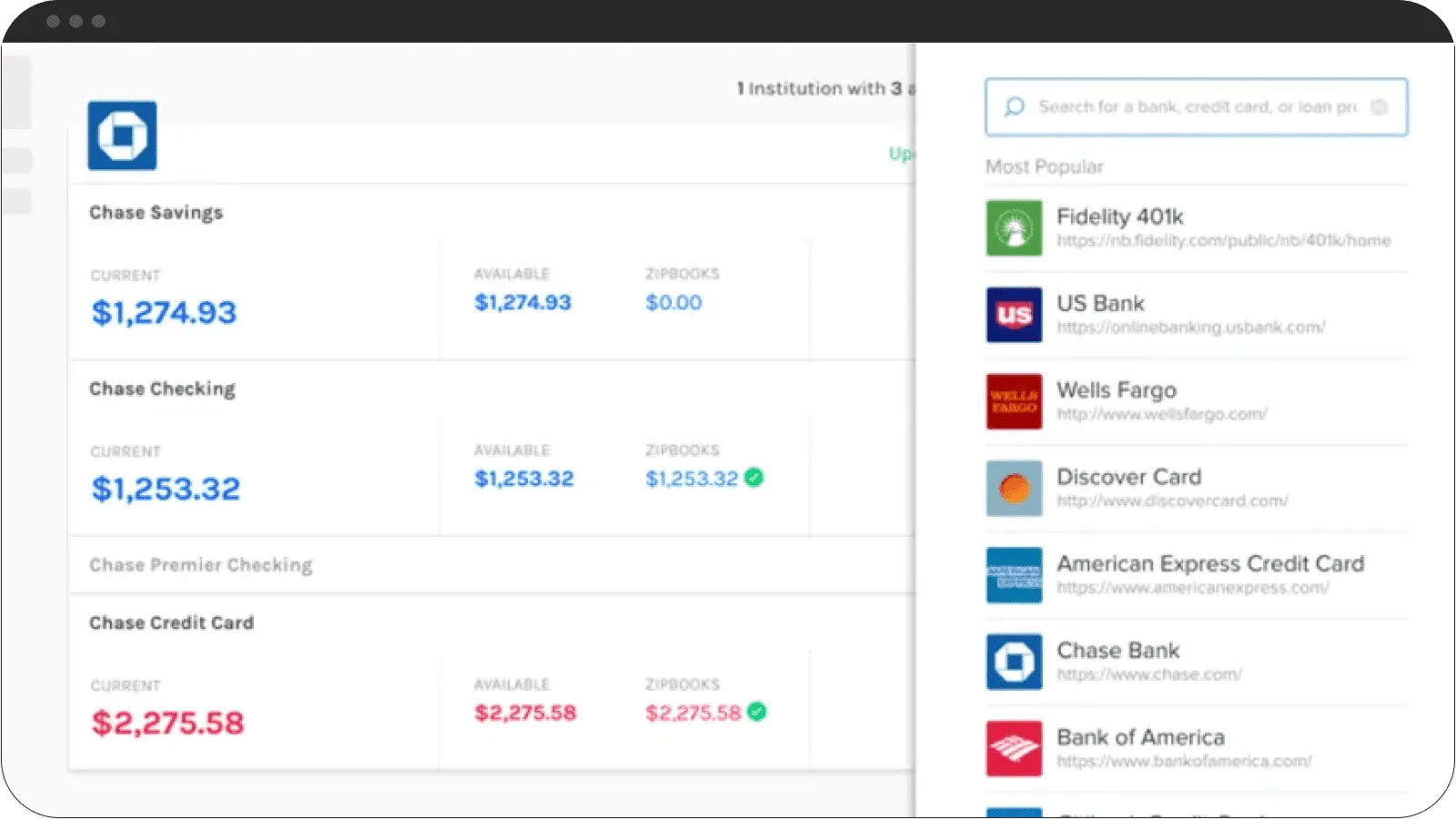

Linking of bank accounts

When users can link bank accounts of the enterprises, they can deal with funds on all accounts quickly and efficiently, transferring money without delays.

A few bank accounts use at once

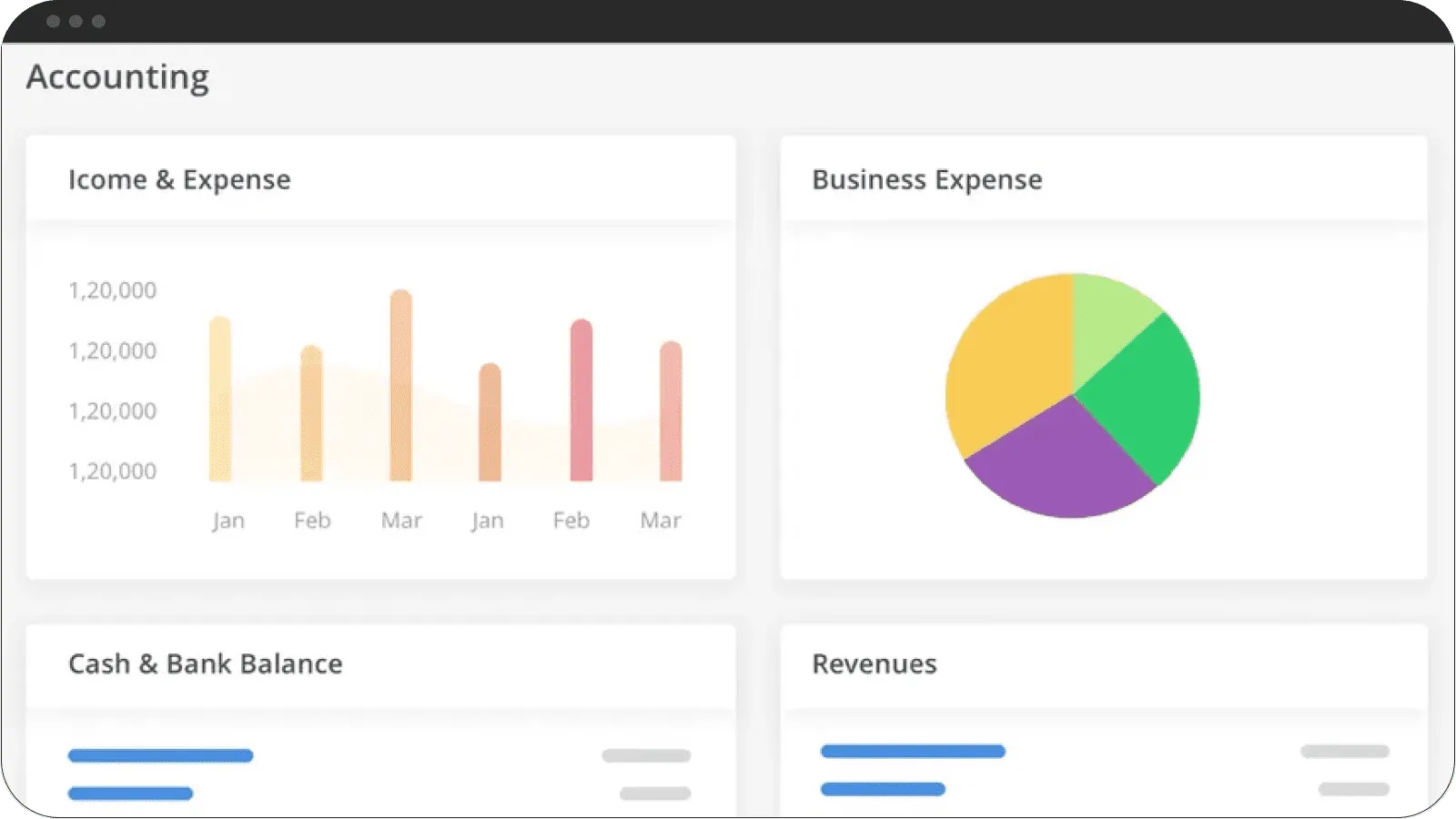

Graphics

The last but not the least feature is the conversion of figures in graphics. When accountants have a lot of figures in their reports, it’s very useful to transform figures into pie charts or any other type of graphs. This way, an accountant can see a structured report in one graph.

Create graphics and easily monitor the expenses

How to Make Accounting Software Secure?

We’ve already mentioned that security is extremely important for accounting software. And here’s why: this type of software is tightly connected with financial information, and it's loss or damage can lead to serious consequences. Network firewall protection and protection from malware are must-haves. So make sure to arrange security issues with accounting software development company in the first place.

Several aspects should be considered while approaching a secure data environment. Let’s overview the most common ones:

- Data encryption. This method appears to be crucial for finance software. It involves implementing cryptographic techniques to secure stored and transmitted data making it less vulnerable and keeping it away from unwanted unauthorized individuals.

- User access control. While operating with finances, no third-party intruders should be allowed. Implementing features like two-factor authentication, RBAC (Role Based Access Control), etc., helps to ensure accounts and data security.

- Firewall and network security. These aspects are essential when creating accounting software. A firewall plays the role of a barrier, separating trusted internal networks from untrusted external networks and preventing network threats. Network security measures include intrusion detection/prevention systems, regular updates, network segmentation, etc.

- Regular software updates. Renewing and improving your software and applying regular updates have a solid defensive purpose. Usually, updates are dealing with possible weak points and bugs in your software, which minimize the number of possible gates for hackers to reach it.

- Compliance with data protection regulations. Here it’s essential to note that regulations may differ depending on the country, and adhering to those particular rules is obligatory. Such regulations include GDPR(General Data Protection Regulation) in Europe, CCPA (California Consumer Privacy Act), PIPEDA (Personal Information Protection and Electronic Documents Act) in Canada, etc.

Find out the best way to find investments for your startup idea. Read How to find investors for your business idea: full guide for startups

That is the full list of what you should take into account if you plan to create your custom accounting software. Now let’s get down to estimating the development cost.

Accounting Software Development Cost

As we already know how to create accounting software, its types, features, and security issues, it’s high time to find out how much this highly-effective system will cost.

How much does it cost to build accounting software? As a basis for the estimate, we took the financial system project for a Scandinavian company, which they needed for accounting. Let’s see what development modules are there.

| Module | General features | Approx time (hours) |

Registration |

| 60 |

Dashboard |

| 192 |

Bank Reconciliation |

| 80 |

Invoice creating |

| 337 |

Quote creating |

| 176 |

Recurring invoice |

| 176 |

TAX Functional |

| 149 |

Accounting |

| 136 |

Export data |

| 243 |

Contacts |

| 68 |

Profile |

| 112 |

Bookkeeping |

| 80 |

Reporting |

| 64 |

Total development time | 1873 hours | |

Keep in mind that software developers aren't the only specialists you need on a team to build such a complex product.

Here's the full team composition you'll need:

- Front-end developer

- Back-end developer

- UI/UX designer

- Business Analyst

- Project Manager

- QA engineer

- DevOps engineer

- Team lead

Given that team composition and the amount of work, accounting software will cost you approximately $165,000 - $220,000. As a software service provider, we can guarantee successful product delivery within a specified time frame only if all needed specialists are on the team.

There is also an option to optimize the budget. You can build work on an outstaff model and hire only developers. In this case, all non-development costs are excluded, but for effective delivery to the set deadlines, you will need to independently perform the functions of PM, UI/UX, QA, and DevOps specialists.

In conclusion, we can say that when you want to build accounting software you should be prepared that the development process is not easy nor fast. But with a clever approach, the final product will be highly competitive and advantageous on the market.

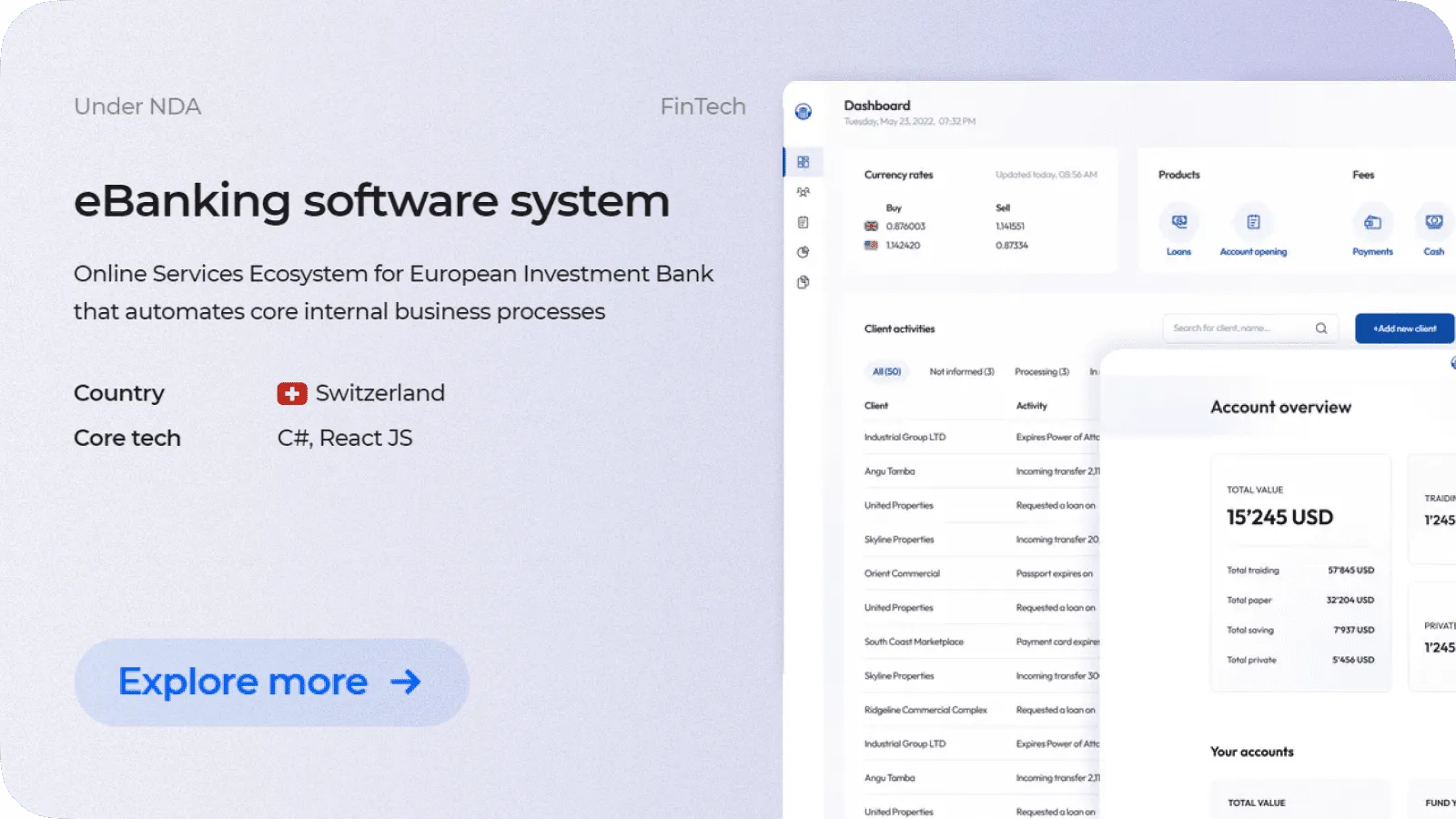

Cleveroad Experience in Creating Software Solutions for Fintech

For this time, our team has built many software solutions for banks and financial institutions. Here’s one of our latest projects we want to share with you.

Our customer is a Swiss bank that offers online investment, loan lending, and trading services to clients from B2B and B2C sectors. Its current solution in use was inflexible and didn't allow business scaling. The bank needed a technical partner to:

- Replace an outdated MVP version and instead create a complete system that will satisfy the needs of B2B/B2C clients, optimize internal processes, and will be capable of enlarging and creating new abilities for global business.

- Boost the user experience (UX) in terms of registration, digital account opening, and work in the eBanking portal, helping become and remain bank clients, and increasing retention rates.

- Work according to regulatory compliance for bank investment software. That means making the new system comply with FMIA (Financial Market Infrastructure Act), following all data rules.

The Cleveroad team has built and designed a custom eBanking ecosystem with all the functionality required to cover the needs of B2B and B2C clients, including: user-friendly sign-up, digital account opening system including KYC pass, and online banking portal.

The new system meets regulations and requirements stated in the FMIA. Now, the bank can now freely operate under its license and provide clients with secure banking at the level of Swiss standards, known for their rigor. It resulted in the increase of user retention by 20-30%.

Cooperation with Cleveroad will give you a transparent and reliable software development process, accompanied by a personalized approach. Our specialists are equipped with robust technical skills and will help you to determine the main goals of a project. A flexible team is always ready to provide you with a quick response to new requirements and changes and smoothly integrates into existing workflows.

Accounting software provides a lot of benefits to the accountants. We can highlight several of them:

- Accounting software saves time due to automation of many financial processes.

- Increased speed of information process. Accounting software can get access to important information in no time.

- Accounting software prevents human mistakes.

- This software raises up overall work efficiency.

It's vital for accounting software to have all important MVP features to fulfill all necessary accounting processes. There are several must-have MVP features:

- VAT calculations

- Payroll processing

- Reports

- Processing of invoices

- Electronic payments

- Credit monitoring

- Multiple access levels

- Integration with other systems

- Expenses tracking

- Linking of bank accounts

- Graphics

There are several types of accounting software that should be highlighted:

- Spreadsheets

- Commercial software

- Software for enterprises

- Ready-made services

- Custom services

Development cost of accounting software starts from $33,000 and above. This estimated price is based on MVP features and includes an average European hourly rate ($50) multiplied on development hours (660 hours)

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

2 commentsOne of the best post on accounting software, As a business owner I can truly understand how it important to have an user-friendly accounting software to track all of business financial data. Can you please also suggest which programming language is best for accounting software if I am willing to create our one accounting software?

Thank you so much. Im looking forward to make a system with you

You're very welcome!