A Full Guide to Software Development for Finance

Updated 07 Jul 2023

17 Min

824 Views

Fintech surrounds us everywhere — from making a deal on a digital platform to scanning a QR code in a fashion boutique or grocery store. So, the fintech app development is quite an unmistakable choice to reach customers looking to take control of their budgeting habits and make their payments more straightforward and secure.

As an IT provider with 10+ years of expertise in FinTech software development, we are eager to share our experience with you in this guide. It will cover all the basics about creating fintech applications, from their types and core feature sets to development peculiarities and average costs. Let’s start considering everything in detail!

What Is Software Development in Finance and Why It’s Lucrative

Finance software has gained popularity as a tool for consumers to keep track of their spending, save money, and securely move funds while dealing with the economic instability caused by the coming recession. Consequently, software development for finance is the process of creating solutions aimed at digital transaction security, optimization and simplification, and has become quite profitable. Its necessity is undeniable for the modern entrepreneurs that tend to spend their finances wisely.

Let’s view the most common finance software types to get acknowledged with the basics and choose the most appropriate fintech app type for your business.

Finance app types, together with their well-known examples

Lending platforms

The option to quickly and conveniently apply for loans and get funding without physically visiting a bank is becoming more important to customers. A money lending application provides them with such an opportunity, streamlining the process of getting a loan, bank account, or mortgage.

Banks may improve back-office operations and save expenses by using digital lending platforms to recruit and evaluate potential borrowers quickly. So, lending platforms aid financial institutions in overcoming these difficulties by providing a central hub for handling every step of the loan process for each unique consumer.

The lending application is advantageous for financial institutions as it:

- Cuts costs for lending operations

- Enhances operational effectiveness and profitability

- Faster closes loans

- Deepens client relationships, etc.

Customer finance

A user's budget may be significantly improved with the help of specialized customer finance software. This is an excellent tool to simplify financial matters management and make financial services quick and effective for clients.

The customer finance app assists users with monitoring, budgeting, accounting, and expense tracking while providing valuable insights into money management. In addition, this platform offers users various investment options, helpful tax advice, valuable insurance insights, and, most importantly, a reliable security system.

Banking applications

The banking apps grew in popularity during pandemic restrictions to help people operate with funds in a contactless and safe way. It functions like a bridge between people and banks, making banking services accessible to anyone with a smartphone and a stable Internet.

What is essential to start using the banking app? First, users should download the app from the appropriate app store and sign up. Then, they can access many features, including making payments, booking tickets, checking account balances, and more.

Using banking applications is beneficial, as it gives:

- Better budgetary control

- Opportunity to instantly transfer money

- Enhanced data security

- Access to banking services and support 24/7, etc.

How to create banking app? Consider its basics in our very particular guide!

Insurance software

Insurance corporations and startups looking for innovations may wish to build a corresponding mobile app. It helps handle agency-policyholder B2C engagement in real-time mode.

Insurance finance software development gives policyholders and claimants a centralized online hub for all insurance-related tasks. Mobile apps contribute to the simplification of processes and improve the quality of the user experience.

Moreover, the insurance software development optimizes support costs and lowers operational expenses, increases data collection and audience insights, automates claims processing and other business tasks, improves user engagement, and boosts insurance agency revenue.

Investment apps

You can keep up with the latest developments at publicly listed firms with the help of an investment app. Keeping a keen watch on the current state of the investing market enables you to make the most of the easily accessible information at your fingertips.

There are a few arguments that will help you decide to develop an investing app:

- There has been a recent uptick in entrepreneurs dealing with stock trading, portfolio management, and other ways of conserving money.

- A wide variety of specialized business niches is available to you.

- The amount of money investors are willing to spend to have a portfolio containing various types of assets.

We’ve enlisted only the most common types of finance apps that may boost your business performance, attract new customers, and retain the existing ones. Now is the time to consider the benefits you may get from software development for financial services for your company.

The benefits of investment in fintech software development

The fintech market increasingly grows. According to Adroit industry research, the total value of the worldwide market for financial technology has now surpassed $110 billion. Given its current pace of expansion, it is anticipated to be close to 700 billion dollars by 2030.

Moreover, the Statista survey mentions that more than 66% of Americans used financial services (especially digital banking) via mobile apps. That should be enough of a driving force for those motivated by business to enter that market as soon as possible.

Let’s discuss in detail the widespread benefits of financial software development:

Cost-cutting. This is a top goal for companies in today's economic state. Fintech software may improve the organization's financial management and lead to cost savings in various operational areas. That's why it tends to be profitable for investors.

Popularity among customers. More and more clients are using e-commerce, payment, banking, and other services online. It's a convenient way to save time and streamline daily tasks.

Business digitization to streamline company flows. Fintech has the potential to simplify and accelerate a wide variety of corporate operations. While thinking on how to create a FinTech app, you'll face with multiple advantages like increased operational efficiency to speed up the processes and avoid human errors.

Security of operations increased. The bespoke fintech solutions may advise on making the most profitable choices in turbulent stock, cryptocurrency, and currency markets.

Let’s go further, and define the core functionality your app should contain to be useful and beneficial for your business.

Core Features for Finance Software Development

With a well-thought-out financial technology app, you can offer customers information and services in seconds. Customers want up-to-date mobile apps, versatile and scalable, particularly for their banking needs. They are looking for a simply consumable interface that will assist them in completing their jobs and moving on with their business tasks.

Based on our experience in finance software development, we have prepared a list of the must-have features your fintech app should contain.

Core feature set you should include into your Fintech app

Secure user authorization. Users' identities are verified via fingerprints or retina scans using this functionality. This protects the app's data and functionalities against unauthorized users. It prevents fraud by making it more challenging for somebody to imitate a person without their biometric data being available.

Know Your Customer (KYC) compliance. Since this regulation is obligatory for all financial institutions, KYC is one of FinTech's most significant concepts. According to it, financial institutions may learn:

- Who is their client

- Whether they are absent on criminal lists

- Clients' verification as platform users

Digital payments. Any fintech app needs digital payments. Users may swiftly and simply pay for products and services securely via them. Fintech companies may simplify online transactions by giving digital payment choices. This software development financial feature may enhance sales and income for the app and its supplier.

Dashboard. A user interface and user experience that is both straightforward and appealing should have a graphical dashboard that provides users with many customization options.

Push notifications. Notifications are crucial to keeping users interested and maximizing app usage. They remind users to pay bills, budget state, account activity, new deals, etc.

Payment gateway functionality includes the following:

- Tokenization. It protects payment cards. It safeguards critical data from your site to the card network.

- Regular money transfers. A mutually beneficial payment plan guarantees on-time payments. This promotes cash flow, client retention, and accessibility.

- Protection from fraud. It is important to make use of a cutting-edge fraud prevention solution that delivers the cybersecurity information that your company needs in order to lower fraud rates and accept a greater number of real transactions.

Note: The above-pointed functionality may differ depending on your business requirements and the business logic of the solution you’d like to develop. Book a call with our Solution Architect and get consulted on the feature integration to support your financial idea.

How to Develop Financial Software: From Idea to Product Launch

FinTech app development might be a challenging thing for entrepreneurs, especially startupers. We have formed a step-by-step guide to help you deal with this question.

Start from analysis

Each business owner wants something special for their company, and nobody requires the same software that everyone else has. So, before you even begin to consider developing financial software, you need to define and think out the following:

- Future aims to accomplish with your software. Simply put, what problems you want to solve with your app. For example, you would like to create a banking app and provide users with an opportunity of secure money transfers.

- Your target audience the software will be aimed to. The audience you are targeting may be determined by a wide range of variables, including age, sex, geography, income, or education level of potential customers.

- Competitor analysis. In order to create original material that customers will find interesting and avoid making the errors that your rivals have, it might be helpful to spend the time to research what works and what doesn't for competitors.

- Monetization models you’d like to implement. You can choose Subscription, Freemium or Pay-as-you-go model to obtain profit from your app.

All this will help you explain the product’s requirements and goals more clearly to your IT partner. This way, you’ll save time and increase the efficiency of negotiations. Let’s consider where to find such a financial service technology provider.

Find a skilled tech partner

Fintech is quite a challengeous and complex business domain. You should have enough skills and expertise to create a secure finance application with an user-friendly interface, simple to navigate.

When searching for a technical partner to create financial software, you may wonder where to start and what to look for.

Look for professional websites (e.g., Clutch, Goodfirms) include a short description of the company, portfolio, links to the company website, blog, etc., number of employees and projects, industry and functional expertise, client reviews, general rating, and more.

Compile a Request For Proposal (RFP) to companies you’ve decided to deal with will also help you find a proper tech partner and build relationships with them. The RFP may include the enough data for the outsourcing vendor to get a full picture of the client’s future expectations and requests.

Ask colleagues and friends. They might recommend a trustworthy financial software development partner.

Use Google search. During it, you should pay attention to the websites of the companies you’d like to cooperate with and thoroughly learn them.

After you’ve chosen the tech vendor to cooperate with, you should submit your application containing brief info about the software you want to develop. We’ll discuss what stages your financial application will go through on the example of our software development lifecycle.

Solution design stage

After you’ve submitted a request on our corporate site, and the managers processed it, as well as you have signed an NDA, the Solution Design phase starts. The team processes your application and basic information together with BAs, SAs, and designers. They define:

- Business objectives

- Work scope

- Major issues, etc.

Solution Design experts may contact you to discuss specifics if needed. After processing the data, we construct a proposal with a rough estimate, team composition, and schedule of meetings with our specialists. The stage takes around two weeks, depending on the project.

Discovery phase

Cleveroad Discovery Phase services aims to create a roadmap for your product development. During it, we identify a scope of work more accurately and provide you with precise estimate. The team lists your requirements — platforms, functionality, third-party services like Stripe or Google Maps, and more — here.

Currently, we conduct the following activities:

- Make a feature list

- Help you choose a future software architecture and tech stack

- Analyze business processes and develop necessary diagrams

- Create design ideas and a UX map

- Solve regulatory compliance issues

- Make rough and detailed estimates

- Sign a development contract if you accept the figures and terms, etc.

Design stage

The UI/UX team will construct the designs after the exact requirements have been agreed upon. When doing so, they will consider factors such as fonts, colors, and styles, among other things. You make any necessary changes and then approve the version to ensure that your product maintains the desired aesthetic. We also provide a style guide that details everything that a designer or developer could want, such as the colors, gradients, and font that should be used.

Development and QA

The developers encode the pre-defined list of features during the stage of finance software development. Depending on the chosen platform to develop your mobile app, you may cooperate with iOS, Android, or web developers (front-end and back-end).

QA engineers are responsible for working on a project all the way up until it is released. They test the functionality that was built throughout each sprint to ensure your app’s seamless performance. After testing the backend and front end, the QA team submits concerns to software engineers.

Launch and maintenance

The team makes final edits to ensure the product is all set to release. We assist you with the finance app's launching on either the Apple App Store or the Google Play marketplace. If the web app is developed, we upload everything to the live server on the day of the release. When you have determined that the outcome meets your expectations, the team will hand over the materials for the project to you.

When the application becomes live, our collaboration does not stop. You may require technical support options and maintenance services. We update your solution with new features according to the early customers’ feedback, as well as check it for bugs for a further seamlessness.

We’ve enlightened the main stages you should pass. Let’s consider what main points should be thought out during the development.

Peculiarities of Software Development in the Finance Sector

Software powers every financial company. Implemented fintech solutions must be flawless because financial transactions may be affected by even modest math errors. Thus, software's tech, unseen to consumers, requires ongoing care during the software development (finance) process. Performance, robustness, usability, and user retention depend on this portion.

So, now, we’ll talk about what aspects you must consider to succeed with your financial software.

Security

Fintech applications are vulnerable to security breaches due to a sensitive personal and financial data. That's why, extended logging, 24/7 monitoring, automatic banning of questionable activity, and further verification are crucial. A good Fintech solution meets security and data encryption standards and has a good UX/UI.

Our AWS-certified DevOps architects are ready to help you avoid security issues and make your data remain safe and secure, as it is pretty essential for the financial industry.

UI/UX design

Fintech solutions handle business problems simply and clearly. These solutions increase corporate operations' speed, cost, and efficiency. When a product solves an issue quickly and adds value, users adore it. So that the user flow shouldn't mislead.

Through iterative UX enhancement, a product may solve problems and be convenient. Our UI/UX designers are eager to help you accomplish such a purpose and offer a user-friendly design and flawless UX.

Compliance with regularions

Business owners must anticipate using fintech solutions for money laundering, fraud, and sanctions evasion. That's why fintech mobile apps should be compliant with regulations to prevent any unlawful use of financial data. Startups must endure certifications, audits, and pen testing. Product owners must implement local policy changes quickly and update functionality for chosen users.

Our fintech software experts will help your app be compliant with regulations essential to maintain the following:

- Security standards (e.g., KYC, PCI-DSS)

- Digital signature (QES, AES, and so on)

- Financial legislation (e.g., AMLD, PSD-2)

- Industry workflows (for example, EMV, CLOB and so on)

Everything you should know about PCI DSS compliance is gathered in our article. Read and learn more!

Average Price to Build Financial Software Systems

You may need from $90,000 to $300,000+ for financial industry software development. But that’s a pretty big range, right? The fact is that there are a wide variety of circumstances that have an impact on the final price. Some of these factors are given below for your attention.

Product requirements fall into the following categories:

- The scope of work is the characteristics or the effort to create them with a scope, project size, and development time rise.

- Product complexity measures a software product's idea. Building, testing, and delivering a product with complex logic and idea is harder.

Scalability, security, usability, reliability, performance, and other non-functional criteria characterize the program's functioning. Customer satisfaction is affected by them.

Development partner location also influences pricing. The cost depends on the professionals' hourly rate in different regions and the country's app production time. Thus, for example, the US FinTech app developers charge more than Estonian ones ($150-$200 against $30-$60 for an hour).

Models of cooperation with software development vendors are another cost-building factor for you to consider. For example, Cleveroad can offer you the following cooperation models, such as:

Time and material enable us to estimate the scope and start a project with a concept and task scope. You may adjust the scope or team effort under the T&M contract during development. This model is particularly beneficial for long-term projects with changeable needs and unknown scopes.

The dedicated team concept works well for ambitious and difficult cooperation tasks. Developers join our client's team, and we can assist organize the development process, which the customer manages. Choosing the most practical model, distributing resources effectively, and acquiring the necessary technological skills at a cost-effective rate are all simple tasks that may be accomplished with relative ease. The clients may also monitor requirements, timetables, teams, and task scope.

Staff augmentation may help you choose and select just the employees that meet your needs, and you can shrink or grow your augmented staff as the need demands. Many organizations provide this service to their clients.

The fixed workscope contract is a one-time payment deal for the Discovery Phase that includes specific timelines, precise estimates, and clearly outlined criteria. To achieve acceptable outcomes, clients may communicate their product vision to developers. Discovery Phase uses the fixed workscope model since needs, specifications, and rates are known. This methodology is highly cost-effective for customers with restricted or set budgets, Minimum Viable Products (MVPs) for startups, and small projects with limited scope.

Software maintenance. When determining how much it will cost you to develop financial software you must also include the costs associated with ongoing maintenance. The creation of bespoke financial applications is a continuing process. After an application has been released to users, the care of the application in relation to its ongoing upkeep becomes a major priority.

Consider the cost to develop fintech app by types in our guide!

Cleveroad Expertise in Fintech Software Development Services

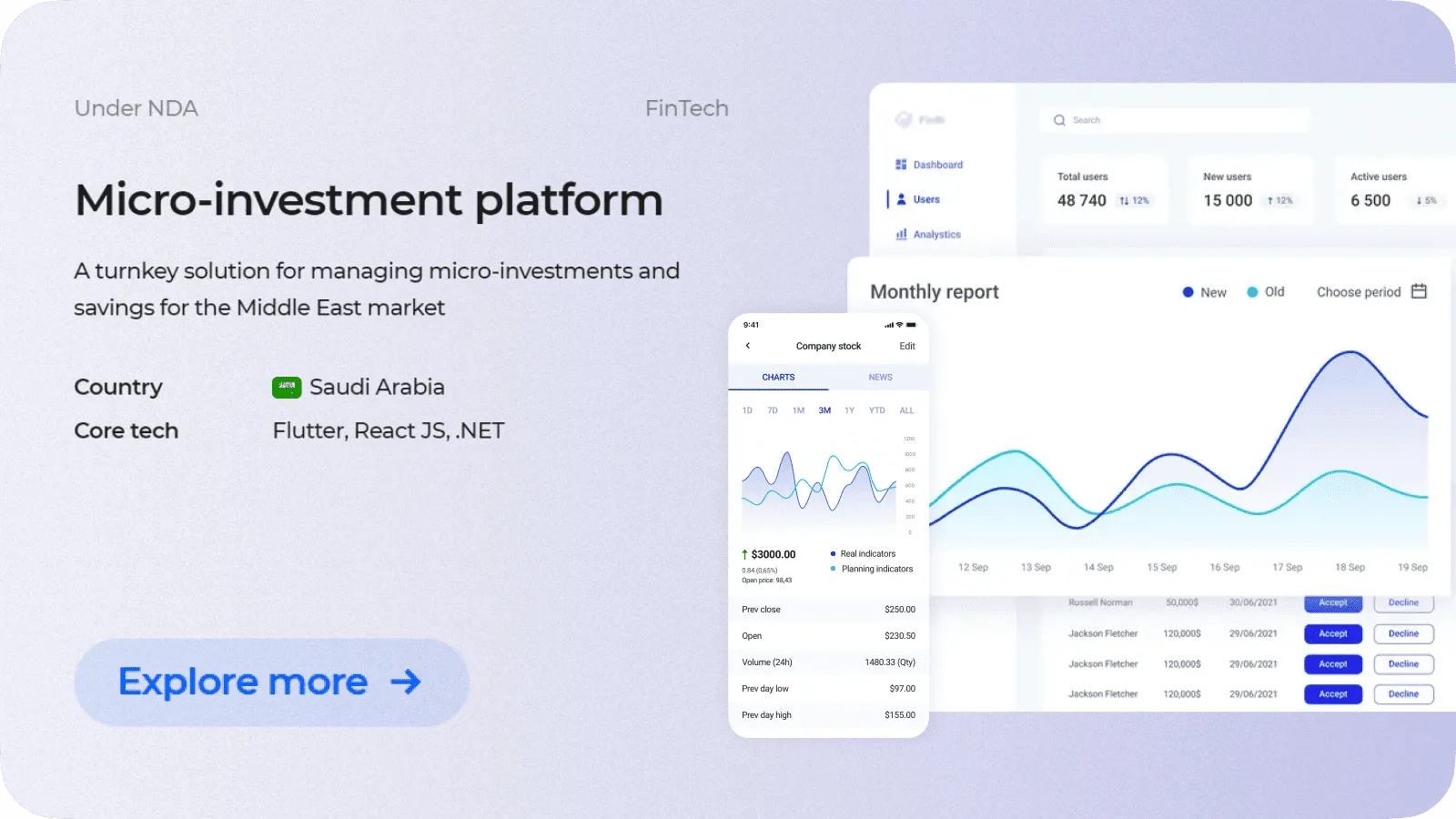

Our customer is an investment company that has been on the market since 1988 and has reached US$3,319.00 AUM (assets under management) by January 2021. Our customer planned to expand to a micro-investment domain and needed a technical partner to build a mobile platform focused on micro-investments from scratch.

We have developed a cross-platform app for traders primarily focused on micro-investments and savings. The solution was developed as compatible with SAMA Cybersecurity Framework, and all legal and technical aspects were considered. We also offered IT consulting services, marketing analysis, and a team of specialists for additional technological enhancements to our client.

Our customer got the following in terms of our cooperation:

- A custom micro-investment platform compatible with fintech regulations, namely SAMA. Now, the company can work freely without risks of regulatory sanctions.

- A platform that is entirely prepared to use and that takes into consideration the challenges, opportunities, and objectives of micro-investors

- Thanks to the high-quality development work and technology consulting services, successful collaboration and growth of the project have been achieved.

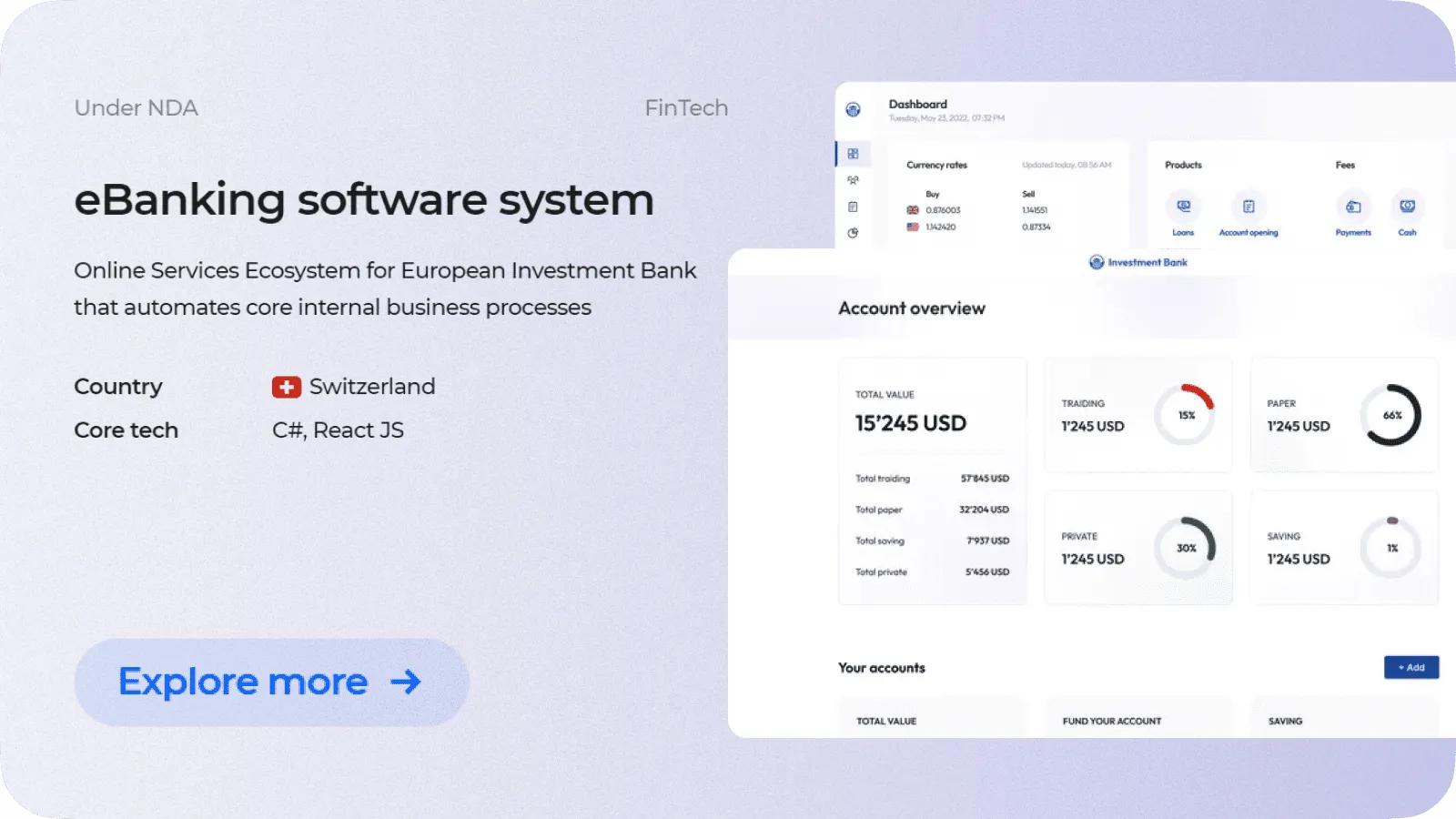

The other company we work for is a Swiss bank that caters to customers in both the business-to-business and business-to-consumer markets by providing online investing, loan lending, and trading services. Its finance structure did not permit the expansion of the firm. The bank required the assistance of a technological partner to develop a fresh, adaptable finance system that had the potential to bring in more clients.

The Cleveroad team has built and designed a bespoke eBanking ecosystem with all the features and solutions required to cover the needs of clients: sign-up process, a digital account opening system that operates in accordance with KYC guidelines, and a web platform for trading and investing. We also applied custom tools and methods in comparison with the requirements of Swiss financial regulators (namely FINMA), including a need-to-know access control system.

As a result, our customer got new eBanking software fulfilling regulations and requirements stated in the FMIA. Now, the investment bank can function freely under its existing license. The integration of the key functionality allowed our customer to increase user retention rate by 20-30%. Moreover, the company got the opportunity to free up its workers for other tasks by making use of a full-fledged ecosystem for digital account opening and other business-related activities.

Let us tell more about Cleveroad. We are a CEE-located outsourcing fintech software development vendor with more than 10 years of experience in creating digital products dealing with secure finance management and transferring. Our clients get turnkey solutions of any complexity that help them enhance the business data security, boost performance and increase profitability.

Working with us, you can benefit from the following:

- Comprehensive consultations with our fintech specialists (PMs, Business Analysts or Solution Architects) as to your product development and implementation

- End-to-end finance software creation, after-development maintenance and support

- A team of software experts with a deep expertise in creating digital solutions for fintech industry

- Cutting-edge tech stack and approaches to create a unique product for your financial company

- Qualified QA services to ensure the quality and flawlessness of your fintech app, etc.

Having a practical experience in financial industry software development, we can create and deliver a modern fintech solution for you. Let’s start our cooperation, enjoyable and productive for both sides!

Make your own finance app

We can fully consult you as to finance app build and integration, and guide you through its creation

Software development for finance is the process of creation solutions aimed at digital transaction security, optimization and simplification, has become quite profitable. Its necessity is undeniable for the modern entrepreneurs that tend to spend their finance wisely.

You should pass the following stages as given below:

- Preliminary analysis

- Finding a skilled tech partner

- Solution design

- Discovery phase

- Development and QA

- Launch and maintenance

Fintech software may improve the organization's financial management and lead to cost savings in various operational areas. That's why it tends to be profitable for investors.

More and more clients are using e-commerce, payment, banking, and other services online. It's a convenient way to save time and streamline daily tasks.

Fintech has the potential to simplify and accelerate a wide variety of corporate operations. The creation of fintech apps means increasing operational efficiency and boosting workflow automation to speed up the processes and avoid human errors.

The bespoke fintech solutions may advise on making the most profitable choices in turbulent stock, cryptocurrency, and currency markets.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article