How Much Does It Cost to Build a FinTech App: Detailed Estimation

Updated 01 Dec 2025

19 Min

2543 Views

The FinTech app development cost depends on two main factors: time and developers’ rates. In turn, the time will depend on platforms, the complexity of features, and server architecture’s requirements. The developers’ rate will depend on the developer's experience and location.

Since 2011, Cleveroad has been building diverse FinTech solutions: from mobile banking apps to insurance, lending, and investment platforms. We surveyed our Solution Architects and Business Analysts, asking them to create FinTech app development cost estimates based on real figures from our previous projects. Their expert insights allowed us to create this guide, where you'll learn:

- The key factors that influence FinTech app development cost, from features and integrations to security and team location.

- Detailed cost estimates by app type (e.g., banking, lending, investment, insurance, and consumer finance) with feature-by-feature breakdowns.

- Practical ways to cut expenses without sacrificing quality, including smart vendor selection, tech stack choices, and nearshore development strategies.

What Major Factors Affect FinTech App Development Cost

FinTech application development involves a number of factors that influence its cost. We’ll examine factors that affect the cost of FinTech application development and guide you in the complexities of creating digital financial solutions.

Number and complexity of the features

The scope and complexity of features are the main drivers for the cost to build a FinTech app. A simple application with basic functionality like account balance checks is far cheaper than a more advanced product that includes investment tracking, AI-driven analytics, or other complex modules.

We calculated typical expenses for a FinTech application depending on its complexity: see the breakdown in the table below. For this estimation we relied on an hourly rate range of $50–$80, which is typical for Central and Eastern Europe (CEE) software development vendors.

| FinTech app complexity | Key features | Required time (h) | Average cost |

Simple | Balance, transfers, profile | 1,000–1,200 hours | $50,000–$70,000+ |

Medium | Payments, KYC, cards, analytics | 2,000–2,500 hours | $100,000–$130,000+ |

Complex | AI/ML, investments, multi-currency | 3,000+ hours | $150,000–$200,000+ |

Security measures and regulatory compliance

Since financial solutions operate with sensitive data and monetary assets, they require solid protection. However, the complexity of implemented security measures significantly impacts the cost to develop a FinTech app. Basic tools like username/password authentication or HTTPS encryption add only a small portion to the budget. Advanced protections, such as biometric authentication, fraud detection systems, secure API connections, and end-to-end encryption, can increase the total cost of fintech app development by 20–30%.

For example, implementing biometric login in FinTech app design not only improves trust but may raise the cost of a FinTech app by $20,000–$30,000+, depending on chosen SDKs and integrations. Companies planning to make a FinTech app should carefully evaluate which measures are necessary at the MVP stage and which can be added later as the product scales.

Let’s revise the key costs of security measures for your FinTech app:

- Basic authentication and HTTPS encryption: $5,000–$10,000+

- Two-factor authentication (SMS, email, or app-based): $15,000–$20,000+

- Biometric login (FaceID, TouchID): $20,000–$30,000+

- Advanced fraud detection and secure API gateways: $30,000–$50,000+

- Enterprise-grade encryption and compliance modules: $40,000–$60,000+

Regulatory compliance has a direct impact on the mobile app development budget. Meeting standards such as GDPR, PCI DSS, or PSD2 can increase cost of a FinTech app, since it requires extra security features, stronger architecture, and additional development hours.

Tasks like encryption, audit trails, secure APIs, and penetration testing increase scope but are essential for legal launch. For this reason, financial companies often choose vendors with compliance expertise to cut risks, speed up certification, and enter the market faster.

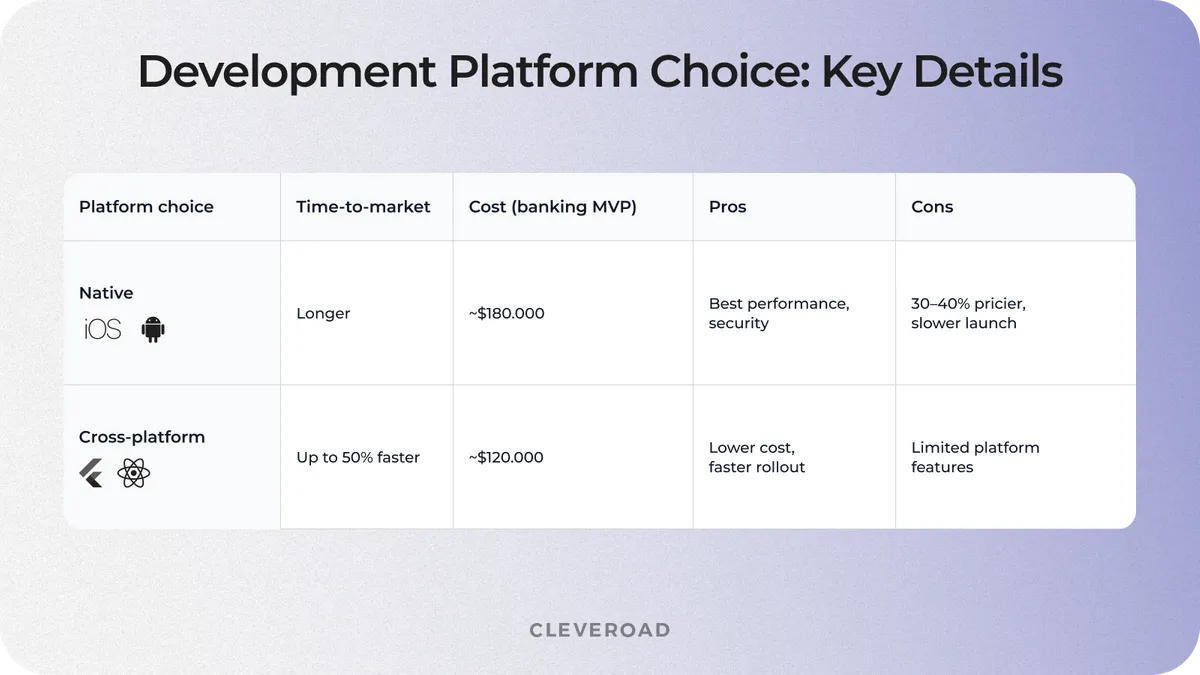

Development platform choice

The choice of development platform strongly affects the cost to build a FinTech app as well as its time-to-market. Developing native apps for iOS and Android separately ensures maximum performance and security, but this approach usually results in approximately 30–40% higher expenses. For FinTech companies operating in the highly competitive global FinTech environment, these additional costs can significantly impact the cost of delivering products to market.

In contrast, cross-platform apps built with Flutter or React Native allow teams to maintain one codebase for both platforms. Flutter app development services accelerate delivery by up to 50% and can lower the overall cost of a FinTech product, which is especially beneficial when launching MVPs to quickly test their FinTech app idea.

The image below highlights key differences between native and cross-platform development approaches, showing how each option impacts FinTech app cost and delivery speed.

FinTech app development cost: platform choice details

Custom UI/UX design

The unique UI/UX design contributes significantly to the overall FinTech app development cost. While design for a standard fintech app based on ready-made templates may cost around $5,000–$10,000+, opting for a custom design from scratch with tailored user flows, brand-specific elements, and accessibility features can reach $20,000–$40,000+. Apps that require advanced animations, interactive dashboards, or personalized financial analytics interfaces may push the design budget even higher, sometimes exceeding $50,000 for complex projects.

This difference directly impacts user adoption: FinTech apps with custom UI/UX can increase onboarding completion rates about 30–35%, which translates into higher customer retention and revenue. For FinTech companies entering the global market, the decision between template-based and custom UI/UX design often determines not only the cost of building a FinTech app but also its long-term competitiveness.

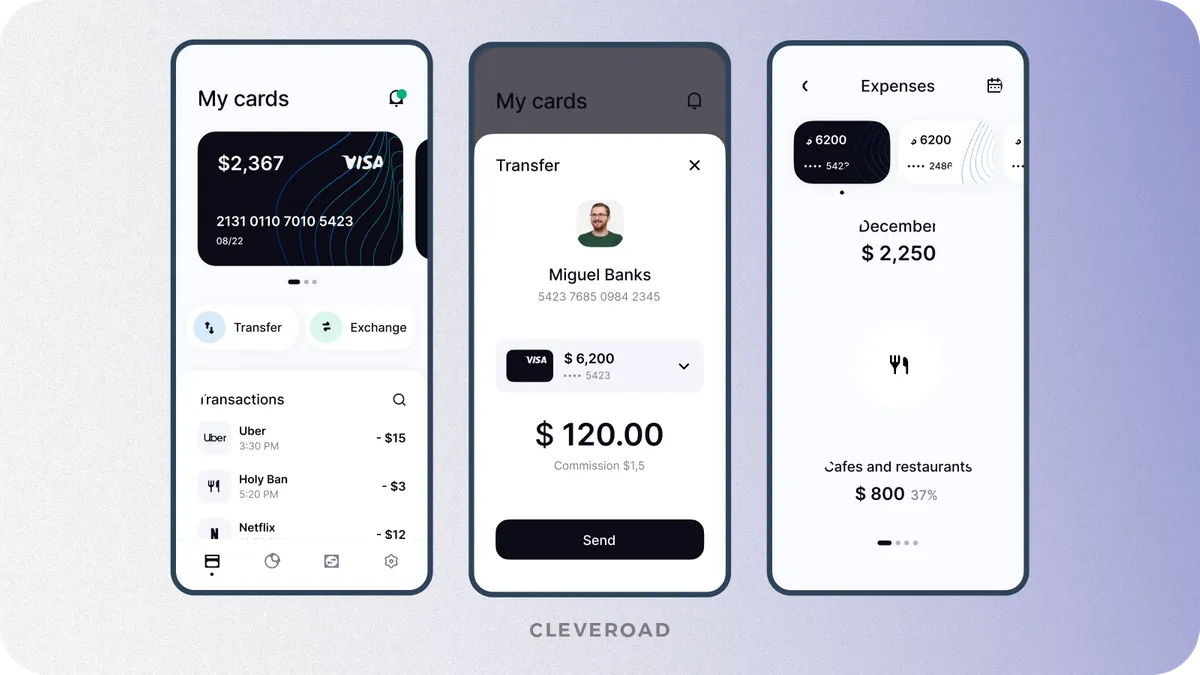

Below is an example of a custom FinTech app interface designed by Cleveroad, showcasing how tailored UI/UX brings both functionality and brand identity together.

Banking app designed by Cleveroad (Source: Dribbble)

Backend development complexity and tech stack

Backend complexity is a major factor shaping the cost to develop FinTech app. A simple backend with one server, basic APIs, and standard database management may cost $15,000–$25,000+, enough for core finance solution features like balance checks or simple transfers. By contrast, when FinTech companies need to develop an app with advanced integrations, analytics, and support for heavy transaction volumes, backend costs can rise to $50,000–$80,000+. According to SDK.finance, companies can spend up to 70% of the total budget on backend development when building a fintech app.

In the FinTech industry, this investment is crucial: a scalable backend ensures security and stability when thousands of users interact simultaneously.

The technology stack also impacts the overall finance software creation budget. Standard frameworks and third-party APIs help build a FinTech application faster and cheaper, while emerging technologies increase complexity. Adding AI-driven fraud detection or Blockchain for transaction transparency may raise the blockchain app development cost and overall budget by $30,000–$60,000+. These choices directly influence not only the upfront price but also the long-term efficiency and competitiveness of a FinTech product.

Team structure and location

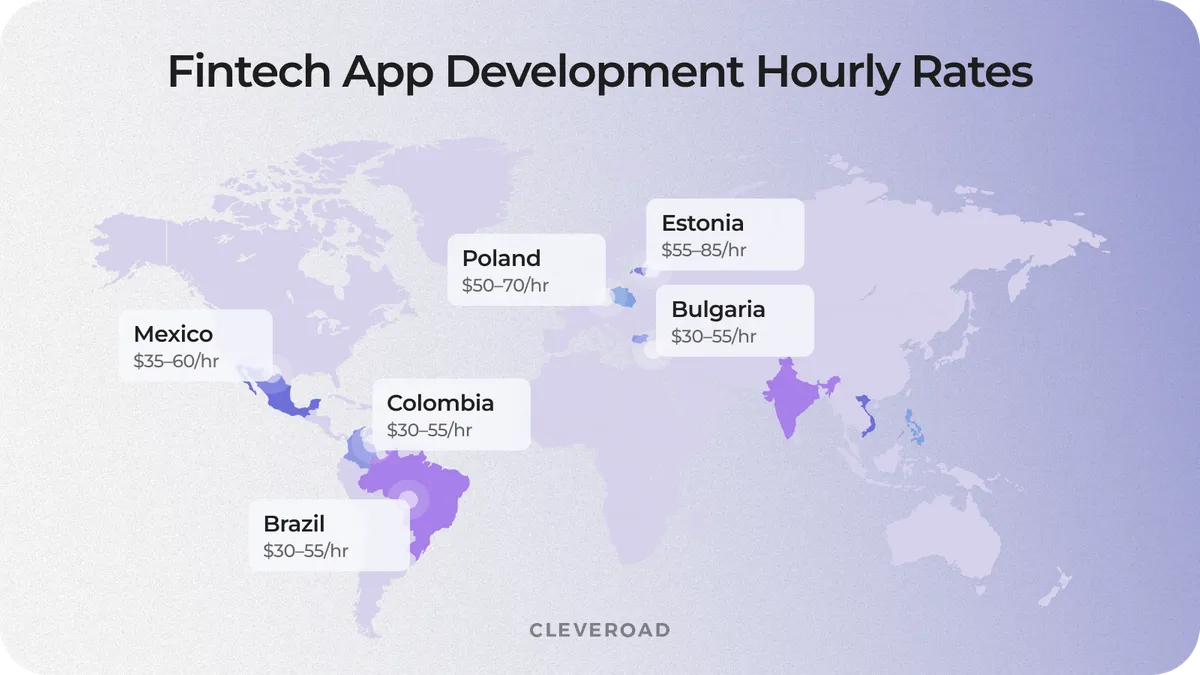

The composition and location of the development team have a direct impact on the cost to build FinTech app. Hiring local developers in high-cost regions like the US often means paying $100–$200 per hour, which quickly raises the overall cost of making a FinTech product. By contrast, working with experienced teams from Central and Northern Europe can reduce expenses significantly, with average rates ranging from $50–$80 per hour. For many commercial startups, choosing this approach allows them to optimize budgets without compromising quality, especially when launching early-stage MVP.

Let’s find out more about the major hourly wages for finance solution development in the key outsourcing destinations:

FinTech app development hourly rates by major countries

Equally important is the team’s structure. Successful projects in the FinTech sector typically require a Business Analyst, Project Manager, Solution Architect, Frontend and Backend Developers, UI/UX Designer, QA Engineers, and DevOps specialists. Depending on project needs, companies can engage a full team or apply staff augmentation to bring in individual experts with niche FinTech expertise. This flexibility is particularly valuable for startups that need to scale quickly.

Each factor contributes uniquely to the overall app development cost. The specific project requirements and priorities will determine how each factor impacts the budget. To put it simply, the FinTech app development cost may vary anywhere between $90,000-$300,000+.

How Much Does It Cost to Build a FinTech App

Before we dive into the details, let’s look at some approximate numbers to give you a general idea of the cost to build a FinTech app. These estimates are based on our previous projects and calculated at an average $50/h rate typical for Central and Northern Europe. They represent rough budgets for MVP versions of the most common FinTech app types: banking, lending, investment, insurance, and consumer finance.

! Important: These figures are only a starting point. We’ll break down each app type feature by feature, show detailed time and cost estimations, and explain exactly what drives the budget up or down. If you’re serious about planning FinTech app creation, don’t skip ahead: the insights are in detail below.

The table below shows rough time and cost estimates for different types of FinTech apps, giving you a baseline before we dive into detailed breakdowns:

| Type of FinTech app | Approx development time (h) | Average cost ($) |

Banking app | 3200 hours | $160,000+ |

Lending app | 2300 hours | $120,000+ |

Insurance app | 2800 hours | $140,000+ |

Investment app | 2500 hours | $125,000+ |

Consumer finance | 2600 hours | $130,000+ |

How did we calculate the cost to develop a FinTech app by each type? We added development and non-development time. After that, we multiplied the time by the team’s hourly rate. We calculated the MVP version of each service. If you want to add more advanced features, you’ll likely pay more.

FinTech App Development Costs by Solution Type

Fintech is quite a broad term, including different types of applications. As a financial advisor with extensive years of experience (since 2011), we’ve pointed out five main types of financial apps and estimated them feature by feature:

- Banking app

- Lending app

- Investment app

- Insurance app

- Consumer finance

Mind that the FinTech app development price described below is approximate. The estimate is based on general features for MVP development. Feel free to contact our FinTech Business Analysts to get a personalized project estimate.

Banking app features development estimation

The mobile banking app development cost consists of the client-side and admin panel costs.The customer side allows you to check your current balance and transaction history, provide transfers to other bank accounts, schedule payments, send P2P payments, and look for ATMs that are free for you to use, and more. An admin panel is established for managing users' profiles and money transactions.

The most popular examples of digital banking apps are:

- Monobank is a mobile-first digital bank that offers free money transfers, instant credit options, and flexible cashback categories reaching up to 20%.

- Revolut is an international banking app known for global money transfers with no hidden fees, integrated crypto and gold purchases, and advanced spending analytics.

- Chime is a US-based neobank that combines checking, saving, and credit-building accounts, with features like round-up savings and fee-free overdrafts through its SpotMe service.

Now, let’s take a look at the approximate banking FinTech app development price and time.

| Banking app feature group | Development time (h) |

Access & identity | 165 hours |

User profile & dashboard | 230 hours |

Payments & transfers | 242 hours |

Cards management | 75 hours |

Security & fraud prevention | 140 hours |

Notifications | 75 hours |

Integrations & services | 210 hours |

Admin panel & support | 441 hours |

Total | 1,578 hours |

Lending app features development estimation

Lending platforms connect borrowers with lenders through secure, fast, and fully digital experiences. These apps typically allow users to request small loans against future income, manage repayments automatically, and access financial insights. While simpler solutions cover only cash advances, an app with advanced features like AI-driven scoring or personalized offers can stand out in the app store and attract more loyal users. Businesses can also experiment with decentralized models and build a DeFi app to enable peer-to-peer lending without intermediaries.

The top three lending apps are:

- ZestFinance is an AI-based lending solution that uses machine learning in fintech to assess users with limited credit history and help lenders determine safe loan amounts.

- Dave is a mobile service that provides up to $100 in cash advances, charges a small membership fee instead of interest, and sends balance alerts to help users avoid overdraft fees.

- Brigit is a subscription-based lending app offering instant cash advances up to $250, alongside budgeting tools and a proprietary score that tracks account health and spending habits.

| Lending app features | Development time (h) |

Authorization & KYC | 120 hours |

User profile | 80 hours |

Loan management | 110 hours |

Credit scoring & risk checks | 90 hours |

Payment & billing | 110 hours |

Repayments & scheduling | 95 hours |

Peer-to-peer lending module | 85 hours |

Admin panel | 300 hours |

Total | 990 hours |

Insurance app features development estimation

Insurance apps help both customers and providers streamline processes that were traditionally slow and paperwork-heavy. These solutions cover a wide spectrum of use cases: from handling claims and policy management to improving customer experience through instant support and mobile-first tools.

For clients requesting a FinTech development app estimate for insurance, the total development time and budget will vary significantly depending on whether they want a basic FinTech product with simple claims tracking or a more advanced platform that combines AI-driven underwriting and omnichannel customer support.

Examples of insurance apps include:

- GEICO is a claims settlement app allowing users to streamline the submission and tracking of insurance claims.

- AIG Travel Assistance is a travel insurance app that provides destination-specific health, safety, and travel updates.

- Root is a car insurance app that enables drivers to document accidents via smartphone and manage their policies digitally.

All these apps have different functionality, thus the final price will depend on industry-specific features. We’ve calculated the cost based on general features that are mostly similar for different types of insurance apps.

| Insurance app features | Development time (h) |

Authorization & KYC | 120 hours |

Policy management | 50 hours |

Quotes | 90 hours |

Claims management | 140 hours |

Payments | 120 hours |

Support & notifications | 120 hours |

Insurer module + analytics | 200 hours |

Admin panel | 300 hours |

Total | 1,140 hours |

Investment app features development estimation

Investment platforms allow users to review and invest in multiple financial assets, from stocks and bonds to cryptocurrencies. These solutions are designed to simplify transactions and empower users with real-time analytics, portfolio tracking, and personalized recommendations. By combining trading tools with educational resources, an investment app can address both novice investors and experienced traders, making it a versatile solution in the growing FinTech market.

Examples of investment apps include:

- Acorns helps users invest small amounts by rounding up purchases.

- Robinhood offers commission-free trading of stocks, crypto, and ETFs with real-time market data.

The table below outlines the key features of an investment app with estimated development time for each module, which is essential to calculate the cost to develop FinTech app.

| Investment app features | Development time (h) |

Authorization & KYC | 160 hours |

Investment portfolios | 170 hours |

Trading & order management | 150 hours |

Payments & transactions | 150 hours |

Dashboard & analytics | 180 hours |

Admin panel | 300 hours |

Total | 1,110 hours |

Consumer finance features development estimation

Consumer finance apps are designed to give individuals full control over their daily spending, savings, and long-term goals. Such applications emphasize budgeting, analytics, and personalized recommendations. A well-built app with a user-friendly interface can significantly improve financial literacy and help users avoid overspending by offering reminders, categorized expenses, and automated saving options.

The costs associated with FinTech app creation in this segment vary depending on complexity: simple dashboards with account aggregation are cheaper, while AI-driven advice and gamification features increase the cost of developing a mobile solution. Since every additional feature is directly associated with FinTech app development time, building a scalable consumer finance platform requires careful planning and prioritization.

Examples of popular consumer finance apps:

- MoneyLion combines personal finance management with loans and cashback rewards.

- Finch simplifies group payments and everyday budgeting through instant transfers and bill sharing.

| Consumer finance app features | Development time (h) |

Authorization & KYC | 120 hours |

Account dashboard | 150 hours |

Accounts aggregation | 70 hours |

Spending & goals tracking | 90 hours |

Support | 120 hours |

Admin panel | 280 hours |

Total | 830 hours |

These FinTech app development cost estimates highlight how functionality and complexity drive the overall budget, but they only scratch the surface of what influences the real numbers.

Step-by-Step Guide on FinTech App Creation and Expected Costs for Each Stage

Building a finance solution requires not only technical expertise but also a well-structured process. Below we break down the main stages of financial app creation, with approximate timeframes and cost to build FinTech app. You’ll also find a summary table consolidating the numbers.

Step 1. First contact

It all starts after you leave a request on our website. The request goes to our Business Development Department, and your personal manager with expertise in Finance domain gets in touch within 24 hours. At this stage, we briefly discuss your project at a high level, answer your initial questions, and schedule a Solution Design Workshop as the next step. No estimates are provided yet: the goal is to understand your idea and quickly move to structured analysis.

Step 2. Solution Design Workshop

The Solution Workshop connects your business needs with technical implementation. Our team gathers business requirements, defines the scope, and prepares a first rough FinTech development app estimate based on similar projects. Workshops also cover high-level architecture, integration requirements, and compliance aspects (e.g., PCI DSS, GDPR).

We have a dedicated Solution Team: business analysts, solution architects, and designers, who tailor the approach to your domain. The stage takes 1–2 weeks and at most vendors costs $5,000–$10,000+.

At Cleveroad, the Solution Design Workshop is free, so you can quickly receive the first rough estimate without extra expenses

Step 3. Discovery Phase

During Discovery Phase, Business Analysts and Solution Architects refine requirements, prepare detailed feature lists, UI/UX designers create wireframes, and outline non-functional requirements. On average, this stage takes 3–4 weeks, with an investment of around $15,000–$25,000+ depending on project complexity. This step results in detailed project documentation, ensuring that every feature from KYC to payment gateways is accounted for. A clear Discovery output reduces risks, shortens the total development timeline, and minimizes scope creep.

Step 4. UI/UX design

Designers create prototypes, user flows, and a user-friendly interface aligned with brand identity. A standard app design phase lasts 3–5 weeks, with costs ranging from $10,000–$50,000+. A template-based UI keeps costs lower, while a fully custom solution with animations or data visualizations can double expenses. Considering the cost of FinTech application development, investing in design pays off: better usability improves conversion rates and user retention.

Step 5. FinTech app development and testing

This is the core stage, where developers build the frontend, backend, and integrate APIs, while Quality Assurance engineers continuously verify functionality, performance, security, and compliance. Depending on app types (banking, lending, insurance, investment, or consumer finance), development may take 4–8 months, with the cost of making a FinTech app ranging from $80,000–$200,000+. Adding an app with advanced features like blockchain integration, or AI-driven scoring can significantly raise the budget compared to a basic FinTech MVP.

Testing activities run in parallel with coding and typically add 15–20% to the total development cost, or about $10,000–$30,000+ for a mid-size FinTech product. This combined approach ensures faster releases, fewer defects at launch, higher compliance with strict financial services regulations, and lower long-term maintenance costs.

Step 6. Deployment & post-launch support

The final deployment stage means the ready product is delivered to end users and prepared for stable operation in production environments. The deployment to the app store and cloud infrastructure setup typically takes 1–2 weeks, costing $5,000–$10,000+. Ongoing support (bug fixing, updates, scaling) is usually billed monthly, starting from $5,000+, depending on the scope of maintenance.

The table below summarizes each stage of FinTech app creation with its expected timeframe and cost, giving you a clear view of the overall budget.

| FinTech app dev stage | Approximate timeframe | Average cost ($) |

First contact | Few days | Free |

Solution Design Workshop | 1–2 weeks | $5,000–$10,000+ (Free at Cleveroad) |

Discovery Phase | 3–4 weeks | $15,000–$25,000+ |

UI/UX Design | 3–5 weeks | $10,000–$20,000+ |

Fintech app development & testing | 4–8 months | $90,000–$230,000+ |

Deployment & post-launch support | Ongoing | From $5,000/month |

Tips to Optimize the Cost to Develop FinTech App

Managing the financial solution development cost is not only about cutting expenses, but also about making smart choices during the project lifecycle. Since the development process involves several stages, from discovery to launch, businesses need a partner who knows how to balance budget and efficiency. At Cleveroad, our team of experienced FinTech app developers helps clients reduce unnecessary spending while ensuring compliance, security, and scalability.

Below are TOP-5 effective strategies we use to optimize the cost to build a FinTech app.

1. Start with clear app requirements

When it comes to controlling budgets, app requirements are the first thing to define. Poorly scoped projects usually lead to feature creep and skyrocketing costs. Cleveroad helps clients structure two aspects of app requirements: business-driven goals and technical feasibility. By aligning them from the outset, you can avoid rework and maintain an efficient roadmap.

2. Prioritize MVP over full-scale development

Launching a finance app through an MVP allows you to validate the market with minimal investment. Instead of adding all possible features integrated into the app at once, we focus on the essentials and scale gradually. Cleveroad supports this approach by delivering functional MVPs in just a few months, enabling businesses to test hypotheses before investing in advanced functionality.

Choose our MVP development services to validate your FinTech app idea quickly, cut unnecessary expenses, and enter the market with a scalable FinTech solution

3. Choose the proper technology stack

Selecting the right technology stack has a direct impact on performance, scalability, and FinTech app development costs. Cross-platform frameworks like Flutter and React Native help reduce time and expenses for early-stage products, while native Swift and Kotlin are often chosen for solutions that require maximum security and performance.

At Cleveroad, we align the stack with business goals and compliance needs: Node.js, .NET, Java, and Python for backend, AWS, Azure, or Google Cloud for deployment, and PostgreSQL, MongoDB, or MySQL for databases. Advanced features such as AI-driven fraud detection or Blockchain can be powered by TensorFlow or PyTorch, ensuring both innovation and reliability.

4. Optimize team composition and cooperation model

Efficient team setup in financial app development starts with defining the right composition, from Business Analysts and Solution Architects to developers and QA engineers, and adjusting the number of specialists as the project evolves. For example, you may scale the team up with extra developers to speed up delivery or reduce its size during the support stage to optimize costs. Cleveroad offers several flexible cooperation models, so you get exactly the expertise you need without overpaying:

- Dedicated Team Services. A full team of FinTech app developers and domain experts working exclusively on your project, fully integrated into your workflows. Best for long-term, large-scale financial app development.

- IT Staff Augmentation. Adding specific skilled professionals (e.g., Business Analysts, UI/UX Designers, QA Engineers) to your in-house team. Ideal when you need to quickly fill expertise gaps without long hiring cycles.

- Project-based model. End-to-end delivery where Cleveroad manages the entire development process that involves several stages, from Discovery to deployment. Perfect for startups or enterprises that want a turnkey solution at a predictable cost to build a FinTech app.

5. Plan for scalability and long-term support

One of the most underestimated cost factors is post-launch maintenance, since many commerce businesses focus only on the initial budget and forget about future expenses. Long-term support often requires regular updates, scaling, and compliance adjustments, which can significantly increase the total cost if not planned in advance.

Cleveroad ensures that each project is built with scalability in mind, reducing technical debt and lowering long-term expenses. This way, our clients avoid expensive redesigns and can extend functionality smoothly as their cost to develop FinTech app grows.

Cutting corners is not the right way to reduce costs: smart planning, MVP-first strategy, and choosing the right partner like Cleveroad will help you build a secure, compliant, and scalable FinTech product within budget.

FinTech App Development From Cleveroad

Cleveroad is a FinTech software development company with over 13 years of experience in the domain. We help banks, financial establishments and institutions automate processes, improve transaction security, and improve finance and banking operations by creating modern FinTech software solutions using the best tools and technologies.

Among the solutions our team develops within our FinTech software development services are electronic trading platforms, digital wallets, cryptocurrency platforms based on Blockchain, financial planning and management applications, the creation of new banks, etc. To ensure the expanded functionality of our FinTech solutions, we integrate various 3rd-party tools and solutions, such as payment gateways, CRM systems, Electronic Resource Planning (ERP), Blockchain, fraud detection, NFC and GPS technologies, etc.

We have successfully partnered with multiple clients in the FinTech sector, providing end-to-end product development as well as flexible IT staff augmentation services. Many of our clients highlight our ability to deliver secure, compliant, and scalable products while ensuring smooth cooperation and transparent communication.

Here’s a short video testimonial from one of our FinTech clients who collaborated with Cleveroad on IT staff augmentation services.

Sarah Timm, CEO of Parthenon. Feedback about Cleveroad's IT staff augmentation services

How we estimate FinTech app development costs

To estimate the cost of application, we at Cleveroad provide two types of estimates: Rough and Detailed. The Rough estimate is divided into 2 phases: Solution and Discovery:

Solution design rough estimate is done at the very beginning of the project and is based on the team's experience in similar projects. It considers objectives, primary scope of work, complexity level, constraints, potential risks, and mitigation plans. These elements, coupled with container specifications, shape the fundamental non-functional requirements. Utilizing this information, we generate a first FinTech app development cost estimation and proposal for the project.

Discovery rough estimate is more accurate and extensive. We analyze business processes, refine features, and outline non-functional requirements. This detailed insight informs a revised estimate covering preparatory tasks, development specifics, integration needs, non-development documentation, and enhancement suggestions, ensuring a more accurate and a proposal.

Finally, after the Discovery Phase, we start the development by preparing a detailed estimate, which is the most accurate. The estimate encompasses comprehensive documentation, non-development aspects, integrations, and relevant suggestions.

To demonstrate our expertise in FinTech, we invite you to review some of our clients' successful cases from our portfolio:

Get a custom FinTech app estimate now

Our FinTech experts will assess your demands on financial app and provide you with a personalized project cost estimation

The development region directly impacts the cost to build a FinTech app, as hourly rates of engineers vary worldwide. For example, hiring US or Western Europe teams can cost $100–$200/hour, while highly skilled developers in Central and Northern Europe typically charge $50–$85/hour, allowing FinTech companies to cut expenses by up to 50% without sacrificing quality.

The cost to develop a FinTech app is usually higher than other apps because the development process involves several stages that require strict compliance with financial regulations, advanced security measures, and integrations with banking or payment systems. Unlike typical consumer apps, FinTech solutions must handle sensitive data and high transaction volumes, which adds complexity, increases testing efforts, and raises overall development costs.

The cost to build a FinTech app with AI features usually starts at $150,000 for an MVP and can exceed $300,000+depending on the type of app, scope, and complexity of AI modules like fraud detection, robo-advisory, or predictive analytics. Since AI development requires additional data processing, model training, and compliance checks, it typically adds 20–40% to the overall FinTech app budget compared to standard solutions.

The cost to build FinTech app is determined by factors such as the type of app (banking, lending, investment, insurance, or consumer finance), the complexity of features, compliance and security requirements, and the location of FinTech app developers. Since the development process involves several stages, from Discovery to deployment, each step adds to the budget, making clear app requirements and the right technology stack crucial for accurate cost estimation.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

1 commentsThanks for this informative guide! https://www.botreetechnologies.com/fintech-app-development