How to Build a DeFi App [Comprehensive 2025 Guide]

Updated 28 Nov 2024

17 Min

1260 Views

How to build a DeFi app is a key question for businesses seeking to tap into the growing decentralized finance (DeFi) market. As DeFi continues to gain momentum, its appeal lies in offering users modern, efficient access to crypto trading, lending, and other financial services.

This comprehensive guide delves into the fundamentals of decentralized finance, the steps involved in building a DeFi app, and the key aspects to consider for success in this dynamic space.

What are DeFi and Decentralized Apps?

A Decentralized Finance (DeFi) system is a cutting-edge platform designed to eliminate intermediaries in financial transactions, empowering organizations, merchants, and users to manage funds more efficiently and securely. By leveraging Peer-to-Peer (P2P) networks, a DeFi project ensures seamless operations supported by robust security protocols and reliable connectivity.

To successfully develop a DeFi application, integrating essential features like a crypto wallet and prioritizing user experience are critical for delivering accessible and controllable financial solutions.

Harriet Taylor is ensured — DeFi will open the world for innovative, comfortable and successful financial operations. She proves this by the following statement:

Harriet Taylor

Executive Director of the UN World Food Programme

With DeFi, we can build a more inclusive financial system that works for everyone.

So, due to DeFi apps development, every customer may trade, borrow, lend, or save money using software that allows to log and validate financial transactions in distributed financial databases online from any location. Let’s find out the major characteristics of DeFi that assist customers in performing the said functions:

- Decentralization: DeFi apps run on blockchain, minimizing intermediaries and enhancing transparency, giving users direct transaction control.

- Programmability: Smart contracts streamline and automate financial tasks, making transactions more efficient.

- Interoperability: DeFi protocols interact, enabling easy asset trading and the creation of composite applications that combine multiple decentralized services, offering enhanced functionality and seamless user experiences within the blockchain ecosystem.

- Liquidity provision: Users can lend to liquidity pools for interest or rewards, facilitating decentralized trading and borrowing.

- Non-custodial control: DeFi apps offer users full ownership and control of their assets through smart contracts ensuring transparency, security, and eliminating the need for intermediaries in financial transactions.

All the transactions are accessible for every user via Decentralized Apps (dApps or DeFi apps) - special software which offers people more control over their funds through personal wallets as well as individual-focused trade services. So, the questions about how to build a DeFi app and its working mechanism become more and more essential.

How dApps work

DeFi technologies, powered by cryptocurrencies like Ethereum, enable financial operations without intermediaries. Entrepreneurs increasingly create a DeFi app to simplify transactions and provide users with direct blockchain access. Here's how these solutions function:

- Decentralized Applications (dApps). dApps operate on blockchain or Peer-to-Peer (P2P) networks, allowing direct P2P transactions and blockchain settlements. Managed through business software, they utilize DeFi protocols to ensure transaction parameters are met before completion.

- Governance tokens. These digital assets enable voting and decision-making within the blockchain, maintaining decentralization. Users may earn tokens for engaging with the platform.

- Smart contracts. These self-executing codes facilitate transactions when agreement conditions are met. Blockchain smart contracts ensure transparency, immutability, and security, refunding users if conditions aren’t fulfilled.

- DeFi protocols: Groups of smart contracts that work together to manage crypto assets and execute tasks. They follow defined rules and are interoperable for broader use across sectors. For those looking to enter the DeFi space, understanding how to create a DeFi protocol is essential for building robust and effective decentralized applications.

DeFi future in statistics

DeFi technology has risen in popularity over the past year. Let's delve into some key statistics that can highlight our statement and help you understand why you should build DeFi application:

- DeFi's Total Value Locked (TVL) remains steady despite market volatility, with Ethereum dominating at 71%, followed by Tron (6.4%) and BNB Chain (5.6%), according to Coinmarketcap data.

- The total number of confirmed transactions per day in 2024 is 586 571, considering the data from Blockchain official website.

- Worldwide DeFi market size is projected to grow from almost $24 billion in 2023 to $48.02 billion by the end of 2031, as Sky Quest remarks.

Next, we will explore the key features and functionality driving the success of DeFi apps, as reflected in the statistics given above.

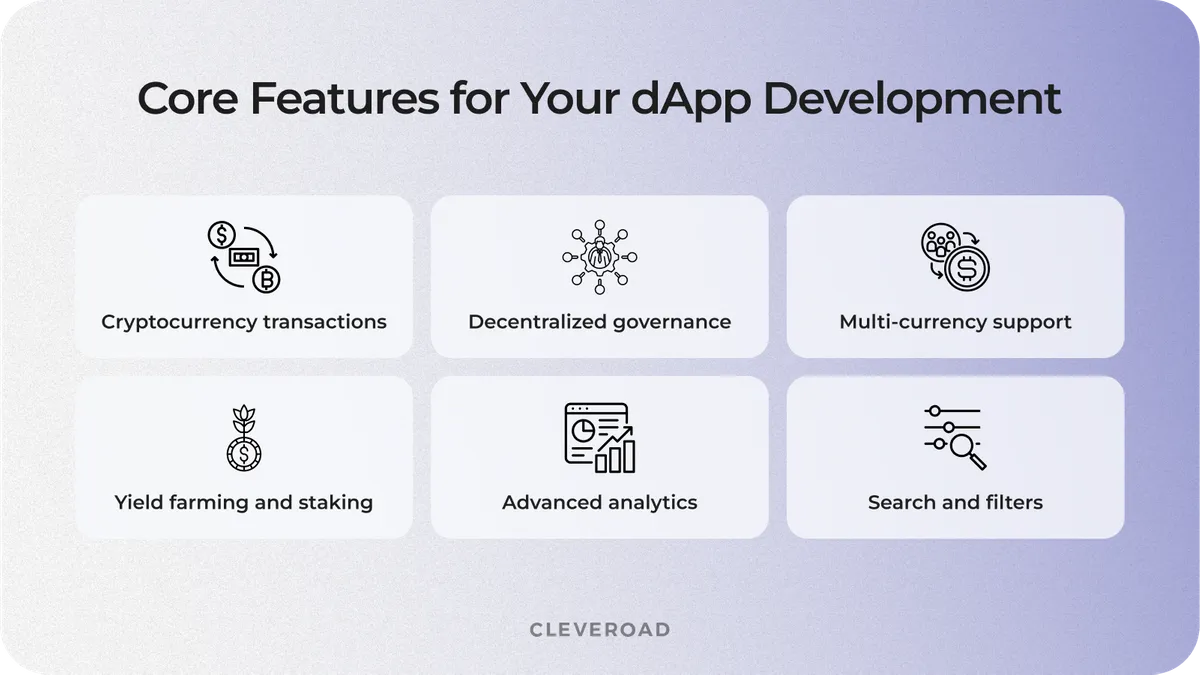

Core Features for DeFi App Development

Let’s examine the fundamental functionality that ensures seamless user experience, robust security, and efficient financial operations in your dApp. These core features serve as the foundation for building competitive decentralized finance solutions.

Core features for your decentralized application

Cryptocurrency transactions

Transactions involving financial assets should be supported by a variety of DeFi apps, not only decentralized wallets and exchanges. You can make it achievable to purchase and sell cryptocurrency, trade and convert, and move funds across accounts.

Decentralized governance mechanisms

Incorporating decentralized governance features, such as voting systems powered by governance tokens, is a vital aspect while building DeFi apps. These mechanisms enhance transparency and actively involve users in decision-making processes, ultimately strengthening trust in the application development process and the DeFi technology itself.

Multi-currency support

Users often require the ability to make transactions in multiple currencies. While some cryptocurrency wallets support only a single coin, demand for such wallets is lower compared to multi-currency wallets. Expanding your wallet's functionality to support various actions across multiple blockchain networks and their respective coins can significantly enhance your client base.

Yield farming and staking capabilities

Yield farming and staking capabilities are essential to building a competitive presence in the DeFi space. By integrating these features, you can attract users seeking passive income opportunities while enhancing user engagement and liquidity within the Blockchain network. Whether you discover how to build a DeFi application, seamless compatibility with tools like Trust Wallet ensures a robust and user-friendly experience.

Advanced analytics functionality

To thrive in the competitive DeFi sector, implementing advanced analytics and reporting tools is essential. These features provide real-time insights into portfolio performance, transaction history, and market trends, empowering users to make well-informed financial decisions.

Such capabilities not only enhance user engagement but also strengthen your position in the evolving DeFi landscape. By prioritizing these features, you can ensure your decentralized application delivers exceptional value to your customers.

Search and filter features

Search and filter functionality is a vital use case in DeFi app development. Incorporating a robust search feature allows users to easily navigate the list of supported currencies and services on your Blockchain-based platform.

Filters enhance usability by enabling users to sort options, such as crowdfunding projects or loans of various terms, simplifying the experience. These instruments are among the key features of DeFi that improve engagement and usability. Whether focusing on a web or mobile app, leveraging advanced blockchain development practices ensures a seamless and user-friendly interface.

How to Create a DeFi App Step-by-Step?

To successfully create and implement your dApp concept, you need a skilled software development team with deep expertise in Web3, DeFi, and cutting-edge Fintech solutions. Let’s discuss each of the stages to build a DeFi app in detail below.

Step 1. Define your app’s purpose and target audience

To start a DeFi app, you should begin by clearly defining its purpose and identifying your target audience. Consider whether your solution will focus on lending, staking, yield farming, or other decentralized finance development use cases.

Moreover, understanding user needs and market demands will help refine your app’s core functionality. This is why you should conduct market research to identify gaps in the DeFi sector and ensure your product stands out. A well-defined purpose will guide the rest of the development process effectively.

Step 2. Choose an experienced vendor

There are two options to consider when you look for a DeFi app building team:

- Building an in-house team. You can hire local specialists to create a solution tailored to your needs, but this approach is costly and time-consuming. Many entrepreneurs prefer outsourcing to develop unique decentralized products like cryptocurrency exchanges and other dApps.

- Partnering with an outsourcing software vendor. This allows you to entrust dApp development to a skilled IT company, saving costs, accessing a vast talent pool, and benefiting from specialized expertise in FinTech for implementing complex software concepts like dApps effectively.

Collaborating with an experienced DeFi app vendor is key to achieving a successful outcome and successfully dealing with intricacies of DeFi apps development, from Blockchain selection to regulatory compliance. They can also provide valuable insights and strategies tailored to your project needs.

You should look for vendors with a proven track record in FinTech (particularly, decentralized finance development) to ensure high-quality results. Additionally, prioritize vendors with strong client reviews and a robust talent pool capable of maintaining a consistent team throughout the project for seamless collaboration and deep product understanding. The right vendor becomes a trusted partner in helping you deploy a DeFi app efficiently.

We can become your reliable and trustworthy partner for DeFi app development, offering you seamless Fintech Blockchain software development services!

Step 3. Design a user-centric interface

A seamless and intuitive user experience is critical to the success of any DeFi app. You should work with an experienced app development team to design a dApp interface that simplifies complex operations and appeals to both beginners and seasoned users.

Prioritize easy navigation, clear visuals, and responsive design to enhance usability. The intricacies of DeFi app workflows, such as crypto wallet integration and transaction management, should be accessible to your future customers. A user-centric design fosters trust and encourages ongoing engagement, making it easier for users to navigate and benefit from the technology of decentralized finance (DeFi).

Step 4. Select the right Blockchain and technology stack

The Blockchain platform and technology stack you choose will directly impact your app’s scalability, security, and performance. Assess popular options like Ethereum, Binance Smart Chain, or Polygon based on their suitability for your DeFi product.

Collaborate with your FinTech app development vendor to select tools that align with your project’s goals and technical requirements. Remember, a well-chosen tech stack simplifies future updates and reduces maintenance costs. This step is the backbone of your guide on how to create a robust DeFi app.

This is the tech stack Cleveroad developers use when building FinTech solutions like dApps based on Blockchain:

dApp development average tech stack

Step 5. Focus on smart contract development and testing

Smart contracts are the cornerstone of DeFi applications, automating transactions and ensuring trustless operations. Invest in thorough development and testing to eliminate vulnerabilities that could compromise security.

Collaborate with your DeFi app development team to define clear contract logic that aligns with your app’s purpose. Rigorous testing helps identify and address potential issues before deployment. This focus ensures your app functions reliably when you make DeFi services accessible to users.

Step 6. Launch and maintain your app

Once development is complete, carefully plan the launch to maximize impact and user adoption. Offer comprehensive support during the initial rollout to address any technical issues users might face. After launch, you should prioritize app maintenance to keep your solution secure and relevant in the fast-evolving DeFi landscape.

Regular updates and feature enhancements demonstrate commitment to your users. With proper planning and ongoing improvements, you can successfully deploy a DeFi app that remains competitive.

How to build a decentralized exchange? Read our guide and dive deeper into the intricacies of DeFi usage!

Benefits of Using DeFi Apps

Let’s find out more about the advantages to create DeFi platforms and use them in your business.

Eliminating middlemen and optimizing costs

DeFi apps remove the need for traditional intermediaries like banks, reducing transaction fees and operational costs. You can directly interact with blockchain-powered platforms, streamlining processes and saving valuable resources. It allows for faster transactions and lowers the barriers to entry for financial services.

By cutting out the middlemen, you can also get more control over financial activities. As a result, DeFi technology empowers users to achieve cost-effective solutions without compromising efficiency.

Getting global accessibility and financial inclusion

DeFi apps provide universal access to financial services, regardless of geographic location or socioeconomic status. They use Blockchain technology to connect users globally, bypassing restrictions from traditional banking systems.

With just an Internet connection, you can participate in savings, lending, or trading activities. This democratization of financial services fosters inclusion and opens opportunities for millions worldwide. DeFi lending platforms, in particular, empower users to borrow or lend assets seamlessly, earning or accessing funds without the need for intermediaries.

Discover the peculiarities of DeFi lending platform development in our guide!

Obtaining enhanced transparency and security

dApps leverage Blockchain’s decentralized nature to ensure transactions are transparent and immutable. Every transaction is recorded on a public ledger, promoting accountability and reducing fraud. Smart contracts automate processes, eliminating the risk of human error or manipulation.

What is more, robust encryption and decentralized storage provide a higher level of security compared to centralized systems. It makes DeFi apps development a perfectly reliable option for managing your financial assets.

Implementing financial innovations

DeFi apps introduce groundbreaking financial tools like Automated Market Makers (AMMs), yield farming, and flash loans. These innovations enable your business to optimize asset utilization and explore new revenue streams. Traditional financial systems often lack the flexibility to adapt to these advanced mechanisms.

With the help of Blockchain, DeFi apps deliver cutting-edge solutions that push the boundaries of financial possibilities. These innovations cater to your company looking for modern financial management tools.

This way, DeFi apps are transforming the financial landscape by offering unique advantages that traditional financial systems cannot match. In order to develop and implement such a complex system as decentralized finance application properly, you can contact us to leverage our expertise and create a tailored solution that meets your business needs.

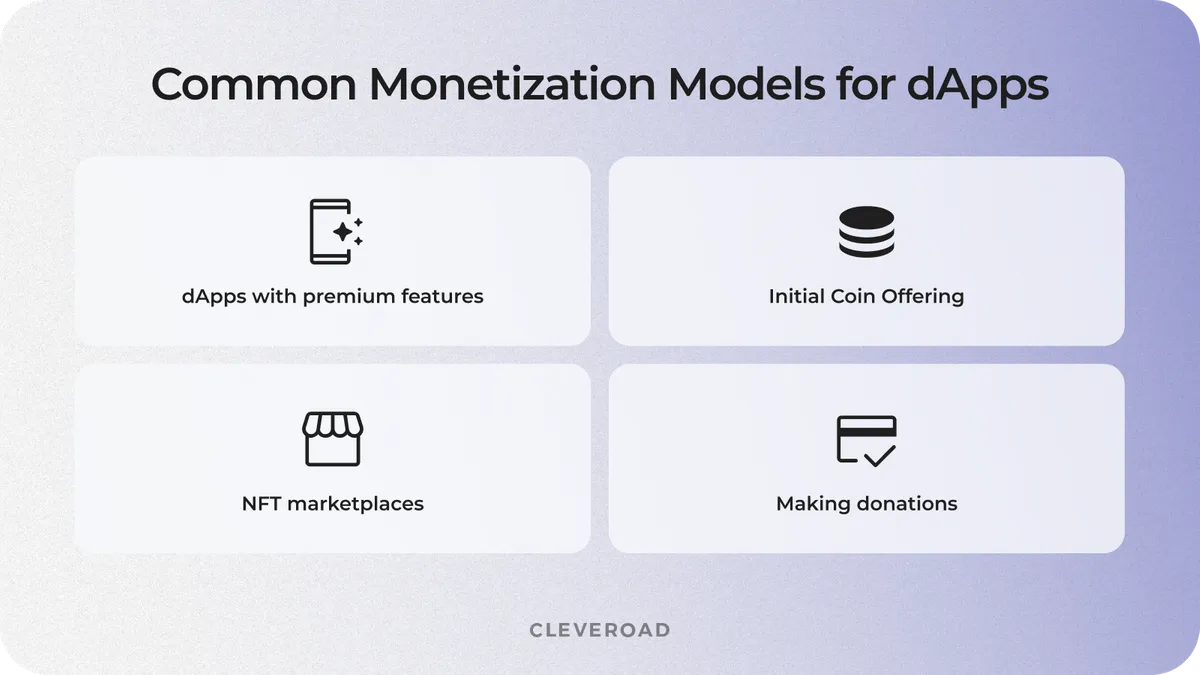

How to Monetize dApps?

DApps represents a lot of opportunities to launch a business and make profit. How to do that? It’s high time to find out what major monetization models you can use to build a DeFi app and make it highly profitable for your business.

Common monetization models for dApps

dApps with premium features

In order to effectively use dApps for profit, you can turn to a “classic approach” and add the paid functionality: for example, provide players a chance to improve their gaming performance without having to work on the levels by allowing them to purchase the premium feature with digital currency.

NFT marketplaces

We can't discuss how to create a DeFi app without mentioning NFTs, right? The NFT marketplace creation lets users sell, purchase, and even generate non-fungible tokens as part of current crypto trends. If your company uses a comparable procedure, you may leverage the transaction fee model to raise NFTs' overall income.

Making donations

If the goal of your dApp project is to address a global problem or advance a social cause, you may include a donation button on your website or application or even share its URL with other social entrepreneurs.

Initial Coin Offering (ICO)

The ability of a DApp to earn income strongly depends on its capacity to be backed by a token and be offered for sale to the general public. You can enter the wide market with your application by capitalizing it with tokens and raising funds from decentralized asset buyers.

Learn more about Blockchain app development cost and how it influences the profitability of your dApp project!

How Much Does it Cost to Build a DeFi App?

The cost of developing a decentralized finance system depends on the platforms used, the complexity of the functionality, the design, and the hourly fees charged by the software developers. For instance, if you contact a domain software provider to develop DeFi app, they will offer several options for your application (e.g., native or cross-platform), help you integrate payment tools that support fiat and crypto currencies, select cloud solutions to optimize performance, etc. Such a company will also offer you several cooperation/pricing options to choose from.

Cross-platform DeFi app development with Flutter is a highly cost-effective option for building such complex FinTech systems, and we’ve outlined the estimated development time for it in the table below. The price is determined by using the $50 average hourly wage actual for Central and Eastern Europe.

| DeFi app feature modules | Approx time, Flutter (h) | Approx time, Backend (h) |

Authentication | 68 hours | 48 hours |

Transactions management | 108 hours | 105 hours |

Notifications | 13 hours | -- |

Settings | 20 hours | 3 hours |

User profile | 128 hours | 107 hours |

Admin panel | 200 hours | 243 hours |

Total development time | 537 hours | 506 hours |

Given the time and effort required, creating a dApp will run you about $155,000 - $170,000, if you turn to a cost-effective Flutter development. Native applications might cost 40-50% more. But keep in mind that those calculations are rough and can be changed depending on your particular situation.

We’ve represented the approximate figures for you to think up the rough budget as to the future financial app development project. Please keep in mind that using Blockchain for a custom solution can increase the cost, so it is better to order an estimate from our experts in the Fintech domain.

Explore dApp development cost with our actual breakdown!

The Challenges of dApp Development

Planning how to make a DeFi app, you should also be aware of the issues you can face when starting the development flow. Our Fintech app development specialists prepared top problems of such a building along with possible solutions.

1. Complex Blockchain integrations

The problem: Integrating a dApp with a blockchain network is highly complex due to the decentralized architecture and the need to ensure seamless interoperability with various protocols. Poor integration can lead to high transaction fees, slow processing times, and limited scalability.

The solution from the vendor: A skilled dApp development vendor can assess your project requirements to choose the best blockchain platform, such as Ethereum, Binance Smart Chain, or Solana. They also employ cutting-edge tools and practices to ensure seamless integration and interoperability with other systems.

2. Ensuring smart contract security

The problem: Smart contracts are vulnerable to coding errors and security breaches, potentially leading to significant financial losses. Even minor bugs in a contract can be exploited by malicious actors, undermining user trust and causing reputational damage.

The solution from the vendor: An experienced Fintech vendor like Cleveroad employs rigorous security protocols and conducts comprehensive audits to identify and resolve vulnerabilities in smart contracts. They utilize specialized tools and techniques to test the code under various conditions, ensuring its reliability and robustness. The vendor also stays updated on the latest security practices and Blockchain standards to safeguard your dApp against emerging threats.

! By the way, the Cleveroad team has successfully implemented a secure payment solution based on smart contracts for an NFT marketplace. Explore our CereNetwork case to learn more.

3. Overcoming regulatory and compliance barriers

The problem: Developing and launching a dApp involves navigating complex regulatory landscapes, which vary by region and are constantly evolving. Non-compliance with local laws, such as financial regulations or data privacy rules, can result in legal issues, fines, or even app shutdowns.

The solution from the vendor: A proficient vendor provides valuable insights into the legal and regulatory requirements for decentralized finance systems in your target markets. They collaborate with legal experts to ensure your dApp complies with relevant regulations, such as GDPR, AML, or KYC standards. The vendor also integrates compliance features, like user verification tools and data encryption, directly into the dApp.

This way, you can see that the choice of the vendor plays a crucial role in overcoming the challenges of DeFi app development and ensuring your project is delivered efficiently, securely, and in compliance with all necessary regulations.

How Cleveroad Can Help You Implement DeFi Development Practice

Cleveroad is an experienced FinTech IT services provider capable of offering you qualified and long-term help with your DeFi solution creation. We are an outsourcing software development company with a deep experience in creating turnkey software products that represent commercial analytics, simplify online financial transactions, and reliably protect all your sensitive information from any third-party penetration.

Thanks to collaboration with us, you’ll get a bespoke blockchain-based commercial ecosystems with an appealing and user-friendly UX, a flawless DeFi digital solution connecting you to the distributed financial system running worldwide, and besides:

- Expert IT consulting services from specialists in the Fintech sphere - both in the technical stack and business intelligence as to the upcoming project

- Collaboration with an ISO-certified vendor that has security management and quality management systems certified by ISO 27001:2017 and ISO 9001:2015

- Signing of a Non-Disclosure Agreement (NDA) to protect your DeFi app concept from being stolen

- A highly qualified and agile-minded Fintech app development team that will work under your DeFi app idea embodiment, implementing it in line with established lending protocols, crypto loans, and P2P lending solutions

- The Quality Assurance services being rendered on every stage of the DeFi app development to ensure the highest quality

- Cutting-edge DeFi apps development approaches as well as an innovative tech stack (e.g., EOS, Ethereal, Rust, Solidity, Ripple) to bring your project concept into life.

We are excited to take on your project and deliver an exceptional, user-friendly product that will help you tap into the vast and profitable niche of Decentralized Finance. Check out our portfolio to see the successful Fintech projects we’ve completed and explore client reviews on our Clutch page!

Collaborate with a skilled dApp vendor

Contact Cleveroad Blockchain FinTech experts to order a dApp that streamlines your operations, enhances security, empowering your business to thrive in the decentralized finance ecosystem

You should start with the following sequence of stages:

- Step 1. Define your app’s purpose and target audience

- Step 2. Design a user-centric interface

- Step 3. Choose an experienced vendor

- Step 4. Select the right blockchain and tech stack

- Step 5. Focus on smart contract creation and testing

- Step 6. Launch and maintain your app

DeFi applications are built on blockchain networks, such as Ethereum or Binance Smart Chain, which form the foundation of the DeFi ecosystem. During DeFi application development, developers use a secure development environment to write and deploy smart contracts that automate processes like lending, trading, and staking.

To create a DeFi application, leveraging advanced decentralized finance software and tools ensures a seamless, efficient, and successful DeFi product.

The timeline to build a DeFi app depends on its complexity, features, and the development team's expertise. On average, it can take 4-8 months to develop DeFi software, including designing the interface, integrating blockchain, and implementing features like smart contracts and DeFi tokens. If you're ready to create a DeFi project, it's crucial to join forces with an experienced vendor who can streamline the process and deliver a robust solution.

To monetize dApps, you can implement transaction fees, subscription models, or premium features that offer additional value to users. Since DeFi apps are going mainstream, leveraging their growing user base and introducing innovative financial products can maximize revenue. A successful DeFi app involves seamless user experience and robust security, both of which are critical to attracting and retaining many DeFi enthusiasts.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

1 commentsThank you, for sharing such great knowledge on defi development.