How to Build a Decentralized Exchange and What You Need to Know About It in 2025

Updated 18 Aug 2023

18 Min

1312 Views

Decentralized Finance (DeFi) software products have become an integral part of many fields. The financial technology sector is a consistent and reasonable vector in the development of this solution. In contrast to the past, when the creation of this type of application was a time-consuming, complex process, the current software development life cycle is much more streamlined and simple.

Adoption of today's transparent development flow opens up a lot of prospects for businesses in this area on the way to renovation. Decentralized Exchanges (DEX) have become a crucial element of the field of decentralized finance. Such a demand is conditioned by the high security, transparency, and clarity within financial operations brought by these platforms.

This article is devoted to how to create a DEX platform, what are its fundamental values, implementation steps, and the differences between centralized ones. Apart from that, we’ll cover the most solid value streams and the core functionality of such software.

What Are Decentralized Exchanges (DEX)?

Independence from the government, intermediaries, and decentralized systems are the most basic and striking characteristics of digital money. However, their exchange mostly takes place on centralized platforms, which operate under the rules of specific financial regulators. In turn, this implies that users provide personal data and full access to information about transactions and transactions to the government, which completely destroys the critical principles of cryptocurrency.

Decentralized exchanges are platforms that bypass all of the above nuances by preserving anonymity and removing third parties in the form of regulators while maintaining complete security thanks to a blockchain-based foundation.

How DEX works for users: the core performance principle

There are the three main types of DEX platforms:

- Automated Market maker (AMM). It’s a DEX platform operating relying on a protocol that takes away the order book that prevails on conventional exchanges, where liquidity is delivered by purchased and seller orders and substitutes it with liquidity pools, an associated basin of tokens.

- Order book DEX. It is a tech solution, serving as a compound engine of the order book and the AMM liquidity pool with full adoption of the users' requests. This will overcome the issue related to the failure of the financial operation brought by the different order book depth present in the market, which facilitates excellent trading experience for customers.

- DEX aggregators. Put it briefly, DEX aggregators are the financial protocols that provide traders/investors with easy access to a diversity of trading pools through a single dashboard. They operate via a complex program analyzing numerous factors prior to opting for the best possible vendor for a particular token swap within the available platforms.

Brian Armstrong

CEO of Coinbase

DeFi is one of the most exciting developments in crypto and has the potential to revolutionize the system as we know it.

A Decentralized Exchange (DEX) is a crypto-asset trading application in which exchanges and other transactions take place using smart contracts rather than a centralized trading system.

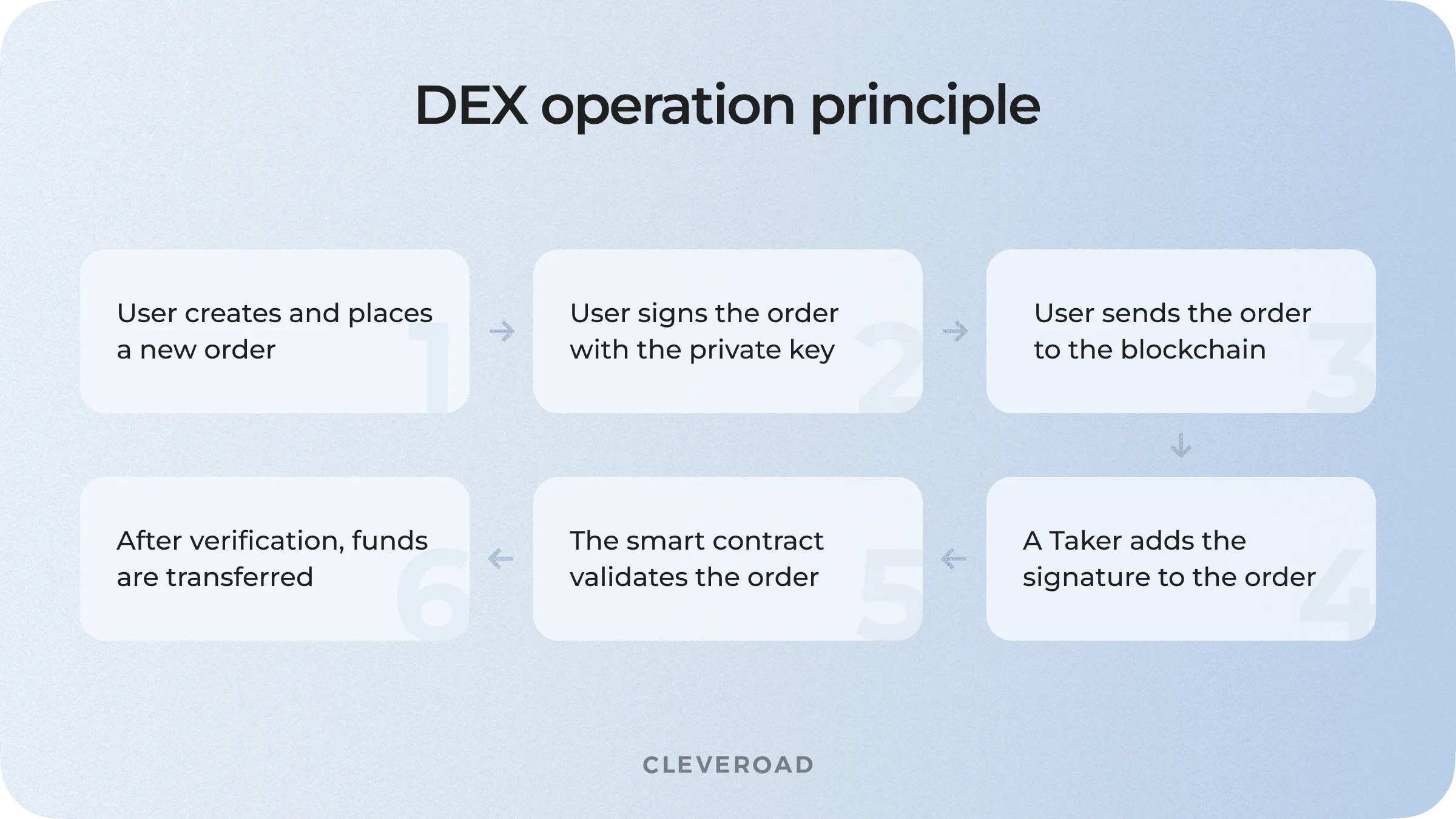

The principle of such a platform is based on a peer-to-peer (p2p) network - all parties have equal opportunities within the platform. The critical difference between DEX and centralized exchanges is that the former does not store user funds and does not control transactions. The transfer of assets takes place directly from the user's wallet, which has been previously linked to the platform.

Also, decentralized exchanges have no user verification procedure. Identification, in the vast majority of cases, takes place using blockchain addresses and non-custodial wallets connected to the application. As previously mentioned, all transactions and other actions within the platform take place via smart contracts.

The system operates on an open source code; all transactions made on the exchange occur without the control and participation of intermediaries.

Answering the question of how to create a decentralized cryptocurrency exchange, it should be highlighted that the platform uses clients' devices to establish a single environment with no defined center. Traders and investors do not have to worry about fraud-associated issues, hacker attacks, or technical malfunctions, as assets are held by the platform's custodian and not a third party.

Centralized and decentralized exchanges comparison

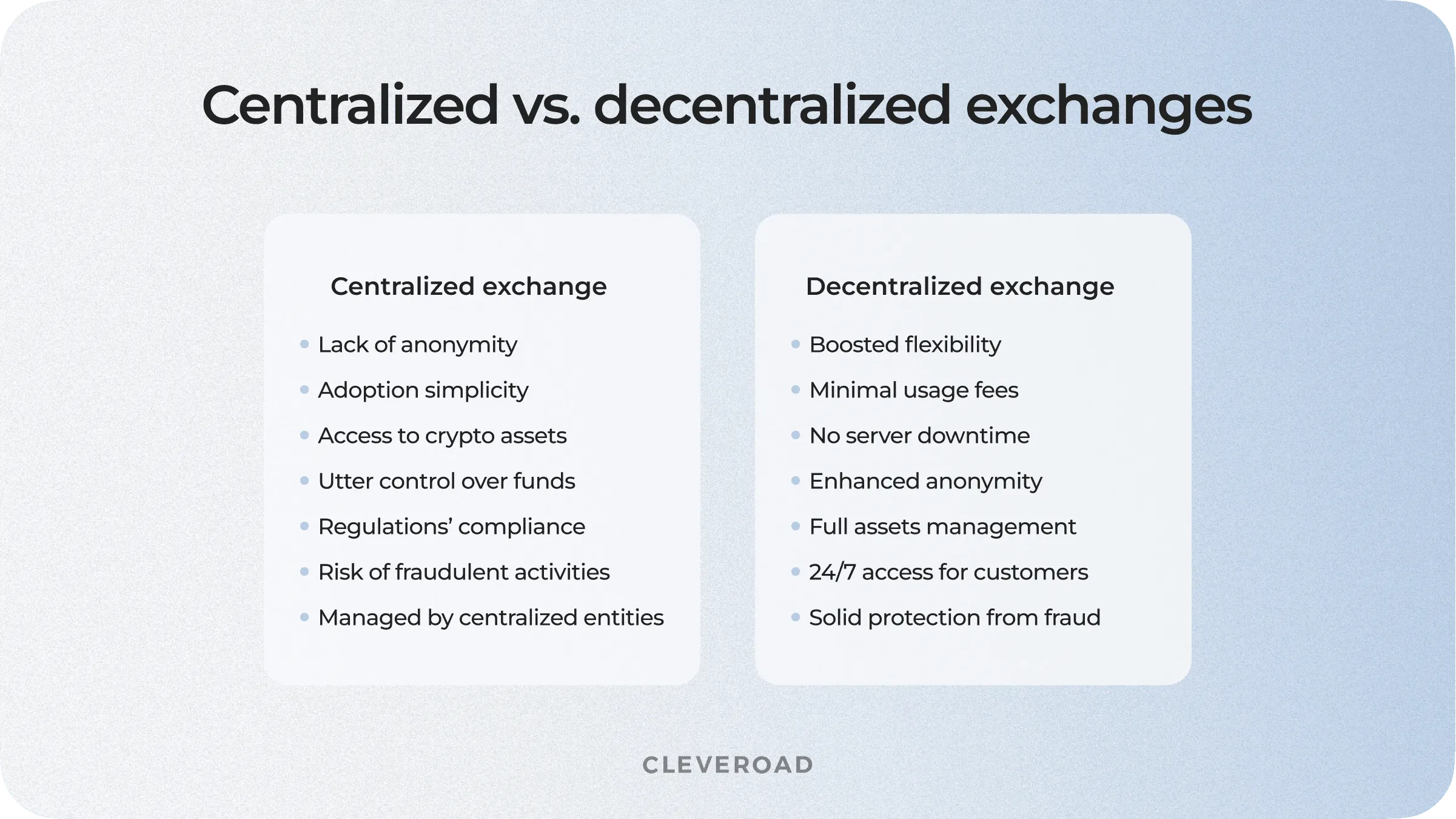

In contrast, centralized cryptocurrency exchanges (CEX) function similarly to traditional stock exchanges. They are managed by legal entities, which are fully responsible for the transactions performed within the exchange, the protection of customers' financial assets, and compliance with the law.

Because of this fact, administrators of centralized exchanges have access to customer funds and, if necessary, can block an individual user and reject a specific transaction or operation, in practice, withdrawals of funds. In addition, each user wishing to register is required to undergo the procedure of identity verification (Know Your Customer). When considering how to make decentralized exchange, we refer to drastically contrasting concepts.

There are a vast number of people who want to conduct transactions without intermediaries. One more driving reason for such rapid development of DEX is the fact that it is one of the key trends and development directions of Web3 (also called Web 3.0), which is a concept for a new infrastructure of the World Wide Web that comprises solutions such as decentralization, blockchain technologies, and token-based economics.

Engaged in Web3 development? Dive deeper into the details of this topic with our article

Contrary to Web monopolization by immense tech corporations, Web3 spans decentralization opportunities and is architected, administered, and possessed by the users. This way, Web3 ensures opportunities and management activities to enthusiasts instead of companies, which is the fundamental principle required to build a decentralized exchange.

These facts resulted in the following statistics - as of mid-2022, there are more than 200 top DEXs running on dozens of blockchains.

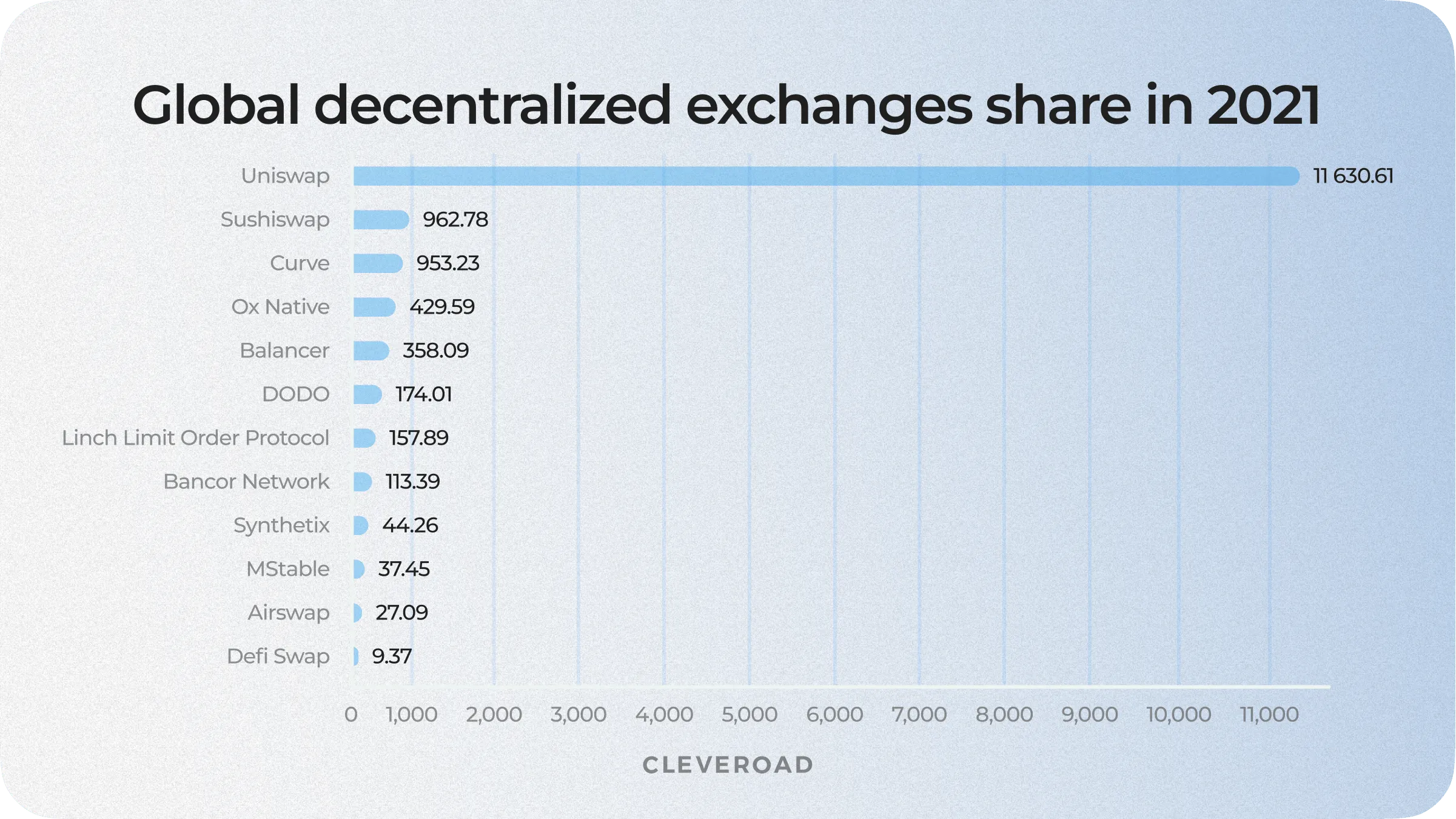

The popular decentralized exchange Uniswap comprised a 7 day trading volume increased four times than the one possessed by Sushiwap within the equal term in September 2021. According to Statista, in conjunction, the two cryptocurrency exchanges embraced a market share of approximately 80%, mentioning trading via DEX. Below we have outlined the major decentralized cryptocurrency exchanges globally, considering the 7-day trading volume:

Decentralized exchanges value worldwide by 2021 (Source: Statista)

Why DEX Is a Great Undertaking for the Crypto Businesses

The cryptocurrency market has been actively developing for more than ten years. The most active growth was recorded in 2021. Capitalization is the best way to demonstrate the relevance and value of the digital world- there is roughly $38 billion of value locked in DeFi.

Why is cryptocurrency important for business, and is it reasonable to create your own decentralized exchange? Let's highlight the fundamental benefits:

- Encryptions and transaction verification as a guarantee of security

- Operations recorded on a blockchain with no mediators control

- Relatively low transaction fees compared to payment services

In fact, the same positive characteristics may be the reasons to create decentralized exchange. And instead of that, let's explore them more intensely:

Robust assets’ protection

The fact that the wallet is non-custodial delivers high anonymity. This is due to the absence of the need to transfer private keys to perform financial transactions. Accordingly, for the highest level of user security, smart contracts enable the interconnection of outer wallets with decentralized exchanges and ensure automated trading.

What are blockchain smart contracts, and why are they valuable? Read the post to find out

Minimal fees

As was mentioned before, smart contracts allow automated transaction execution with no engagement of intermediaries. This concept reduces transaction fees to a minimum. Thus, users save much more compared to centralized exchanges. Looking at practical examples, Swap charges approximately 3% for exchange transactions. However, the commission tends to fluctuate and depends on the platform, so defining how to build DEX, you should consider each case separately and think over the tokenomics.

Privacy and anonymity

The accountability for assets doesn't lay down on DEX due to the fact that the user wallets purport external administration. The principle required to build dex exchange implies that the clients do not fulfill Know Your Customer (KYC) and Anti-Money Laundering verifications. Therefore, the level of confidentiality is relatively high.

Flawless user experience

A clear and laconic interface is an excellent way for users to get acquainted with the crypto sector and get maximal profit from it. Intuitive usage of features accompanied by the above-mentioned benefits is a great way to attract and retain the audience.

Global leverage

The peer-to-peer lending, two-click easy operations, and maximal anonymity brought by decentralized exchanges have raised their necessity among users and have infiltrated the world economy, becoming an integral part of it. There are no usage boundaries- each enthusiast with the Internet access and a platform is able to run a platform effectively.

What architecture predetermines such value? Let’s delve into this question and define how to build a decentralized exchange.

The major DEX benefits

How Is the Decentralized Exchange Software Arranged?

Currently, we may outline the three integral models of decentralized exchanges:

Monolith

This model implies a multifunctional type. The pitch that comprises user wallets, transactions, profiles, and operations are deployed on the same server. It takes the least time to deploy such a platform. It takes minimal terms to build a DEX of this model. Nevertheless, scalability-related challenges may occur. In essence, the utter delivered functionality may be launched via a single server without the ability to cater to vast loads of customer requests.

Modular

The concept to create DEX exchange of this type requires standalone, efficiently operable pitches. To illustrate, a wallet section, a user section, an exchanging system, and others. Every element this model comprises is self-contained. When you decide to create your own DEX with a modular architecture, you provide for excellent performance with a high workload in advance. For this, it would also be wise to make a responsible choice of the hosting vendor. Another valuable advantage of this model is the maintenance and updating simplicity.

Distributed

When we want to create a decentralized exchange of this model, we mean an enhanced modular architecture. With it, each pitch is not only substantive but also comprises self-contained submodules. In practice, a repository can be set through several servers. The fundamental is a trade operation, whereas the second is all the other elements. Due to the maximally qualitative performance, such software requires substantial investments for support and updating.

When delving into how to create decentralized exchange, you should understand that every model reflects the requirements of each software type. Put it in practice, small projects should opt for the monolith one, while the modular architecture is appropriate for moderate software, and the distributed option will be the most suitable path for vast DEXs.

Hesitating on the model selection?

Contact our Senior Delivery Manager for initial consultation and connect with the tech advisor team

It’s time to draw up a possible tech stack to build decentralized exchange:

Technology stack to create a DEX

Below we’ve prepared the list of potential solution stacks to implement a DEX platform. However, it is reasonable to mention that this is the potential range that will differ due to the specific project’s peculiarities:

- Languages. PHP, Java, MEAN stack, Laravel

- Databases. MySQL, MongoDB

- MEAN. MongoDB, Express JS, Angular JS, Node JS

- Cloud. AWS, Google Cloud Platform

- Push notifications. Twili

With the aforementioned tech set, you are able to create DEX with the following approximate functionality. How to build a DEX is surely a complex process, just like the product itself. To fit in the user requirements and obtain a customer base rapidly, you should consider its functionality.

Core functionality to create a DEX

The optimal solution is to start with a list of fundamental features to deploy the software and keep its upgrade subsequently, based on the customers’ feedback. We would like to once again highlight that the list of functions is pretty variable, so please consider this one to be exceptionally the suggested one:

Trading engine

This is an integral feature for customers to execute trading processes online and see the data modifications and tendencies in real-time mode. Owing to this fact, high processing is a must in terms of this process.

Client navigation

It’s significant to keep in mind that each element within your software is associated with your audience, which means that the navigation among the screens should be straightforward and intuitive to deliver a top-class user experience. When it’s unclear how to deal with the platform, your product won’t find widespread use.

Order book

The exchanges split the factual assets acquisition and selling requests, and the range of requests is called the order book. In case the set order detects an offer that reflects its set conditions, the automated platform performs a deal between customers, and the executed request isn’t shown on the range anymore. The order lost enables customers to observe the actual rates.

History of operations

The range of executed deals comprises fundamental information concerning the entire operation, such as the transaction rate, the sum, and the precise order time. This enables clients to monitor their performance.

Push notifications

This is an integral element in building decentralized exchange as it keeps users up with all of the actual processes appearing on the platform. Therefore, you, as a platform owner, as well as your users, will be aware of the significant events.

Insights generation

The report-generating algorithms will update you to be aware of the current market conditions and tendencies, enabling a proper plan for further platform development. You are able to set the KPIs (key performance indicators) on your own and track the user behavior patterns as well as all of the upcoming, pending, and completed orders.

Lending

A DeFi lending protocol is a feature that allows users to lend and borrow crypto assets, excluding mediators from the deal (via P2P). In a conventional banking system, financial organizations provide loans to borrowers. Such a feature allows lenders to gain interest for lending their crypto assets. Besides, DEX platforms with lending features facilitate routes for long-term investors to attain high-interest rates.

Borrowing

With this feature, the borrower can choose to borrow from one of the offered protocols and put down collateral. The significant peculiarity of these loan types is that they are over-collateralized. This means borrowers deposit as collateral an amount in crypto assets that surmounts the one that they borrow.

Yield farming

Yield farming also called liquidity farming, is a way of increasing engagement in your cryptocurrency, likewise how you’d obtain a yearly percentage engagement when you deposit money with conventional financial organizations. When investors take part in yield farming, their cryptocurrency value grows over time.

Among the other potential features to implement, there is an illustrative list:

- AMM integration

- Crypto wallet integration

- Flexible payment system

- NFT marketplace

How to Make a Decentralized Exchange: Development Pipeline

It’s time to move forward and consider the software development life cycle (SDLC) indispensable in terms of how to create a DEX.

Discovery phase

At this initial stage, all relevant information is collected from the client in order to understand how to create a DEX exchange according to expectations. The tech vendor conducts a call with the client to outline objectives and workscope, assess complexity level, containers and constraints, detect potential risks and mitigation plans, as well as prepare the fundamental non-functional demands. Any ambiguities should be resolved only at this stage. Also, high-quality preparation helps to avoid the following challenges that arise during the development of the DEX platform:

- Tokenomics outlining. Establishing the economic algorithm of your DEX

- UI/UX concept. Avoiding the competitors’ concept repetition

- Product patent. Releasing a license that prohibits source code utilization

Taking into account this data, your IT partner performs and delivers an estimate and cooperation proposal.

UI/UX design

The design phase follows after a good understanding of customer requirements has been achieved. This phase defines the layout of all screens and elements of the platform, as well as components, security levels, modules, architecture, various interfaces, and data types handled by the system. As a rule, experienced companies offer several variants of the design concept based on customer requirements.

Implementation

Based on the specification document prepared at the start, developers begin the process of architecture, implementation, and deployment. This is the flow of how to create a decentralized exchange and realize the functionality. Here, various components and subsystems are assembled into one complete system. The necessary APIs, frameworks, and security features are integrated. The implementation phase can vary in its terms - it depends on the complexity of the system’s functionality.

Quality Assurance and deployment

This phase is accompanied by verification of system operability, identifying, fixing, and eliminating bugs until the product reaches the required quality and security standards. Manual and automated types of testing are used for this purpose. After this, the platform is deployed to ensure accessibility to users.

Maintenance and support

The next step of how to make a decentralized exchange is to provide regular technical support to the system to extend its software development life cycle (SDLC). Updates of certain components, as well as the entire functionality, are carried out to ensure that the system meets the required standards and the latest technologies so as not to be exposed to existing / newly emerging security threats.

Delve into the comprehensive SDLC guide in our post

Examples of Successful DEXs and Their Monetization

Prior to analyzing the most efficient monetization models and understanding how to build DEX exchange with a solid value stream, let's try to estimate its development cost roughly. Please, remember that the following data is delivered exceptionally for introductory purposes. Applying to a credible software development partner is the best way to get the precise DEX cost calculation.

- Initial exploration and market analysis: $10,000-$25,000

- Project management: from $5,000 to $25,000

- UI/UX design creation: from $15,000 to $50,000

- Frontend implementation: from $10,000 to $30,000

- Backend implementation: from $25,000 to $70,000

- Quality Assurance: from $15,000 to $50,000

In total, the cost to build DEX amounts to roughly $75,000 and may rise up to $200,000.

Need a precise estimate?

Apply to Cleveroad qualified specialists who will calculate the accurate cost of your DEX

Let's also consider the major cost-determining factors:

- Hourly rates of the chosen tech architecture provider. Depending on the region, wages tend to vary, and accordingly, the higher the cost of tech services per hour, the more expenses the development will require in total.

- Chosen cooperation model. It is primarily selected depending on the scope of work your project comprises and may entail extra expenses, especially in case of the physical team assembling.

- Team composition. The tech stack and complexity level reflect the IT specialization needed to implement the ideas. For this, the basic team composition will expand, resulting in higher costs.

- Functionality complexity. To comply with milestones and design features of a higher sophistication, your project will need more time and human resources which also affects the cost.

- Chosen OS/ hosting expenses (for web solutions). In case with web platforms, you cover the maximal audience due to the access through the browser. Talking about the native app development, your software is aimed at users of the specific OS. The alternative is to opt for the cross-platform app architecture for different platforms utilizing the initial code. The final DEX cost will vary depending on your choice.

- Development approach. Your tech vendor executes projects using certain strategies. Each approach impacts the deadlines in parallel with the investments.

To understand how to create your own DEX and implement a proper monetization strategy, let’s consider the most popular models for revenue generation. Such platforms are founded on top of blockchain technology that comprises smart contracts.

Therefore, users store their assets in custody, and each transaction charges an operation commission aside from the deal fee. This is where the predominantly-used monetization lies in, allowing to recoup costs within the shortest time possible.

Uniswap

Uniswap is an Ethereum-based DEX that allows users to exchange ERC-20 tokens. It is one of the most popular platforms in the DeFi ecosystem, which is designed to counter one problem associated with DEX - lack of liquidity. Uniswap integrally generates revenue in two separate strategies: trading fees and the UNI token. The token allows possessors to vote on offers, such as fee structures, and perform trading via the DEX.

Comission: 0,3%

SushiSwap

SushiSwap is another platform that demonstrates how to build decentralized exchange successfully. It operates on the Ethereum blockchain, allowing users to exchange digital assets with each other directly. Owners of the platform's own token, SUSHI, can propose changes to its operation by voting on proposals submitted by other users.

Commission: 0,3% (0.25% goes directly to the participants of the liquidity pool. The remaining 0.05% is converted into SUSHI and distributed to token holders)

Nomiswap

Nomiswap is the first decentralized exchange (DEX) in the cryptocurrency market with a binary referral system and the lowest commission on the market. Currently, it is a decentralized exchange platform for exchanging tokens in BEP-20 (Binance Smart Chain) network, but in the future, it is planned to support multichain.

Comission: 0,1%

PancakeSwap

PancakeSwap another platform similar to Uniswap, built on its source code. However, instead of working with the Ethereum blockchain, PancakeSwap runs on Binance Smart Chain, which allows users to trade their BEP-20 tokens and dApps directly. Right now, PancakeSwap's daily volume is about $13 million.

On PancakeSwap, users trade against a liquidity pool. The pools are filled with exchange users' funds. In exchange for funds, users receive liquidity provider (LP) tokens. These tokens may be applied to recoup their share and portion of the operation fee. PancakeSwap also has its own CAKE token, which is used for farming, steaking, lottery entry, and NFT profile creation, serving as a revenue-generating engine.

Check our article concerning the five on-demand business models for startups to find out more ideas

How to Make a DEX: Cleveroad Experience in DeFi

Cleveroad is your trustworthy software development partner across a great diversity of on-demand industries. With 10+ years of company history and development as well as 120+ high-qualified tech engineers, we are competent in creating turnkey digital products for both longtime market players and newcomers.

FinTech and DeFi are among the sectors where we keep our consistent development direction. Cleveroad software engineers are aware of how to implement a solution that performs online transactions, generates financial insights, executes essential banking operations, and delivers top-notch privacy and security. Legal compliance and high privacy are the fundamental standards for Cleveroad.

To prove this, let us introduce one of our successful projects in this domain:

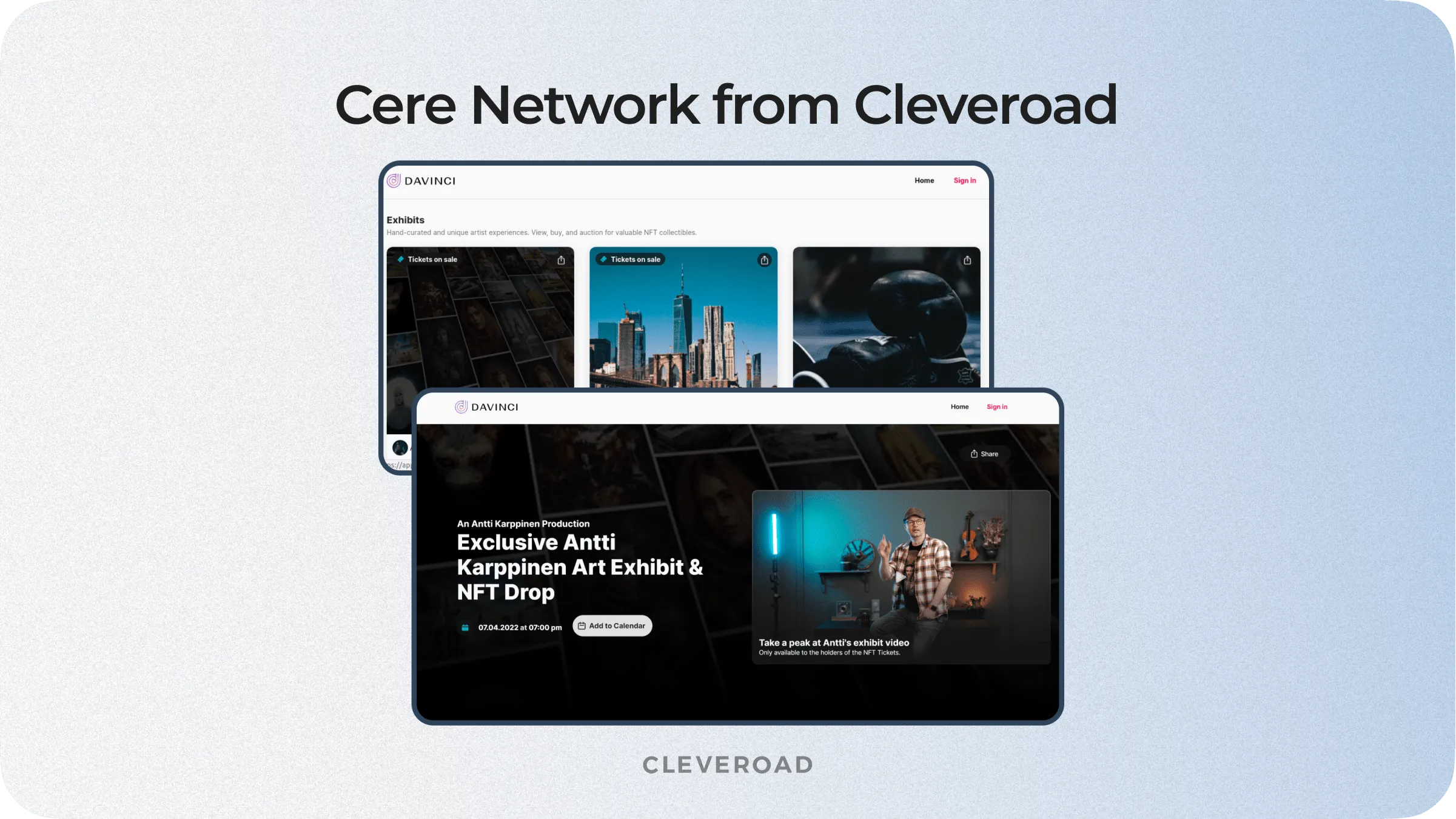

Cere Network NFT marketplace

Our USA-founded customer Cere Network is a business-to-consumer-oriented company delivering services in the sector of decentralized finances.

Cere Network NFT marketplace by Cleveroad

Integral objectives for Cleveroad

The vital objective was to design the platform for the NFT trading process, enabling the connection of all the engaged parties in one utter ecosystem. One more goal was to set the new value stream that allows profit generation matching the software concept.

Outcome delivered by our team

A full-fledged web solution that embraces all parties of NFT trading (artists, fans, and collectors). Besides, the product is compatible with the Cere Network’s Decentralized Data Cloud (DDC), aimed at capturing activities among users and keeping with the blockchain-based storage. Delivered decentralization is also an optimized way to place collectibles in the secure infrastructure, eliminating any potential interference. Payment gateway integration implemented in the software is crucial to allow clients to pay via both fiat and crypto wallets.

Result of cooperation for the customer

Our client has received the web-based software that connects all enthusiasts engaged in NFT, eliminating third parties. We’ve also integrated the already built DDC Platform to ensure setting, displaying, and purchasing the media content. With the NFT media assets trading processes, our client is able to obtain higher profit, enhancing the overall rentability.

Cleveroad can develop a solution for you comprising simple and effective monetization models and build it into your business.

Set the new value stream now

Cleveroad tech professionals will deliver a perfect DeFi solution with robust monetization models

The steps below answer how to create DEX and comprise the general SDLC phases:

- Discovery phase

- UI/UX design

- Implementation

- Quality Assurance and deployment

- Maintenance and support

Such platforms are founded on top of blockchain technology that comprises smart contracts. Therefore, users store their assets in custody, and each transaction charges an operation commission aside from the deal fee. This is where the predominantly-used monetization lies in, allowing to recoup costs within the shortest time possible.

Please, remember that the following data is delivered exceptionally for introductory purposes. Applying to an on-demand software development partner is the best way to get the precise DEX cost calculation. In total, the cost amounts to roughly $75,000 and may rise up to $200,000

The cryptocurrency market has been actively developing for more than ten years. In case you research how to make DEX, you might be aware that the most active growth was recorded in 2021. Capitalization is the best way to demonstrate the relevance and value of the digital world- there is roughly $38 billion of value locked in DeFi.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article