How to Build an Investment Platform: Features Guide, Development Steps, and Average Price

Updated 22 Aug 2023

20 Min

702 Views

In 2020, we started working with a UK conglomerate with 22 years of experience in property investment. The company's in-house resources weren't enough to build the software solution it needed: a platform for investors to manage funds and real estate objects. The customer came to us to find a provider with industry expertise to create an investment platform. We've submitted the proposal and had a successful project launch.

We, at Cleveroad, understand all the peculiarities of building an investment platform. So, in this article, we'll talk about the potential of your idea to create investment platform, its must-have features, building peculiarities, and other basic necessities you should know when planning such a solution development. Don’t hesitate to start learning them right now!

Before You Create Your Own Investment Platform: What Is the Potential of Your Idea?

Building an investment platform that is robust and secure has immense potential for your financial business. Utilizing this kind of software can have several benefits, including opening up new income opportunities, boosting consumer loyalty, distinguishing your brand, providing insightful data, making it easier to form future collaborations, and guaranteeing sustainability over the long run. It can also establish your business as a leader in the investment sector and promote development and success.

We researched the current statistics and made an inspiring set for you to prove the effectiveness of the investment platform development for your company:

- It is popular, especially among the youth: according to Statista’s research, 12.29% of Americans (aged 18-29) confirmed they used investment software during the last year.

- The investment platform development is comfortable and in demand: Google mentions that investing software searches grow up 115% a year.

- The investors have proven its potential: the Research and Market report forecasts that the global Fintech sector profitability will rise to $137.44 by 2028.

- Online investment platforms are stable: Deloitte stats mention that the WealthTech management (mainly, the investment) business sector kept working even during pandemics.

If you still doubt, let us offer the best examples of profitable investment solutions. They have existed for years, being financially advantageous, successfully retaining existing customers, and attracting new ones. This rating can also inspire you to ensure the necessity of the investment platform for your business and create an accurate core feature list for your own financial platform.

Successful online investment platforms

The TOP-5 of the widespread and successful software for the investment business are the following, according to our investigation.

Robinhood

Robinhood is a well-known platform for investment that offers commission-free trading and an easy-to-use mobile application. The platform facilitates trading securities, options, ETFs, and digital currencies. The fractional share investing feature enables the purchase of partial shares instead of full shares.

Betterment

Betterment is a digital solution that offers automated investment services through robo-advisors. It considers risk tolerance and financial objectives to provide consumers with investment strategies based on their goals. Betterment's advanced tax efficiency methods are a significant advantage in minimizing investors' tax liabilities.

Wealthfront

Wealthfront. Another well-known software for robo-advisors dealing with passive investing is Wealthfront. It employs the current portfolio theory to construct diversified portfolios of affordable ETFs. One of Wealthfront's best features is its financial planning tool called Path, which provides individualized guidance on various financial objectives, including retirement planning, house ownership, and education savings.

eToro

The eToro investment platform includes social trading, allowing users to copy successful traders. It also provides various financial instruments, such as stocks, ETFs, forex, and cryptocurrencies, as well as educational materials and tools. Additionally, it operates on a commission-free model, generating profit from the margin between buying and selling prices of assets.

Fidelity UK

The Fidelity UK investing platform offers investment options, including investment funds and a trading platform for various assets. Beginners can use the "pathfinder" function on the mobile app to select from 10 pre-made growth portfolios or six income-focused portfolios. A simple graph tool helps users project their potential profits. The lowest-cost portfolios have a yearly cost of 0.64%.

Types of Investment Platforms

If you think out how to create an investment platform, choosing its type appropriate for your business vision is one of the things you should do first. That’s why we provide you with a list of the common investment software types to consider.

Brokerage platforms

Brokerage trading platforms (aka investment brokerages or online brokers) are investment software providing users with various services, such as analyzing financial market transactions, assessing trading risks, and assisting in managing market positions for investors and traders.

Brokerage platforms offer different account options, which include individual brokerage accounts, retirement accounts (such as IRAs), margin accounts (that allow borrowing for trading), and more. Each account has distinct features, eligibility requirements, and tax implications, so choosing the proper account aligning with your investment goals and needs is essential.

Moreover, online brokers typically provide customer support services, such as phone support, live chat, email support, and informative FAQs or knowledge bases, to assist with any inquiries or technical issues that may arise. Dependable customer support is crucial for resolving concerns or questions throughout your investment experience.

Crowdfunding platforms

Every business concept needs proper funding; otherwise, it stays the concept. But finding investors isn’t easy, and crowdfunding platforms help entrepreneurs do that.

Guy Kawasaki characterizes this looking-for-investment dilemma in the following way:

Guy Kawasaki

an American marketing expert, a well-known author, and a venture investor from Silicon Valley

Someone once told me that the probability of an entrepreneur getting venture capital is the same as getting struck by lightning while standing at the bottom of a swimming pool on a sunny day.

Crowdfunding is a method of soliciting small donations from numerous individuals via specialized online platforms rather than seeking a large sum from a small group.

A crowdfunding app development means creating a digital market with two sides to perform crowdfunding activities: producers/fundraisers and funders/backers. Communication is done virtually through software. A project description, business plan, and product images must be uploaded to start a campaign. Campaign types include charitable organizations, business ideas, or personal needs. Backers invest if they find the project worthy.

Social trading platforms

Social trading solutions provide online communication and exchange of trades and investment ideas for traders and investors. They are centered around "copy trading" or "mirror trading" enabling users to replicate the trades of other accomplished traders in real-time.

Additionally, social trading platforms offer users a collaborative and interactive space to gain insight and knowledge from successful traders. Novice investors can learn from seasoned traders, improving their investment returns by adopting successful techniques. However, users must conduct their research, evaluate the traders they follow, and consider their risk tolerance and investment objectives.

Peer-to-peer lending platforms

Peer-to-Peer (P2P) lending platforms enable individuals/businesses seeking financing to connect with investors willing to lend money online without the need for traditional financial institutions.

Loan lending app development aims to democratize financing by directly connecting borrowers with investors. They offer an alternative lending option that may be more accessible and efficient. Still, it’s crucial for participants to fully comprehend the risks involved, conduct proper research, and assess their financial situation before engaging in P2P lending activities.

These platforms also enable direct borrowing and lending between individual investors and borrowers, eliminating the involvement of intermediaries such as banks or credit institutions and streamlining the lending procedure. Moreover, P2P lending solutions utilize a range of risk assessment methods to evaluate the creditworthiness of borrowers. Such evaluations assist investors in making informed lending decisions based on the risk profiles of borrowers.

Also considering P2P payment app development? Read our post prepared to clarify the basics!

Real estate investment platforms

Such platforms allow individuals to invest in real estate assets or assets secured by real estate, previously available only for institutions or high-net-worth individuals.

These solutions aim to enhance the availability of real estate investments to a broader group of investors. They provide real estate management services and opportunities for passive income, capital appreciation, and diversification. When investing, lenders need to conduct due diligence, analyze investment options, assess their risk tolerance, and seek expert advice as required, as is standard practice for any investment.

By the way, we have recently worked on a platform for managing investments in property. It’s a digital system that covers all the processes and parties of real estate development investment and loan management.

Crypto exchange solutions

Crypto exchanges serve as a platform for the sale of digital currency, where buyers and sellers are matched. To take part, users must go through registration and complete the Know-Your-Customer (KYC) process for authentication purposes. After successfully verifying their identity, individuals can deposit funds onto the platform using either traditional currency or digital currency to complete transactions. It is a good assistance in trading and price discovery and offers storage solutions for cryptocurrencies. When selecting an exchange through digital assets, it is crucial to consider your requirements, budget, and security expectations.

Our team is also experienced in building Bitcoin cryptocurrency investment app; if you need one, we are ready to help you and guide you through a complicated process of such a software creation.

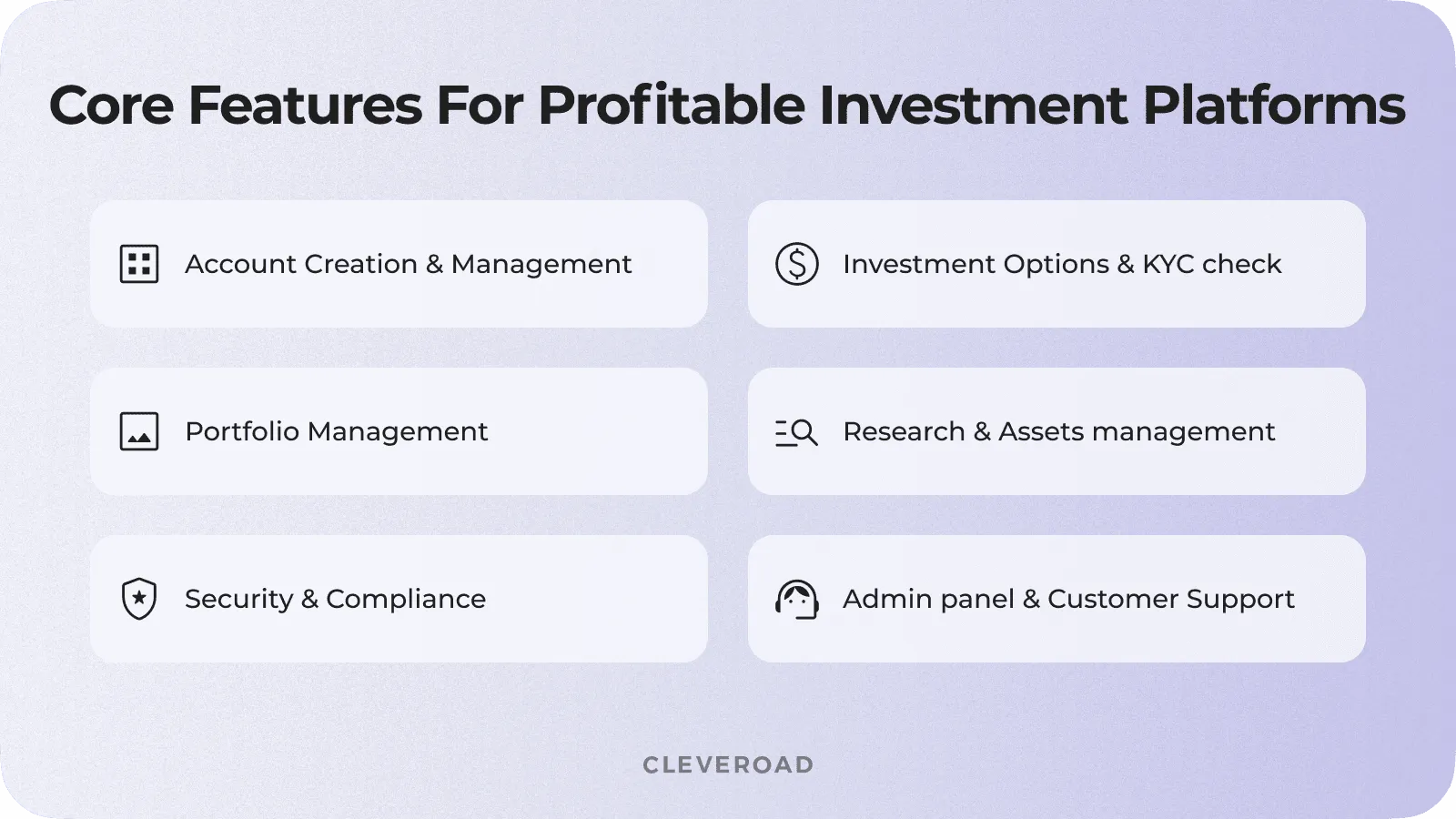

Core Features Found in Profitable Investment Platforms

Building an investment platform requires careful planning, development, and integration of various technologies and systems. Moreover, it's essential to prioritize UX, security, and regulatory compliance throughout the development process as well as correctly choose a set of core features that should be implemented first.

To facilitate your choice task, we’ve prepared a must-have feature list (based on our experience) you should look through and select for your digital solution for investment operations.

Core feature set for profitable investment software

Due to the account creation and management feature users can edit account details, manage preferences and monitor investments on the platform's dashboard. This feature also offers user authentication, password management, and collection of personal information.

Investment options. Your platform should offer various valuable points for investors to lend their money, such as stocks, bonds, and real estate. The investors must have access to comprehensive information about each option, including performance data, risk factors, and investment terms.

Know-Your-Customer (KYC) process helps you to check users, collect documents, and do background checks to ensure that only verified investors can join your investment system. KYC is a must for platform compliance with necessary security regulations and risk management.

Portfolio management functionality allows for efficient tracking and management of investment portfolios by users. The platform clearly presents assets, transaction records, and performance indicators.

Analytics tools. The platform is designed to provide users with various research and analysis tools, including market data, charts, financial news, company profiles, analyst reports, and educational resources. Customers should be able to research investments, analyze assets, and access information for investment strategies.

Security and compliance. To ensure the protection of user data, it is vital to implement industry-standard security protocols such as encryption, secure authentication, and regular security audits. Maintaining trust and meeting legal obligations requires compliance with relevant regulations, including data protection and financial laws.

The admin panel is intended for your platform administrators to manage various operations such as user and content management, investment product management, transaction monitoring, and report generation to ensure the platform runs smoothly.

A responsive and efficient support system is essential for users to address any inquiries or issues they may encounter. The FAQ section, email conversation, live chat, or phone support can quickly assist customers and answer questions concerning your platform.

We have enlightened the essential features your investment software system should include. It is not an ultimate functionality set; it can be extended depending on your business needs. You can contact us: our Business Analysts and Solution Architects will help you compose a feature list for your app considering your requirements, technical feasibility, and architectural factors.

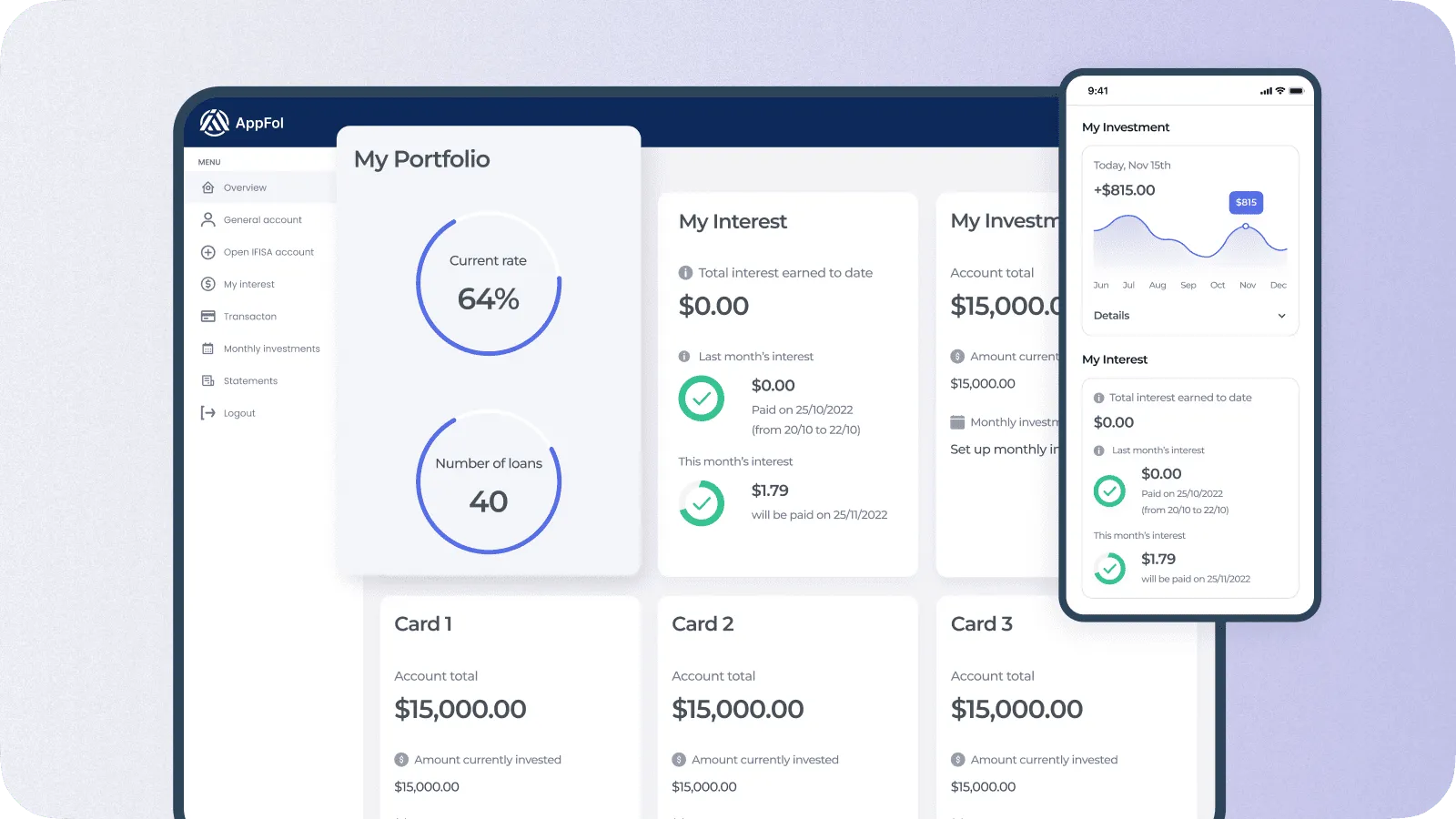

Short Story Case on How Cleveroad Successfully Delivered Investment Platform

We want to present you one of the latest fintech solutions we’ve delivered for our client — Investment management system for property.

Our client is a UK-situated property investment conglomerate with an extensive 20+ year of experience in their business domain. They were required to create a software platform for the investors with the opportunity to manage real estate objects and funds lent for that purpose, but their in-house team resources were not enough for that. That’s why our customer needed a partner fintech software company that would to:

- Provide the customer with the pool of industry experts that will work in tight cooperation with the client’s in-house staff on creating their digital product: from developing the solution’s architecture and composing a list of functionality for it to the product’s launch, maintenance, and support.

- Develop an investment system (based on marketing and competitor research results) that reflects all the aspects and processes of investment flow with organized user navigation to aid in decision-making.

- Ensure the delivered solution meets legal requirements for financial fraud protection, user identification, and information validation in government organizations.

To cover business and project challenges, we provided the customer with an outstaff team with the proficiency level needed for efficient working on their project. The team has built a powerful property investment management digital system, consisting of a mobile app for iOS and Android and a web-based advisor site and administrative backoffice covering the entire investment cycle. To guarantee the solution compliance to regulatory terms, we’ve developed the solution consider the requirements of the Financial Conduct Authority #722801 and implemented KYC/AML check functionality.

As a result, our client received a full-fledged and modern solution for investing in real estate objects. The system is industry-compliant, so the company can provide individual and institutional investors with a secure digital solution to make public offers to raise funds. The sum of earnings in the first operational year was stated as £7.6m; in the second year, this sum raised to £9.3m.

- Explore the Platform for Managing Investments in Property case in more detail.

Investment management system interface designed by Cleveroad

Essential Aspects to Know Before Building an Investment Platform

To create a robust and secure investment software platform, you should consider all the ins and outs of such a development process and weigh them out. In order to facilitate your task, we’ve composed a list of such factors for you. Get acquainted with this information and think it out carefully while planning how to create an investment platform.

Security

It is an essential factor to consider when developing an investing software platform. As the platform handles vulnerable financial transaction data, guaranteeing user data security and safety is crucial. When putting in place reliable security measures, be mindful of:

- Data encryption (e.g., encrypting communication channels with SSL/TLS certificates)

- Secure authentication (e.g., multifactor authentication (MFA), strong password policies, and account lockout mechanisms)

- Reliable infrastructure (choosing a reputable hosting provider with robust security measures, such as firewalls, intrusion detection systems, and regular security updates)

- User authorization and access control (e.g., role-based access control (RBAC), limiting privileged access, and regularly reviewing and revoking access for inactive or terminated users)

Regulatory compliance

When developing an investing software platform, regulatory compliance is an essential factor to take into account. It ensures that your platform runs within the law and safeguards the interests of investors.

Here are some standard regulations that an investing platform must adhere to; however, specific legislation may vary depending on the country and kind of platform:

- Anti-Money Laundering (AML) Regulations (for example, USA PATRIOT Act (in the United States) and the EU's Anti-Money Laundering Directive)

- Data Privacy Regulations (e.g., General Data Protection Regulation (GDPR) in the European Union)

- Financial Industry Regulatory Authority (FINRA) Rules (for the United States)

- Exchange Regulations (cover areas such as market integrity, trading rules, order handling, and reporting requirements)

Architecture considerations

Choosing the right architecture for a fintech project, namely platform is crucial and demands specialized expertise. When assigning this duty, it is advisable to involve a solution architect who will assess various factors, such as dependability, expandability, team structure, and other technical and business objectives, before making a final decision.

Expert team will conduct market research and analyze audience data to establish a unique value proposition and determine suitable architecture for an investment platform. When designing fintech products, it is important to consider factors such as scalability, security, and compliance in the architecture.

UI/UX interface creation

Building an investing software platform that is user-friendly, aesthetically pleasing, and easy to use requires careful consideration of UI/UX design.

Remember that design improves usefulness, engagement, and overall satisfaction among users in addition to aesthetics. By prioritizing design concepts and user-centric methods, you may develop an investing software platform offering your customers an aesthetically pleasing and understandable experience.

How to Build an Investment Platform Step by Step

Let’s consider the steps you should pass to create investment software that will securely satisfy the needs of your financial business and bring profit for you. As such a process is quite a complex task from the tech point of view, it’s highly recommendable to ask a skilled outsourcing fintech software development vendor for help.

Take preparation steps

You should make some arrangements while planning your perfect investment system to create. Do market research to understand better the trends, obstacles, and opportunities facing the investing sector today. Determine any possible market gaps or neglected fields that your platform may fill.

When creating an investment software platform, it is crucial to establish its central idea and function while considering the range of investment products or services it will provide. Additionally, conducting competitor analysis can aid in identifying opportunities for differentiation and areas where the platform can provide a better value proposition.

Define and comprehend your target market, including its characteristics, financial objectives, risk tolerance, and preferred investing strategies. Don't forget to create a compelling USP that connects with your target audience and clearly expresses the unique benefits of your platform.

Going through the described steps, you can always rely on the help of an outsourcing tech vendor with practical expertise in creating investment solutions. We’ll talk more about how to find such a partner now.

Looking for a software development vendor

Developing such a complex product like the financial platform for investment services needs extensive technical knowledge and a high level of expertise in fintech software development. Entrepreneurs typically find experienced specialists to bring the fintech app ideas to life through outsourcing IT experts.

When evaluating a potential software development outsourcing partner, it is crucial to consider various factors. Here are some key points to keep in mind.

- Evaluate the vendor's proficiency and background in creating fintech software solutions similar to your needs. Look through their case studies and real clients’ feedback to determine their abilities and industry expertise.

- To establish a prosperous outsourcing relationship, evaluate the vendor's communication methods and project management resources. Access to committed project managers or team leaders who can support efficient communication and collaboration is crucial.

- To assess the vendor's reliability, proficiency, and overall satisfaction, it's recommended to request client references and gather feedback from past or current clients.

- It's also essential to consider their location and time zone concerning your business. Factors such as proximity, language barriers, and overlapping working hours should be regarded to ensure effective communication and collaboration.

You can look for a skilled tech partner offline (e.g., at industry conferences and hackathons) and online (e.g., through professional networks, filling out RFP, or looking for a vendor on online platforms like Clutch, Glassdoor, or GoodFirms. Moreover, Cleveroad as an experienced fintech software development vendor with 11+ years of domain expertise, is always ready to come for help.

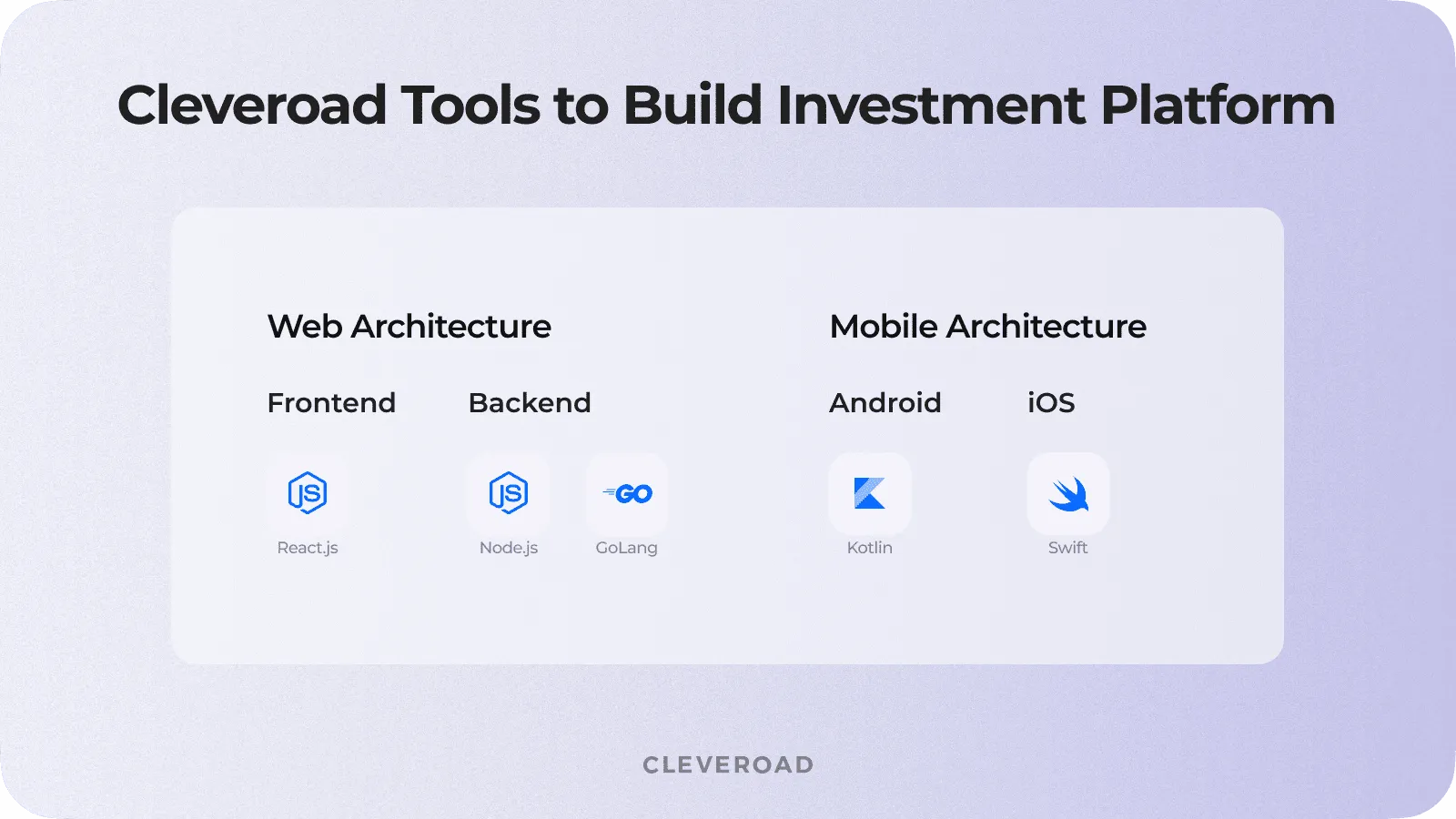

Discussing product requirements with the software vendor

After you have found an IT provider you need and started your collaboration, you can ask them for Discovery Phase services. They will help you compose a feature set, choose an appropriate tech stack for your project, define the regulations your investment platform should comply with (depending on your target market), help you create the architecture, and do other necessary tech things before starting the development.

A part of Cleveroad tech stack to build web/mobile architecture for investment platform

Passing product development and QA

The team can start the investment platform development when all the tech details are clarified. The UI/UX designers work on developing a user-friendly and straightforward interface for your future software system. After they finish, the work is handed over to developers.

The software developers’ main task is to encode the previously chosen functionality and make it work. When the part of functionality (or a whole system) is ready, it’s time for Quality Assurance services. The QA engineers make sure the system’s working correctly without bugs. If they find some, they make bug reports for the developers to fix the problem.

Making investment platform’s release and support

The day of release means the investment system works properly to be ready for use by you and your clients. If your investment solution includes a mobile app, the team publishes it in marketplaces, and if it’s a website — the specialists move it to a live server.

However, the cooperation with the vendor doesn’t end on this note. The provider’s specialists continue tracking your investment platform’s performance to timely fix the bugs or add more features for making rendering investment services more comfortable through the created software.

Cost to Create an Investment Platform: Average Price Estimation

Let's sum up and see how much it costs to create an investment platform. Our team calculated the approximate time to build an investment platform for basic features.

| Core features | Approx development time (hours) |

Account creation and management | 528 hours |

Investment options | 480 hours |

KYC check | 384 hours |

Portfolio management | 1038 hours |

Research and assets management | 2040 hours |

Security and compliance | 2160 hours |

Admin panel | 5280 hours |

Support | 576 hours |

Keep in mind that software developers aren't the only specialists you need on a team to build such a FinTech solution.

Here's the full team composition you'll need:

- Front-end developer

- Back-end developer

- UI/UX designer

- Business Analyst

- Solution architect

- Project Manager

- QA engineer

- DevOps engineer

- Team lead

To effectively estimate and plan costs, it is vital to consider various factors that contribute to the overall expenses of building an investment platform.

We mention some of the common price-forming factors for your consideration:

- The scope and complexity of the project will impact the required resources and, ultimately, the expenses.

- A longer development timeframe can lead to higher costs due to increased resource utilization and project management.

- The technology stack. The need for specialized expertise in certain technologies may impact hourly rates or require additional resources.

- Customization and integrations. Customizing or integrating your investment software may result in extra costs. This may require creating new features, integrating APIs, moving data, or ensuring compatibility with external systems.

- Hourly rates for different roles involved in the project should be considered when estimating the budget, as rates may vary based on location, expertise, and experience level.

Considering all the factors, the cost of investment platform development may vary from $45,000 to $100,000+.

Programming outsourcing can effectively cut costs for your investment product development and don’t lose quality. So, the price may depend on the hourly rates; we give you the hourly rates of different outsourcing regions to consider the cost of IT specialists’ services.

| The most popular outsourcing region | The price ($/hour) |

Central/North Europe | 50-60 |

Western Europe | 75-200 |

North America | 50-200 |

Asia | 20-40 |

Africa | 20-45 |

As you see, the CEE region (Central and Eastern Europe) is one of the most advantageous regions having the beneficial quality-price ratio. Outsourcing software development to the CEE region can provide various benefits, like

- The CEE region is recognized for its plentiful supply of highly skilled IT professionals due to a robust educational system that produces many qualified engineers, developers, and IT specialists.

- Outsourcing software development to the CEE region could potentially result in cost advantages compared to other regions like Western Europe or North America.

- Outsourcing software development to CEE can speed up time-to-market with a large talent pool and efficient development processes. CEE countries are known for their strong work ethic and meeting project deadlines.

- The CEE region has invested in strong IT infrastructure and technology, including modern tools, fast internet, and advanced facilities.

We would like to represent you as one of the CEE vendors capable of giving you skilled help and support with your investment software development.

Our team also worked on a Micro-investment software system for our customer — click our link and discover!

Cleveroad Experience In Investment Software Development

Building an investment platform is a process containing complex aspects inside. Thus, the developed solution should be secure enough to deal with clients’ personal information as well as payment data and protect them from stealing by third parties. Various integrations with internal systems should also be provided to ensure data exchange and synchronization.

This domain platform creation requires an IT team with extensive tech knowledge and deep fintech software development expertise. You can find all this if you apply to a fintech software development company capable of helping you.

Cleveroad is a perfect choice to gain this purpose. We are an Estonian outsourcing software development vendor with profound experience creating digital solutions for FinTech and Banking. Being on the IT market for 11+ years, we know how to satisfy your financial business challenges by delivering robust financial software.

Working with us, you’ll get a whole bunch of benefits, such as:

- Practical experience creating in turnkey software compliant with fintech regulations and standards (e.g., ePrivacy, PCI DSS, PA DSS, AMLD, QES, etc.) and simplifying banking and online payments, helping with financial analytics and ensuring the security of the sensitive data

- On-demand fintech app building services: software creation from scratch, legacy systems modernization, IT consulting, cloud app development, etc.

- A team of IT specialists having deep experience in investment platform building and ready to answer your tech questions, as well as deliver top-notch software for your company

- Signing Non-Disclosure Agreements (NDA) to protect the uniqueness of your financial app concept

- An innovative tech stack to create the financial solution perfectly fitting your workflows and increasing your company performance

- Full-service development, after-release support, and maintenance of your created fintech software by our professionals, etc.

We provide our services to clients upon the following models of cooperation:

Staff augmentation. With the help of this approach, you may grow your staff by bringing in external experts. The hourly wage of the specialists is multiplied by the number of working hours each day (typically, these are 8 working hours a day), to determine how much they will be paid.

Dedicated team. For managing complicated and huge projects, this strategy works very well. You hire a dedicated development team to perform the required work. Instead of working directly with your team, the experts report on their work to the Project Manager or Service Desk. Multiplying the hourly rate by the daily hours yields the payout amount.

Project-based model. The outsourced team oversees all development-related duties, from planning to release. The team sets guidelines and lets you know how things are going.

If you work on a fixed work scope, the estimated number of hours needed for development is multiplied by the hourly rate. In a time and material contract, the total cost is calculated by multiplying the hourly rate by the number of hours worked. The number of hours spent is multiplied by the hourly rate.

Cleveroad is ready to help you choose the type of software cooperation that best fits your budget and timelines. Share your details, and we'll recommend a suitable model for you. We’ll also help you deal with investment software development cost-effectively and profitably for your financial business.

Make your investment platform now

Our team is ready to deliver of a robust fintech product to engage more investors

- Brokerage platform

- Crowdfunding platform

- Social trading platform

- P2P lending solution

- Real estate investment system

- Crypto exchange solution

- Preparation

- Looking for skilled IT vendor

- Discussing product requirements

- Passing product development and QA

- Making investment platform release and support

The cost of investment platform development may vary from $45,000 to $100,000+.

- Data encryption (e.g., encrypting communication channels with SSL/TLS certificates)

- Secure authentication (e.g., multifactor authentication (MFA), strong password policies, and account lockout mechanisms)

- Reliable infrastructure (choosing a reputable hosting provider with robust security measures, such as firewalls, intrusion detection systems, and regular security updates)

- User authorization and access control (e.g., role-based access control (RBAC), limiting privileged access, and regularly reviewing and revoking access for inactive or terminated users)

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article