How to Create a Digital Wallet App And Make It Highly Secure

Updated 19 Sep 2025

20 Min

11325 Views

How to create a wallet app? Developing a digital wallet is a strategic, long-term investment and an excellent entry point into the FinTech niche. As demand for quality digital financial services grows, a well-designed wallet app positions your business to offer innovative, convenient solutions while establishing a strong foothold in the FinTech market.

Cleveroad, as an experienced FinTech app development company, will help you identify the reasoning behind building a digital wallet, define how you can benefit from it, go through essential functionality and digital wallet app security considerations, and more.

Before we dive in, here are the key takeaways of our guide:

- Why digital wallets are in demand today and how they transform payments

- Types of wallet apps, including closed, semi-closed, and open models

- Essential features for users and admins covering onboarding, KYC, and fraud protection

- Step-by-step development roadmap from market research to launch

- Recommended tech stack and integrations with mobile frameworks, gateways, and security tools

- Challenges and risks to address, such as compliance, fraud, and user trust

What Is a Digital Wallet Application?

Let’s start with the basics. A digital wallet application is a mobile or web-based app that securely stores sensitive payment information, allowing users to make transactions, manage funds, and store digital assets like loyalty cards or tickets. This solution significantly simplifies casual payments by enabling quick, cashless, and often contactless transactions.

Types of mobile wallet apps

The types of e-wallets are different according to the models of payment processing. We will provide you with a few examples:

Wallets based on mobile operators

These wallets rely on telecom providers. Users can send and receive money by linking transactions to their mobile and a card number. A well-known example is M-Pesa, widely used in Kenya and India, which allows people without bank accounts to perform digital payments through their mobile carrier.

SMS-based wallets

In regions with limited internet coverage, an SMS-based digital wallet’s opportunities allow users to authorize and process payments via text messages. For example, a user can top up airtime or pay bills by sending an SMS code, and the amount is deducted from their balance. This approach is still relevant in developing countries.

Mobile web wallets

Creating a digital wallet of this type enables payments through mobile web applications or in-app gateways. A user initiates a transfer or purchase via an app connected to their banking system or card. A wallet like PayPal Mobile is a prime example of a web wallet that combines accessibility with wide merchant acceptance.

NFC wallets

Near-Field Communication (NFC) wallets use a chip inside the smartphone to connect with payment terminals for contactless transactions. Popular digital wallets include Apple Pay and Google Wallet, where users simply tap their phone at checkout.

QR code wallets

You can create a wallet app that allows scanning QR codes to complete payments. This method is especially popular in Asia. Apps like Alipay and WeChat Pay dominate the Chinese market by allowing users to pay bills, shop, or even split restaurant checks with a quick scan.

Closed, semi-closed, and open wallets

Apart from technology, wallets differ by how widely they can be used:

- Closed wallets (e.g., Amazon Pay) allow payments only within the issuing company’s ecosystem

- Semi-closed wallets (e.g., Paytm) let users pay a wide range of merchants and services, but restrict cash withdrawals

- Open wallets (e.g., Visa- or Mastercard-based apps) support full functionality, including withdrawals and payments across any merchant that accepts cards

Opt for our Fintech software development services to create your own digital wallet app successfully and obtain benefits

Mobile wallet application development perspectives

Understanding the current mobile wallet market is crucial before diving into development. By grasping the scale and growth of e wallet adoption, you can better appreciate the market opportunity and the urgent need to cater to users’ evolving payment preferences.

Here are some of the most compelling stats proving that e-banking is taking over the world:

- According to Statista, the global digital payments market is projected to hit $10 trillion by 2026, signaling enormous transaction volumes flowing through digital channels.

- In the U.S., 65% of adults have used a digital wallet at least once in the past month, reflecting how commonplace and routine mobile payments have become for American consumers (Source: Capital One Shopping).

- China and India lead in the adoption of digital wallets, with homegrown platforms like Alipay and WeChat Pay transforming everyday payments. Alipay alone now serves over 1.43 billion users worldwide, illustrating the immense user bases these apps command (Source: Electro IQ).

- Juniper Research forecasts that global digital wallet users will grow to 5.2 billion by 2026, a 53% surge in just four years. This explosive growth means over 60% of the world’s population will be using digital wallets by 2026.

Seth Perlman

Global Head of Product at i2c Inc.

“Digital wallets are growing in popularity because they take some of the friction out of point-of-sale and online payments.”

Benefits of Digital Wallet App Development

By building a digital wallet, you create new opportunities to improve customer experience, generate revenue, and strengthen your presence in the growing FinTech market.

Customer experience boost

Digital wallets eliminate the need for physical cards or cash, allowing users to complete payments and transfers faster. They can also store loyalty cards, tickets, or passes in one place, making everyday tasks seamless. This convenience translates into stronger customer loyalty: 51% of consumers say they would stop shopping with a merchant that doesn’t accept digital wallet payments (Source: Forbes). With NFC and QR-code transactions becoming mainstream, offering a wallet app ensures your business appeals to tech-savvy audiences who expect fast and secure payments.

Alternative revenue opportunities

Digital wallet app development can unlock multiple revenue streams, from transaction fees and merchant partnerships to in-app ads and premium features. McKinsey reports that global payments revenue reached $2.4 trillion in 2023 and will grow 7% annually through 2027, largely driven by digital payment apps. Adding advanced digital wallet features such as budgeting tools or crypto wallet integration can help attract a broader audience, boosting retention and lifetime value while also generating higher transaction volumes.

Expand capabilities of your digital wallet by examining our guide on how to create Bitcoin wallet app

Personalization and data-driven insights

Every wallet transaction provides valuable insights into customer behavior. By analyzing spending patterns and preferences, businesses can create tailored promotions, loyalty programs, or personalized offers that drive repeat use. Researches show that 78% of consumers are more likely to repurchase from brands that provide personalized experiences (Source: McKinsey). A data-driven approach helps you strengthen engagement, refine product strategy, and maximize long-term revenue potential.

Higher security and trust

Digital wallets use encryption, tokenization, and biometric authentication to secure digital wallet transactions. This makes them not only convenient but also more reliable than traditional payment methods. “Consumer Adoption and Security Concerns in Digital Wallets and Mobile Payments” shows that security remains a major concern among respondents (Source: Deloitte). By investing in compliance with standards like PCI DSS or PSD2, businesses not only reduce fraud risks but also build the trust needed for sustainable growth.

Cost efficiency

Unlike cash or card-based systems, wallet payments can reduce transaction and administrative costs. According to the 2024 McKinsey Digital Payments Survey, merchants in the U.S. and Europe report that digital payments help lower operating expenses by up to 20% compared to traditional methods. Lower processing fees and automated reporting improve margins and free up resources for innovation.

FinTech niche entry

When you create a digital wallet, you can position your brand as an innovator in a fast-expanding market. It also creates opportunities to integrate with banks, retailers, and e-commerce platforms, expanding your ecosystem. With over 5.2 billion people projected to use digital wallets by 2026, more than 60% of the world’s population (Source: Juniper), entering this niche now means securing a place in the financial services landscape of the future.

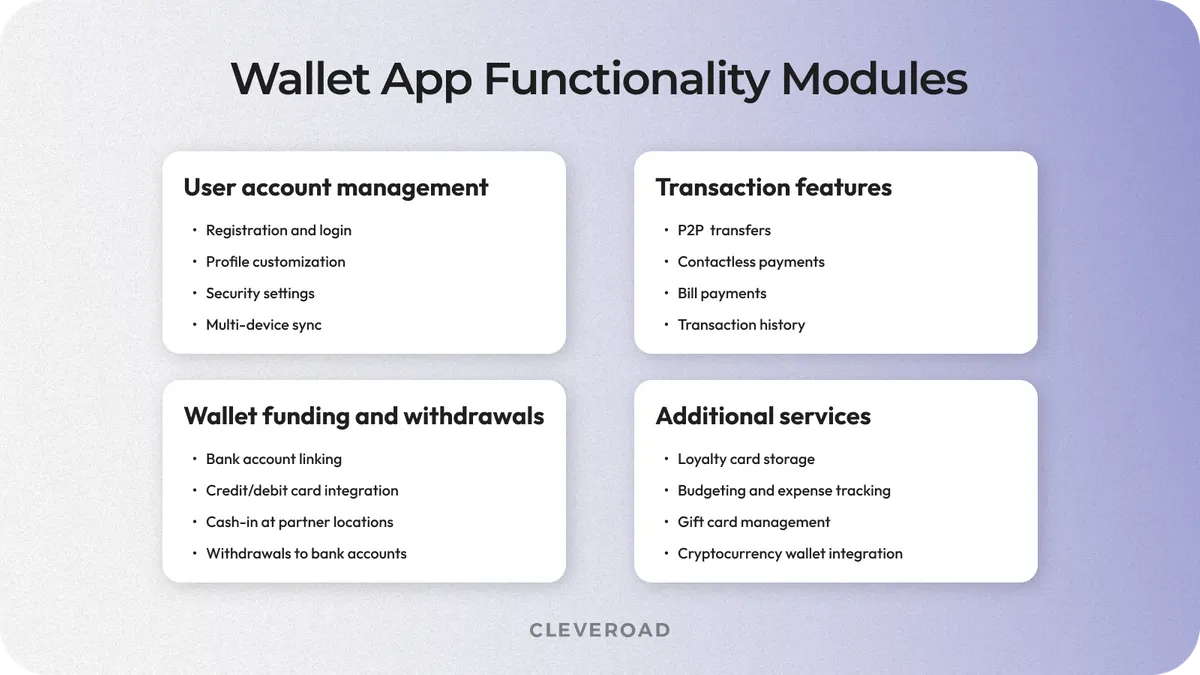

Must-Have Features to Create a Wallet App

If you decide to find out how to develop e-wallet app, you will have to consider all the basic features the new app must contain to satisfy clients' demands. Let’s identify key functionality modules and overview each component in more detail.

User account management

The user account management module within mobile wallet application development is essential for creating and managing user profiles, ensuring secure access, and offering features that personalize the app experience while maintaining data security. This functionality module usually includes:

- Registration and login: Secure sign-up and login methods using email, phone numbers, or social media accounts. These make onboarding simple for users while ensuring that only verified profiles gain access to the wallet.

- Profile customization: Options to personalize accounts with details, profile pictures, and preferences. This helps create a familiar, user-centric experience and allows businesses to deliver tailored services.

- Security settings: Advanced safety features such as PIN codes, fingerprint scanning, or facial recognition. These tools protect sensitive financial data and prevent unauthorized account access.

- Multi-device sync: The ability to link accounts across smartphones, tablets, or even smartwatches. This ensures users can access their wallet seamlessly on different devices without losing data.

Transaction features

The Transaction Features module is designed to handle all payment-related interactions, enabling seamless, efficient, and secure financial transactions for users. Transaction features are:

- Peer-to-Peer (P2P) transfers: Allow users to send and receive money instantly within the app. This makes it easy to split bills, repay loans, or transfer funds without relying on a cash app.

- Contactless payments: Enable purchases using NFC technology or QR code scanning. These methods provide quick, tap-and-go transactions at retail stores, restaurants, and online checkouts.

- Bill payments: Integrate utility and service providers directly into the wallet. Users can pay electricity, water, phone, or internet bills without leaving the app, saving time and reducing missed payments.

- Transaction history: Maintain a detailed log of all transfers and purchases. This helps users track spending, review past payments, and identify suspicious activity quickly for added financial control.

Wallet funding and withdrawals

The wallet funding and withdrawals module facilitates adding funds to the wallet and accessing them when needed, offering flexibility and control over user finances. This mobile wallet app development functionality module consists of the following features:

- Bank account linking: Connect users’ bank accounts directly to the wallet. This allows instant deposits and transfers without the need for third-party services or manual processes.

- Credit/debit card integration: Enable users to add their cards to the app for quick top-ups. This ensures a familiar, convenient method for funding the wallet anytime, anywhere.

- Cash-in at partner locations: Allow deposits through retail stores, kiosks, or agent networks. This feature expands access for users without bank accounts, making the wallet more inclusive.

- Withdrawals to bank accounts: Let users move funds from the wallet back to their bank accounts. This flexibility ensures users maintain full control of their money and can cash out when needed.

Additional services

To build a digital wallet, enhancing the app’s overall functionality, there is a wide range of services you may want to include within your digital wallet. This will provide users with extra tools and features to manage their financial and digital assets more effectively. Here are the most distinct ones:

- Loyalty card storage: Allow users to store and manage all their loyalty and rewards cards in one place. This eliminates the need to carry a physical wallet or cards and makes redeeming rewards quick.

- Budgeting and expense tracking: Provide smart tools that categorize spending and generate reports. These insights help users understand their financial habits.

- Gift card management: Enable users to add, organize, and use digital gift cards directly from the wallet. This ensures no card goes unused and makes gift card spending simple.

- Cryptocurrency wallet integration: Allow users to buy, store, and transact with digital currencies. This feature expands the app’s utility for crypto-savvy customers and positions your wallet as future-ready.

Wallet app functionality modules

Besides, you can also create a wallet application that will provide users with a more profound experience by implementing more complex functionality. Below, you can examine the list of advanced functionalities that may facilitate deeper user engagement and experience:

- Cross-border payments

- Dynamic currency conversion

- Advanced fraud detection and risk management

- Integration with decentralized finance (DeFi) platforms

- Voice-assisted transactions

- Investment and savings options

- Split bills and group payments

- Real-time payment notifications

So it is up to you to choose what type of mobile wallet you want to create, whether it’s an open wallet or one linked to a specific debit card. Before diving into development, research the wallet market thoroughly to identify opportunities and challenges.

Keep in mind that wallet providers already dominate the landscape, making it challenging to emerge as a leader. Your decision to build a mobile wallet must focus on offering substantial advantages over competitors, ensuring it stands out with innovative features and user benefits.

How to Build a Digital Wallet App

While attempting to create your own wallet application, it’s vital to cooperate with an IT partner with extensive experience in delivering solutions for the FinTech domain. By doing so, you’ll receive robust assistance throughout each wallet app development stage.

As an experienced FinTech software development services provider, Cleveroad team prepared a list of 6 steps for you to keep up with during digital wallet mobile application development:

Step 1. Research the market and define your goals

To create a mobile wallet solution successfully, you should begin with thorough research into the digital wallet market. Analyze user needs, current digital finance trends, and competitor offerings to identify unique value propositions.

To build a mobile wallet app, it’s crucial to precisely define the app's core functionalities and set clear business objectives aligned with market demand. Besides, digital wallets provide convenient solutions for users, enhancing transaction efficiency and accessibility. An experienced FinTech software development vendor can assist you in validating your concepts to create solutions with feasibility studies and by identifying tech requirements to achieve your goals effectively.

Planning to build your e-wallet solution but wondering how much it may cost? Read our article about e-wallet app development cost to find out

Step 2. Find a credible digital wallet development partner

To build a high-performing wallet, choose a tech partner with hands-on FinTech experience who understands compliance, payment rails, tokenization, KYC/AML, fraud prevention, bank integrations, and more. Also, review the vendor’s portfolio to confirm launch-ready products in finance. Check Clutch or similar platforms for detailed customer reviews. They show how the team communicates and meets deadlines in practice.

Cleveroad has deep experience in FinTech software development. We design and ship secure wallet features, banking integrations, and KYC/AML workflows that meet industry standards.

Recently, we provided staff augmentation services to Penneo, a Danish SaaS provider for digital signatures and KYC/AML. Their platform runs on AWS across more than 200 accounts and serves thousands of B2B customers under strict European regulations.

We reinforced Penneo’s internal platform team with senior DevOps engineers. The goal was to harden security and improve reliability at scale. We set up and automated a cloud infrastructure with Terraform. Also, we migrated Grafana to a persistent SQL database for stable observability and moved Prometheus to a dedicated node group for better performance. Our experts created IAM groups and policies for secure access to AWS ECR and supported CI/CD with GitHub Actions.

As a result of our collaboration, Penneo gained a stable platform scaling along with growing demand while meeting security and compliance needs. Read more in our case study.

Here is what Hans Jørgen Skovgaard, CTO at Penneo, says about collaboration with Cleveroad:

Hans Jørgen Skovgaard, CTO at Penneo: Feedback on Cleveroad's Cloud Infrastructure Services

Step 3. Plan the features and design the app

At this stage, your IT partner will create a comprehensive roadmap outlining your wallet app’s features, ensuring a balance between essential functionalities like payment processing and advanced tools such as budgeting or cryptocurrency support. Following this, UI/UX designers will develop prototypes and design templates, focusing on intuitive navigation and visual appeal to enhance the overall user experience. This collaborative process ensures that the wallet app aligns with both functional requirements and user expectations.

Step 4. Select the right technology stack

While considering how to make a digital wallet app, choosing the appropriate technology stack is critical for ensuring scalability, security, and performance of the completed solution. Whether leveraging cross-platform frameworks like Flutter or native development for iOS and Android, the technology must support the app’s goals. A FinTech software vendor’s expertise ensures the selection of reliable tools and frameworks, optimizing both development efficiency and app functionality.

Here’s the tech stack the Cleveroad team usually uses to create a wallet app:

Wallet app development tech stack

Step 5. Ensure compliance and security

Digital wallet apps deal with sensitive financial and personal user account information, making regulatory compliance and robust security measures a must-have. A software development vendor with extensive experience within FinTech will help you ensure your wallet app complies with standards like PCI DSS, ePrivacy, GDPR, etc., and will employ encryption to protect user data.

At Cleveroad, we facilitate wallet app security through implementing 2FA (Two-Factor authentication), MFA (Multi-Factor Authentification), biometric data authentication, etc. Besides, we strictly align with essential FinTech security standards like GDPR, ePrivacy, PCI DSS, and more to deliver highly safeguarded, trustworthy and reliable digital finance solutions.

Step 6. Develop and test the wallet application

After completing all preparations, your development team starts coding the app, beginning with the back-end infrastructure to ensure secure and efficient data management. The front-end development focuses on creating an engaging user experience. Comprehensive testing is essential to detect and resolve bugs before launch. Your development partner thoroughly manages iterative testing cycles to ensure the app functions flawlessly under various conditions.

Step 7. Launch, monitor, and evolve

After the wallet app deployment, your development team will monitor the app’s performance using analytics tools (e.g., Mixpanel) to identify areas for improvement. Then, you’ll be able to gather user feedback and roll out relevant updates to enhance features or fix issues.

Note: The partnership with your development vendor doesn’t end at launch – they can assist with maintenance, scaling, and implementing new technologies to keep your wallet reliable, secure, and functional. Feel free to contact us to discuss your specific needs directly with our FinTech business development manager, to discuss the next steps for creating an innovative digital wallet.

How to create a banking app in 2025? Dive into our extensive guide to learn more about price tags, functionality, key banking app development challenges and their resolution strategies

Tips to Secure Your Mobile Wallet App

Security is undoubtedly the most important component of digital wallet creation. Nobody wants to disclose their sensitive financial and personal data to an external party.

As a FinTech software development company upholding ISO/IEC 27001:2013 for security management, we at Cleveroad would like to provide you with valuable practices you’ll need to include during digital wallet app development to make your service a safe space for users.

Point-to-point encryption (P2PE)

This is an advanced and robust security tool that protects the whole transaction from the beginning to the end. It starts encrypting the transaction when you swipe your phone over the PoS terminal, and then the funds are in transit and up to the authorization. This type of protection is included in the list of must-have security features your wallet payment app gateway should have.

Tokenization

Tokenization is a technology that makes e-payments secure with the help of a reliable data encryption system. The buyer doesn't give the seller his or her payment details, paying by card. All card information is encrypted, and it is turned into a token that looks like a random symbol combination.

Transaction limits

Implementing transaction limits within mobile wallet development help mitigate risks by capping the amount or frequency of payments, safeguarding users from unauthorized or fraudulent activities. Limits can be dynamically adjusted based on user behavior or account verification levels, offering flexibility while maintaining security.

AI/ML-powered fraud detection

Artificial Intelligence (AI) and Machine Learning (ML) help detect and prevent fraudulent activity in real time. By analyzing transaction patterns, mobile device fingerprints, and behavioral anomalies, AI models can flag suspicious activity before it causes harm. Unlike traditional rule-based systems, ML-powered fraud detection continuously adapts to new threats, making it especially effective against emerging fraud schemes. For businesses, this not only reduces financial losses but also builds user trust, as customers feel confident that their data and funds are safeguarded.

Use our AI advisor to get a tailored strategy for securing your wallet app using artificial intelligence

Password

Of course, a password is the type of protection any app or website with personal information should have. It is better to add a rejection feature if the customer creates too-simple or too-short a password. It will help you increase protection and build wallet app more secure.

Optionally, additional biometric protection support can be added. If the smartphone of the user is advanced enough and it has a fingerprint scanner, your mobile wallet app may require authorization using biometric data.

Account blocking

Account blocking immediately responds to suspicious activities, such as multiple failed login attempts or flagged transactions. Users or administrators can temporarily freeze accounts to prevent further unauthorized access. Together, these features protect user funds and sensitive data, enhancing trust and compliance with financial security standards.

Blockchain

Blockchain enhances wallet app security by creating a decentralized ledger that ensures transaction transparency and immutability. Each transaction is encrypted and recorded in blocks linked chronologically, making unauthorized alterations nearly impossible. Blockchain-based wallet apps also eliminate reliance on a central authority, reducing vulnerability to cyberattacks. Blockchain enables secure user authentication and data sharing through cryptographic methods.

Digital Wallet Mobile App Development Challenges

Building a digital wallet may go hand in hand with different technical and functional complexities. Let’s unpack each of them and try to extract the potential digital wallet solution:

Regulatory compliance

Digital wallets must adhere to laws such as PCI DSS for payment data security, GDPR for user privacy in Europe, or AML and KYC standards to prevent illegal activities. Meeting these requirements demands legal expertise to ensure data protection protocols are in place. Mind that regulatory standards vary across regions, complicating development for businesses aiming for global markets. Unfortunately, failure to comply can result in severe penalties or loss of user trust.

Cleveroad expert tip: Pay strong attention to your software development vendor's expertise and past experience in delivering FinTech solutions, especially regarding their ability to align with legal requirements. Seek an IT partner that proficiently integrates secure digital app data encryption, thorough KYC processes, and robust AML checks into the app, ensuring it meets global regulatory standards without compromising user experience.

Examine our guide to learn how to become PCI compliant and how to apply these practices while building your wallet app

Tech struggles

Digital wallet mobile app development involves tackling numerous technological hurdles, such as ensuring scalability to handle a growing user count and optimizing performance for high-speed transactions. Implementing cutting-edge features like NFC payments or blockchain integration requires advanced technical expertise and careful planning. Compatibility across multiple devices and operating systems, especially in cross-platform apps, adds further complexity. Moreover, ensuring data security amidst growing cybersecurity threats remains a constant concern.

Cleveroad expert tip: We at Cleveroad overcome these challenges through a systematic, future-oriented approach. By leveraging advanced tools like Flutter and React Native, we deliver seamless compatibility across iOS and Android devices. Our team specializes in integrating technologies such as blockchain for secure transactions and NFC for modern payment solutions.

Fraud prevention

Preventing fraud within virtual wallet app development is a continuous challenge as cyber threats constantly evolve. Balancing stringent security protocols with user convenience can be difficult, as overly complex measures may deter users. However, maintaining up-to-date security measures and responding swiftly to potential threats is essential for protecting user funds (Source: IOP Science).

Cleveroad expert tip: It’s quite reasonable for you to consider implementing AI-driven fraud detection systems and integration of multi-factor authentication with your vendor. Besides, user behavior analysis and dynamic risk scoring proactively mitigate risks while maintaining a seamless user experience. Ensure that your wallet app receives qualitative updates in order to keep it highly secure.

Third-party integrations

Integrating a wallet app with external systems such as payment gateways, banking APIs, and e-commerce platforms presents technical and logistical challenges. Ensuring seamless communication between the systems of the wallet requires compatibility with various protocols, compliance with security standards, and robust data synchronization mechanisms. Managing integration for global markets adds complexity, as different regions often use distinct banking and payment systems.

Cleveroad expert tip: Integration of a wallet app with external systems is achieved through a combination of API development, middleware solutions, and adherence to best practices in compatibility and scalability. Prioritizing secure and efficient data exchange ensures minimal latency and reliable communication between your app and payment gateways or banking APIs.

How Cleveroad Can Help You with Mobile Wallet App Development

Cleveroad is a FinTech software development company with over 13 years of experience in digital finance solution creation. Leveraging our extensive expertise, we assist businesses in creating secure, reliable, and user-friendly solutions that maintain user trust and foster long-term engagement.

We provide a wide range of FinTech software development services, including custom FinTech software development, third-party integrations (e.g., Blockchain, ApplePay, NFC, PayPal, SEON, GPS, etc.), existing software reengineering, digitalization, and optimization.

Besides, our team design solutions that fully align with industry regulations including PCI DSS (SDP, CISP, AIS), GDPR, ePrivacy, KYC, SES, MiFID, and much more.

Here’s the brief list of FinTech solutions we deliver:

- Digital wallets

- Cryptocurrency wallets

- Cryptocurrency exchange

- AI-based robo-advisory

- DeFi apps

- Malware & fraud protection, etc.

We have already delivered a wide range of FinTech solutions, including digital wallets. To prove our experience, we’d like to present our recent case – B2B reward-based cashback service system.

Our client, a Norwegian startup, focuses on rewarding consumers for purchases made at partner shops across the Nordic countries. The goal was to create a platform where consumers and merchants could benefit from cashback services. The company sought Cleveroad’s assistance to ensure the project was delivered on time and within budget.

We’ve delivered a multifaceted cashback system with a reward-based module. One of the platform's key features is the user wallet, which allows users to manage and utilize earned cashback easily. Users can transfer their rewards to their bank accounts through Stripe integration and participate in charity campaigns where cashback donations go to charitable organizations.

As a result, our customer received a bespoke platform that enhanced user experience and met business objectives within the initial timelines, thanks to strategic team assembly and expert solutions.

Trust wallet app development to our domain experts

Contact us! By cooperating with our FinTech software development experts with 13+ years of experience in the domain, you’ll receive a reliable and intuitive wallet app on time and on budget

A digital wallet application is a mobile or web-based app that securely stores sensitive payment information, allowing users to make transactions, manage funds, pay for goods, and store digital assets like loyalty cards or tickets. Digital wallets can reduce the time for casual payments by enabling quick, cashless, and often contactless transactions.

Creating a successful digital wallet, you should perform these steps:

- Step 1. Research the market and define your goals

- Step 2. Find a credible digital wallet development partner

- Step 3. Plan the features and design the app

- Step 4. Select the right digital wallet development technology stack

- Step 5. Ensure compliance and security

- Step 6. Develop and test the wallet application

- Step 7. Launch, monitor, and evolve

When you launch your digital wallet, the main benefits include:

- Customer experience boost

- Alternative revenue opportunities

- Personalization and data-driven insights

- Higher security and trust

- Cost efficiency

- Entry into the FinTech niche

Digital wallets earn money through transaction fees when users add debit or credit card information to their digital wallet and make payments, or when they link services like Google Pay. They also profit from merchant partnerships, premium features, loyalty integrations, and more. Across different types of digital wallets, providers often combine these streams to stay profitable while offering convenience to users.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

1 commentsThanks for sharing informative and valuable blog .This blog is more helpful . I got more information about mobile wallet app.