How to Build a P2P Payment App: Steps, Features, Tips, Cost

Updated 21 Feb 2025

19 Min

8058 Views

Why should you, as a FinTech business, build a P2P payment app? Genuinely, because it significantly simplifies the way people transfer money. A custom P2P payment solution adds value to your business by boosting appeal and additionally unlocking new revenue streams through transaction fees, tiered premium features, and more.

As an experienced IT vendor with 13+ years of assisting businesses in creating robust FinTech software solutions, we will guide you through the peculiarities of building a robust and legally compliant peer-to-peer payment application. In this guide, you will discover the required functionality, types, cost, and other valuable points.

What are P2P Payment Apps and How Do They Work?

Peer-to-peer (P2P) payments, also called person-to-person transactions, allow users to transfer money between online or mobile apps. These payments can cover everyday expenses like car rentals, meals, or rides. A P2P payment app allows users to seamlessly send funds from their bank accounts or credit cards, ensuring quick and convenient transactions.

Further you’ll learn about key types of P2P applications and how exactly they function.

Types of P2P apps

Peer-to-peer app development can be divided into these 4 key types:

- Bank-centric P2P apps. Developed by banks or financial institutions, these apps enable direct transfers between bank accounts with minimal processing time. Zelle – A U.S.-based service that allows instant bank-to-bank transfers within partnered institutions.

- Standalone P2P payment apps. Independent platforms that connect to multiple banks and payment cards offer flexibility and broad accessibility. PayPal – A globally recognized platform enabling secure transfers, online purchases, and business transactions.

- Social media & messaging-based P2P apps. Integrated into social networks or messaging apps, allowing users to send money within conversations. Venmo – A PayPal-owned app that facilitates social payments with an interactive transaction feed.

- Cryptocurrency P2P payment apps. Allow users to send and receive digital assets without intermediaries, offering global and decentralized transactions. Cash App – A mobile payment service that supports both fiat and Bitcoin transactions, making crypto transfers accessible.

How do P2P apps work?

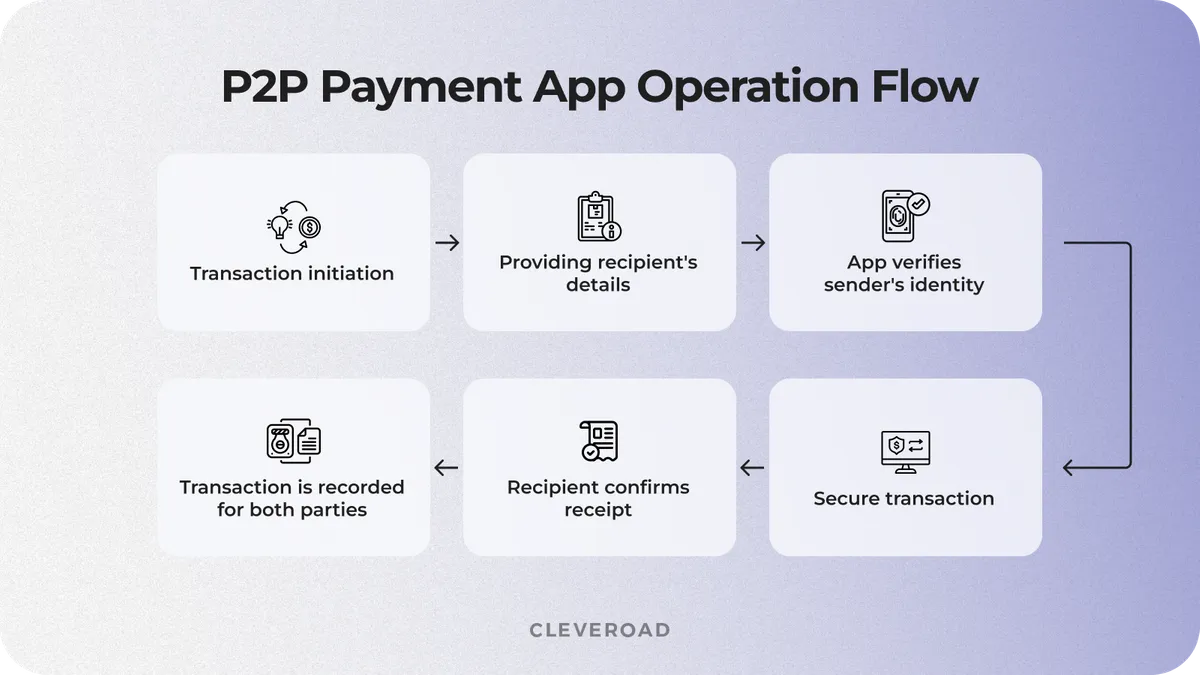

Before assessing how to create a P2P payment app, it’s time for you to learn about its work principle. Within a P2P app, the transaction begins when the sender initiates a payment by entering the amount and selecting the recipient. From there, they provide the recipient’s details – whether it’s a phone number, email, or a unique app ID. Before the transaction goes through, the app steps in to verify the sender’s identity using security measures like two-factor authentication, biometrics, or a PIN code.

Once verified, the payment is securely processed with encryption and fraud detection protocols in place. The recipient then gets a notification and confirms they’ve received the funds. To wrap it up, the transaction is recorded for both parties, making it easy to track and reference later.

How P2P payment apps work?

Why Create a P2P App?

P2P payment app development is indeed a smart move. Cashless transactions are on the rise, and by implementing a P2P solution, you can supply your users with fast, frictionless payments. However, let’s get to the point and find out how it may optimize your FinTech business operations.

P2P app development benefits

We’ve outlined 4 main benefits that you'll receive by embracing payment P2P app development:

Steady customer retention and engagement

A well-designed P2P payment app keeps users engaged by simplifying their digital payment routine. Instant transfers, bill splitting, and social payment options encourage frequent use and support consistent customer loyalty. By implementing additional financial services like crypto payments or digital wallets within the app, you can further create an ecosystem that keeps users within your platform rather than turning them into competitors.

Expanded data insights

P2P transactions generate valuable user data, including spending patterns, transaction frequency, and preferred payment methods. You can leverage these insights to refine your services, personalize user experiences, and develop targeted financial products tailored to your users' actual demand. Data analytics also help detect emerging trends, allowing you to stay ahead of market demands and continuously improve your offerings.

Additional partnership and ecosystem opportunities

A P2P payment app development opens doors to strategic partnerships with banks, retailers, and financial service providers that raise your business’s credibility and trustworthiness. By integrating with e-commerce platforms, digital wallets, or even loyalty programs, businesses can expand their service ecosystem. These collaborations not only enhance user convenience but also create additional revenue streams through transaction fees, co-branded services, and embedded finance solutions.

P2P app market statistics

When discussing the value of P2P payment apps, it's impossible to ignore the undeniable – statistics. Here are the most vibrant P2P payment solution insights:

- According to Global Market Insights, in 2023, the P2P payment market was valued at $3.21 trillion. Projections indicate this figure will soar to approximately $13 trillion by 2032, reflecting a CAGR exceeding 15% from 2024 to 2032

- EMarketer states that in 2024, an estimated 169.6 million U.S. consumers were utilizing mobile P2P payment apps, accounting for 68.1% of smartphone users

- PYMNTS reports that in 2024, Zelle, one of the biggest US-based P2P payment platforms, reported over $1 trillion in transactions, marking a 23% increase from the previous year

- As mentioned by Yahoo Finance, by 2028, 75% of U.S. smartphone users are expected to engage with P2P payment apps, underscoring the growing reliance on digital payments.

You clearly can see that P2P app development is a perspective niche that is totally worth engaging with. Now, we’ll proceed to explore essential functionality to implement into your P2P payment app.

Essential Features for P2P App Development

To provide users with flawless quality, your custom P2P payment system should include a few must-have features. The following list is an MVP (Minimal Viable Product) functionality. This is a basic selection of features enough for your P2P payment app to function correctly and deliver a seamless user experience. As your app grows, you may consider integrating additional functionalities to enhance performance and the app’s scalability.

Registration form

This functionality allows users to create an account by entering personal details such as name, email, phone number, and password. The process may include verification steps like OTP authentication, email confirmation, or biometric login to enhance security. A seamless registration experience ensures quick onboarding while maintaining compliance with security requirements.

Send and request money

Everything is simple – users should be able to send money or request the required amount from other users effortlessly. This functionality should be intuitive, allowing transactions to be completed in just a few taps. Whether splitting bills, paying for services, or sending money to friends and family, the process should be smooth, secure, and instant to ensure a seamless user experience.

Send bills/invoices

To create a P2P payment app, you need to add the capability to use the camera to scan bills and then send them to other users. Besides that, person-to-person payment apps should make it possible to generate invoices as well and submit them.

Unique ID/OTP

If users plan to make any transaction in the P2P payment app, they need first to verify and confirm their unique ID and OTP (one-time password). It is required to increase security and prevent unwanted or occasional transactions. If the device has an integrated fingerprint scanner, they may confirm a transaction with fingerprint scanning as well.

User digital wallet

A digital wallet is a space for a user where they can keep their funds and card data, make electronic transactions, and so on. A user digital wallet also includes other features that we will list below.

If you also assessing how to build a mobile wallet app feel free to examine our comprehensive guide

Transfer to a bank account

Users can easily transfer their funds to a bank account or card through your peer-to-peer mobile payment app. By supporting multiple withdrawal options and fast processing times, your app enhances user convenience and trust, making it a reliable solution for everyday financial transactions.

Chat

A chatting feature will be good if users need to clarify specific details concerning payment, and they can do it directly in the P2P payment app. Besides that, it will reduce the number of possible mistakes.

Transaction history

The last but not least must-have feature needed to create a P2P payment app is the transaction history. Users will be able to see all their transactions, received and sent payments, dates, and correct times. If you don’t add, the app will become quite inconvenient, and users will abandon your app.

Push notifications

Notifications pop up on the main screen of a mobile device when any activity occurs. For example, new funds are received, or it is the due date to pay bills. Also, if there are new special offers or discounts, a user will be notified.

Admin panel

This feature is essential for you as the app owner. Developers need to build a web-based admin panel that enables you to manage the app efficiently. With this panel, you can oversee user activity, update settings, edit or remove content, and ensure smooth operation. A well-designed admin dashboard provides full control, helping you maintain security, compliance, and optimal performance.

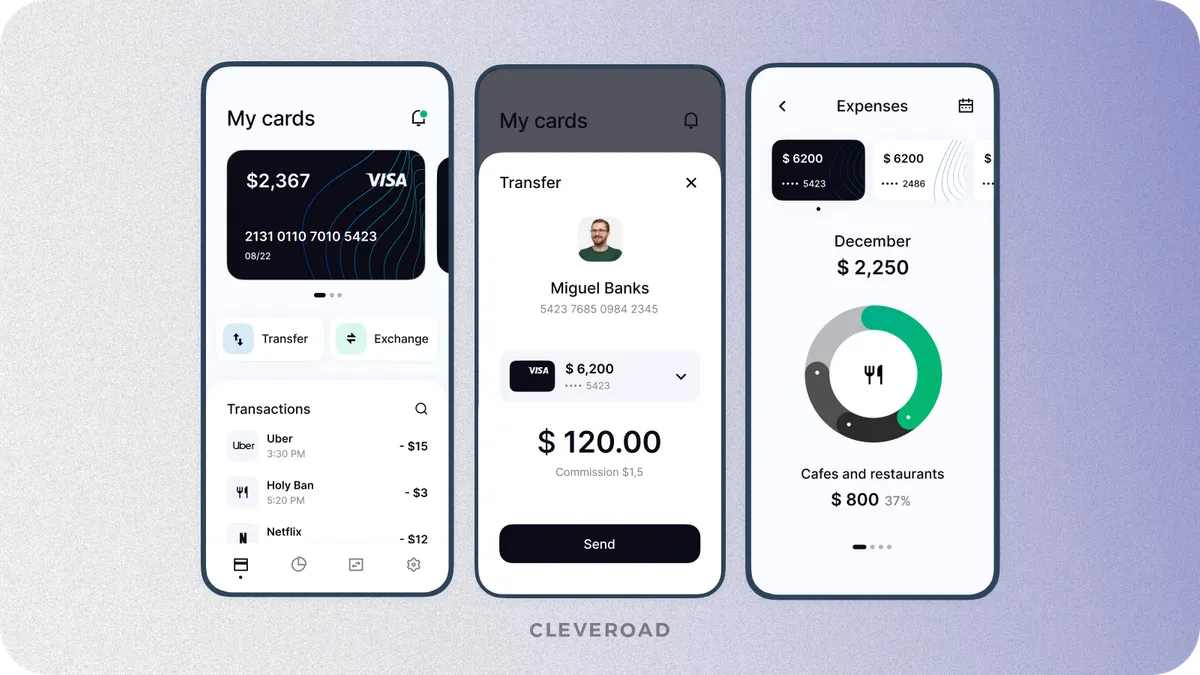

Payment app interface designed by Cleveroad. Source: Dribbble

We think you understand that these features are basic, and most P2P payment services have more specific features. Your service may also require additional and unique features that none of your competitors have. And a software development company will help you turn it into reality.

Here’s the list of possible advanced features you can add to your P2P payment app:

- Two-factor authentication (2FA)

- End-to-End encryption

- AI-powered fraud detection

- Support for multiple payment methods

- Integration with real-time payment networks

- Instant payment notifications & smart alerts

- Payment requests & invoicing

- Currency conversion

- Multi-currency wallets

- Group payment features

- QR code scanning

- NFC-based contactless payments

- Voice-activated payments

- AI-powered expense tracking

- Blockchain-based security

- Personalized financial insights, etc.

How to Create a Mobile Peer-to-Peer Payment App in 9 Steps

We’ve compiled a list of 9 comprehensive steps roadmap to help you understand the flow P2P payment app development.

Step 1. Define your Unique Selling Proposition (USP)

Begin by thoroughly understanding the user pain points your app intends to solve. Conduct user research, surveys, and market analysis to pinpoint the specific problems users face when it comes to peer-to-peer transactions. Outline such details as competitors, target market, user preferences and demands, as well as trends in P2P app development. Your USP should encapsulate what makes your app unique and why users should choose it over existing solutions. Consider factors like speed, security, ease of use, and any innovative features that set your app apart.

Step 2. Conduct market analysis

Market analysis is a crucial step in determining your app's viability. Research your competitors to understand their strengths and weaknesses. Analyze your target market to identify user demographics, preferences, and behaviors to create a P2P payment app successfully. Stay updated with the latest P2P app development trends and emerging technologies. Use this information to refine your app's features, design, and marketing strategy to align with market demands.

Step 3. Choose a monetization model

Selecting the right monetization model is essential for sustaining your P2P payment app's growth. Explore different revenue streams such as:

- Transaction fees. Charge a small fee for each transaction conducted through your app.

- Subscription plans. Offer premium subscription tiers with additional features and benefits.

- Advertising. Display relevant advertisements to generate revenue.

Evaluate which model aligns best with your app's user base and market positioning. Keep in mind that your monetization strategy may evolve as your user base grows.

Step 4. Build your team

When assembling your team for the mobile P2P payment app development project, focus on expertise in FinTech software creation, security, design, and project management. Seek professionals with prior experience in P2P payment app development, effective communication skills, and agility in adapting to changing requirements. For instance, you can consider outsourcing software development to Central and Eastern Europe for a cost-effective, high-quality talent pool with a strong focus on data security, compliance, and cultural compatibility. This choice can streamline the development process and provide access to a skilled team ready to meet your project needs.

Cleveroad is an IT company based in Central and Eastern Europe (Estonia). Throughout the years, we’ve provided tech assistance for multiple FinTech businesses, and here’s what our client Kirk Donohoe, CPO at Mangopay, says about our mutual cooperation on cutting-edge e-wallet solution.

Kirk Donohoe, CPO at Mangopay, provides feedback about cooperation with Cleveroad

Step 5. Requirements discussion with tech partner

At this stage, you will closely collaborate with your chosen vendor to define essential product requirements. This includes determining the platform (iOS, Android, or both), specifying features, selecting the tech stack (programming languages, frameworks, databases), establishing robust security measures, integrating payment gateways, and ensuring compliance with industry regulations, like AMLD, MiFID II, PSD2, and MiFIR. Effective communication and a clear understanding of these requirements are crucial for a successful project. This phase lays the foundation for your mobile P2P payment app's development, ensuring it aligns with your vision and user expectations.

Step 6. Think on UI/UX design

Invest time and resources into designing a user interface (UI) and user experience (UX) that enhance usability and engagement within your P2P payment app development. Consider aspects such as:

- Intuitive navigation. Ensure users can easily navigate through the app.

- Mobile responsiveness. Design for various screen sizes and orientations.

- User feedback. Incorporate user feedback loops to continuously improve the app's design and functionality.

Step 7. Go through development and QA

Initiating the peer-to-peer app development process may involve creating a Minimum Viable Product (MVP), a pivotal stage in building your app. The MVP focuses on implementing core features essential for your P2P payment app, allowing you to test its viability and gather initial user feedback.

During MVP development services, you and your vendor will work on prioritizing the features that form the backbone of your P2P payment app. This could include account creation, fund transfers, and basic security measures. By concentrating on these foundational elements, you can swiftly launch a functional version of your app for testing.

Rigorous quality assurance (QA) and testing should be an ongoing process to identify and resolve any issues or bugs. Regular updates and feature enhancements will help refine the app.

Step 8. Assess security approaches

Security is paramount in payment P2P app development. Implement robust security measures, including data encryption, secure authentication mechanisms (e.g., multi-factor authentication), and adherence to industry standards and regulations (such as Payment Card Industry Data Security Standard - PCI DSS). Regular security audits and updates will protect user data and financial transactions.

Find out how to become PCI-compliant in our guide

Step 9. Launch and gather feedback

After thorough testing and refinement, launch your app to the market. Encourage user feedback through ratings, reviews, and customer support channels. Monitor app performance, analyze user behavior, and track key performance indicators (KPIs) to identify areas for improvement. Iterate on your app based on real user feedback and emerging trends in the P2P payment industry to stay competitive.

By following these detailed steps, you can create a mobile P2P payment app that not only addresses user needs but also stands out in a competitive landscape.

P2P App Development Challenges and Ways to Mitigate Them

Probably, it’s not a surprise that P2P payment app development may pose a particular amount of hurdles. However, we’ve outlined key difficulties you may encounter during the creation process and potential ways to overcome them below.

Ensuring robust security and fraud prevention

P2P payment apps handle sensitive financial data, making them prime targets for fraud and cyberattacks. Weak security measures can lead to unauthorized transactions, data breaches, and user distrust. Compliance with financial regulations like PCI DSS and GDPR adds another layer of complexity, requiring rigorous security protocols.

Cleveroad experts tip: At Cleveroad, we primarily focus on implementing multi-layered security measures during P2P app development, like end-to-end encryption, two-factor authentication, biometric verification, and AI-driven fraud detection. Besides, regular security audits, compliance checks, and real-time transaction monitoring help prevent breaches while building user trust in the platform.

Cleveroad is an IT vendor certified with ISO/IEC 27001:2013, proving the effectiveness of our data security approach. Check out our article to learn more!

Achieving seamless cross-border transactions

P2P apps often struggle with international transfers due to differences in banking regulations, currency exchange rates, and transaction processing times. Users expect fast, cost-effective global payments, but hidden fees and delays can create friction and limit adoption.

Cleveroad expert tip: We highly recommend discussing with your vendor an ability to Integrate your P2P app with real-time payment networks and blockchain-based solutions for faster and more transparent cross-border transactions. For example, we at Cleveroad offer multiple integrations including Stripe, PayPal, ApplePay, GooglePay, Mastercard and Visa. Multi-currency wallets and AI-driven currency conversion ensure users get competitive exchange rates.

Facilitating scalability and high performance over time

As user demand grows, P2P apps must handle increasing transaction volumes without slowdowns or crashes to facilitate smooth experience and reliability. Poor backend architecture can lead to performance bottlenecks and app downtime, negatively impacting user experience.

Cleveroad expert tip: To mitigate this issue, it’s common to focus on using cloud-based microservices architecture to enable seamless scalability. Load balancing, caching mechanisms, and API optimization enhance performance, ensuring smooth transactions even during peak usage. Your vendor will reinforce regular stress testing and database optimization to prepare the system for future growth.

Note: Cleveroad has an AWS Select Tier Partner status, allowing us to deliver scalable and flexible software solutions while leveraging the full capabilities of AWS cloud architecture.

How to Make Your P2P App Secure and Compliant?

Apart from reliability and convenience, robust data security within your P2P payment solution remains the first priority and usually becomes the key concern during the whole development flow. Below, we’ll help you navigate through peer-to-peer app development legal landscape:

Adhere to legal requirements

As mentioned, payment P2P app development falls under the category of digital solutions that operate sensitive financial user data and have to facilitate the highest level of security. There are multiple laws and regulations that you’ll need to follow accordingly:

- PCI DSS compliance. A global security standard that ensures safeguarded handling of card transactions by enforcing encryption, secure storage, and fraud prevention measures. Mandatory for any app processing credit/debit card payments.

- GDPR. This is a Europe-specific regulation requiring strict user data protection, consent management, and the right to data portability for EU citizens. Non-compliance may lead to heavy fines and reputational damage.

- AML & KYC regulations. These are international practices that mandate identity verification, transaction monitoring, and reporting of suspicious activities to prevent money laundering and fraud, ensuring financial security compliance.

- PSD2 (Europe). Enables secure open banking, requiring Strong Customer Authentication (SCA) and API-based third-party access to user accounts for enhanced transparency and competition in financial services.

- FinCEN & CFPB regulations (U.S.). P2P apps operating in the U.S. must register as Money Services Businesses (MSBs) and comply with reporting rules under the Bank Secrecy Act (BSA).

Note: As it might be complicated to orient within these requirements on your own, we recommend turning to an IT vendor with a proven track record of providing services specifically for businesses in the FinTech sector.

At Cleveroad, we help FinTech businesses comply with key regulations like PCI DSS, KYC, GDPR, ePrivacy, and MiFIR. Check out our FinTech software development services page to explore the expertise, solutions, and services we provide.

Implement robust security measures

Here, we’ve gathered proven ways to safeguard your P2P payment app that we personally use during the development:

AI-powered fraud detection

Machine learning algorithms continuously analyze transaction patterns to detect anomalies and flag suspicious activities in real-time. This proactive approach minimizes fraud risks, prevents unauthorized access, and enhances overall system security, ensuring a safe and seamless payment experience.

To learn more about fraud detection machine learning go through our detailed guide

End-to-end encryption

We encrypt all transaction data to ensure only the sender and recipient can access sensitive information. This prevents unauthorized interception, safeguards user privacy, and maintains the integrity of financial transactions. Our encryption protocols align with industry standards to provide maximum security.

Multi-factor authentication

We reinforce user authentication by integrating biometric verification, OTPs, and security questions. This extra layer of protection helps prevent unauthorized access, secures sensitive financial data, and ensures that only verified users can complete transactions.

P2P App Development Cost

P2P payment app development doesn’t come with a fixed price tag. Costs vary significantly based on multiple factors, including the app’s complexity, security measures, platform choice (iOS, Android, or both), integrations with banking systems, compliance with financial regulations, etc. Additionally, hiring an experienced development team in different regions can impact overall expenses too.

Even though it’s quite challenging to provide an exact number, here is the gradation of P2P payment apps by complexity and their approximate price range:

- Basic P2P payment app. A simple app that allows users to send and receive money, link their bank accounts, and view transaction history. These apps have essential security features like OTP verification and basic encryption but lack advanced fraud detection or AI-driven security. Their approximate cost ranges from $40,000 to $80,000.

- Medium-complexity P2P payment app. Includes digital wallets for storing funds, invoice and bill payments, integration with multiple payment methods (cards, bank accounts, mobile wallets), and real-time notifications. These apps also feature enhanced security, such as biometric authentication and two-factor verification. Here the number rises up to $80,000 – $150,000.

- Advanced P2P payment app. Offers high-end features like AI-powered fraud detection, multi-currency wallets, cryptocurrency transactions, blockchain security, and social integrations. These apps support cross-border payments, regulatory compliance automation, and advanced analytics. Complex P2P payment apps usually range from $150,000 to $300,000+.

Here’s the estimate for a P2P payment app based on the features described in this article:

| P2P payment app feature | Development time (h) | Estimated cost ($) |

User digital wallet | 80 – 120 hours | $8,000 – $12,000 |

Send and request money | 100 – 150 hours | $10,000 – $15,000 |

Send bills/invoices | 70 – 110 hours | $7,000 – $11,000 |

Push notifications | 40 – 60 hours | $4,000 – $6,000 |

Unique ID/OTP | 50 – 80 hours | $5,000 – $8,000 |

Transfer to a bank account | 90 – 140 hours | $9,000 – $14,000 |

Chat | 120 – 180 hours | $12,000 – $18,000 |

Transaction history | 60 – 90 hours | $6,000 – $9,000 |

Admin panel | 150 – 200 hours | $15,000 – $20,000 |

Total | 760 – 1130 hours | $76,000 – $113,000 |

Note: In case you’d like to receive a more precise calculation of your unique P2P app payment app concept, feel free to contact us! Our FinTech expert will provide you with a free rough estimation and help you clear up initial project requirements.

Cleveroad – Your Reliable Partner for P2P App Development

Cleveroad is a software development company with over 13+ years of experience of assisting FinTech businesses to create secure, reliable, and engaging digital finance products. We provide a wide range of services, including delivering solutions like electronic trading platforms, apps with blockchain and cryptocurrency support, digital wallets, B2B/P2P payment apps, and more.

By cooperating with us, you’ll get the following benefits:

- An expert team of 280+ in-house engineers (75% senior and middle level) with a proven track record of delivering 200+ successful software solutions.

- Offshore R&D centers provide access to top-tier expertise while minimizing in-house research costs, fostering innovation, and rapid adaptation to industry trends with cost-effective solutions.

- Free solution design workshop helps define project objectives, explore tailored strategies, and assess feasibility—completely risk-free and without any initial financial commitment.

- Deep expertise in integrating advanced tools, including API integrations, cloud-based CRM systems, secure payment gateways, AI and ML proficiency, data analytics platforms, and industry-specific enterprise solutions.

- Full compliance with security standards and legal regulations, including HIPAA, GDPR, PCI DSS, PIPEDA, FDA, KYC, etc., ensuring robust data protection and regulatory adherence.

- An IT partner certified with ISO/IEC 27001:2013 and ISO 9001:2015, proving the effectiveness of our approach to deliver secure, high-quality solutions.

To represent our expertise, here are some notable FinTech projects delivered by Cleveroad:

- Micro-investment platform. We’ve developed a cross-platform app for the Middle East market, enabling individual traders to manage micro-investments and savings seamlessly.

- Investment management system. We’ve worked on a comprehensive digital platform for a UK-based property investment conglomerate, facilitating fund and real estate asset management

- eBanking software system. Cleveroad built an online services ecosystem for a Swiss investment bank, optimizing client services and automating internal processes.

- Broker research platform. Our FinTech experts developed a web-based SaaS solution for a U.S. consulting firm, enabling efficient tracking and evaluation of brokerage services

- Video-on-demand platform for NFT collectibles. Our team created a web-based platform integrated with a decentralized data cloud, allowing artists to distribute and sell NFT collectibles

Here’s what our client Hans Jørgen Skovgaard, CTO at Penneo says about collaboration with Cleveroad on augmenting their development team:

Hans Jørgen Skovgaard, CTO at Penneo: Feedback on Cleveroad's Cloud Infrastructure Services

To build a P2P payment app, follow these steps:

- Step 1. Define your Unique Selling Proposition (USP)

- Step 2. Conduct market analysis

- Step 3. Choose monetization model

- Step 4. Build your team

- Step 5. Requirements discussion with tech partner

- Step 6. Think on UI/UX design

- Step 7. Go through development and QA

- Step 8. Assess security approaches

- Step 9. Launch gather feedback and monitor

A P2P payment app allows users to send and receive money transfer directly between bank accounts, cards, or digital wallets without intermediaries. Using P2P technology, these apps streamline online payment processes, offering a seamless money transfer app experience. A successful P2P payment system supports different payment methods, enhancing accessibility. Building a payment app requires careful planning, as payment app features must ensure security and efficiency. Whether creating a money transfer app or a P2P mobile solution, businesses must strategically build an app that meets user needs.

Depending on complexity, it typically takes 4 to 12 months to build a P2P payment app, covering MVP development, security measures, and regulatory compliance. The timeline for money transfer app development varies based on features, integrations, and security standards required in the fintech industry. To build a payment solution successfully, focusing on a user-friendly payment experience is crucial. Developing apps like leading P2P platforms requires careful planning and adherence to compliance regulations.

A P2P developer specializes in building peer-to-peer payment applications, ensuring secure transactions, regulatory compliance, and seamless user experiences. They focus on application development, integrating various payment methods and optimizing payment processing. Whether you aim to create a payment app, build a payment app, or launch a payment wallet app, a skilled developer is essential for developing a P2P solution that meets industry standards and results in a successful payment app.

The process of building a successful payment app includes market research, UI/UX design, backend development, security integration, compliance setup, testing, and deployment. Understanding different types of payment apps helps define essential functionalities your app provides to users. A payment app must incorporate robust security measures and seamless transactions, making each app feature crucial for user satisfaction and regulatory compliance.

Evgeniy Altynpara is a CTO and member of the Forbes Councils’ community of tech professionals. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics

Give us your impressions about this article

Give us your impressions about this article

Comments

3 commentsWhats the average cost to build an P2P app

Hi, Kyle! It depends on many factors. Please, contact us for more details.

Need a website based p2p system

Hi there! Please, feel free to contact us for more information.

Very nice article !! Ty <3

Thank you!