FinTech Software Development Services

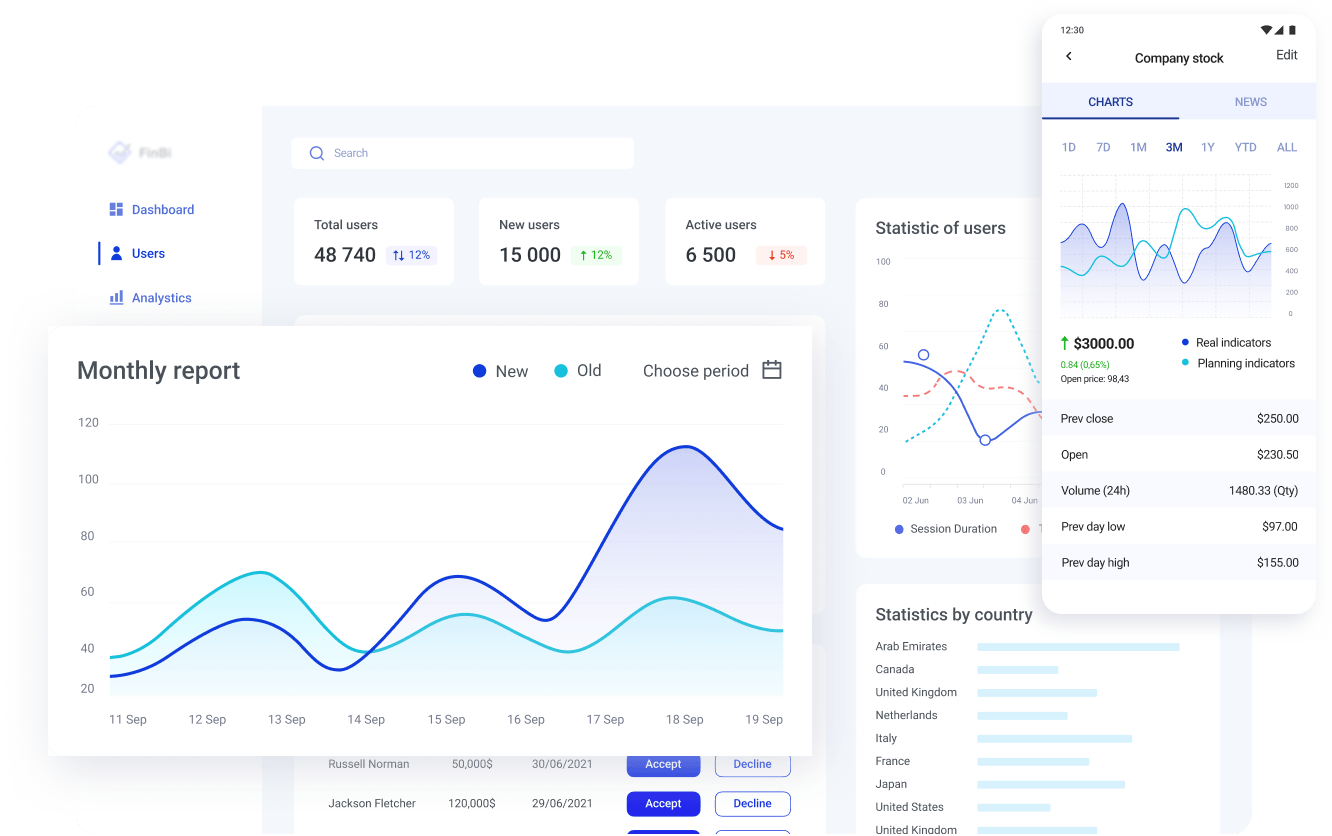

- Creating custom software to improve finance and banking

- Implementing payments in your FinTech applications

- Build better analytics to make smart business decisions

Featured partners

Financial software development services

we offer that you can leverage to boost your FinTech businessFinTech software solutions

we architect, build, and scale combine regulatory compliance and AI-native experiencesInnovative digital payment

- Embedded finance and PaaS

- Real-time payments and ISO 20022 rails

- Super apps and mobile wallets

- Biometric and passkey authentication

- Contactless and IoT payments

AI-powered risk systems

- Next-gen fraud detection engines

- AI-driven credit scoring

- Predictive risk analytics

- RegTech automation

- AI-powered document verification

Trading platforms

- Robo-advisory 2.0

- Digital brokerage platforms

- Tokenized assets and fractional ownership

- Market intelligence dashboards

- Social and gamified trading

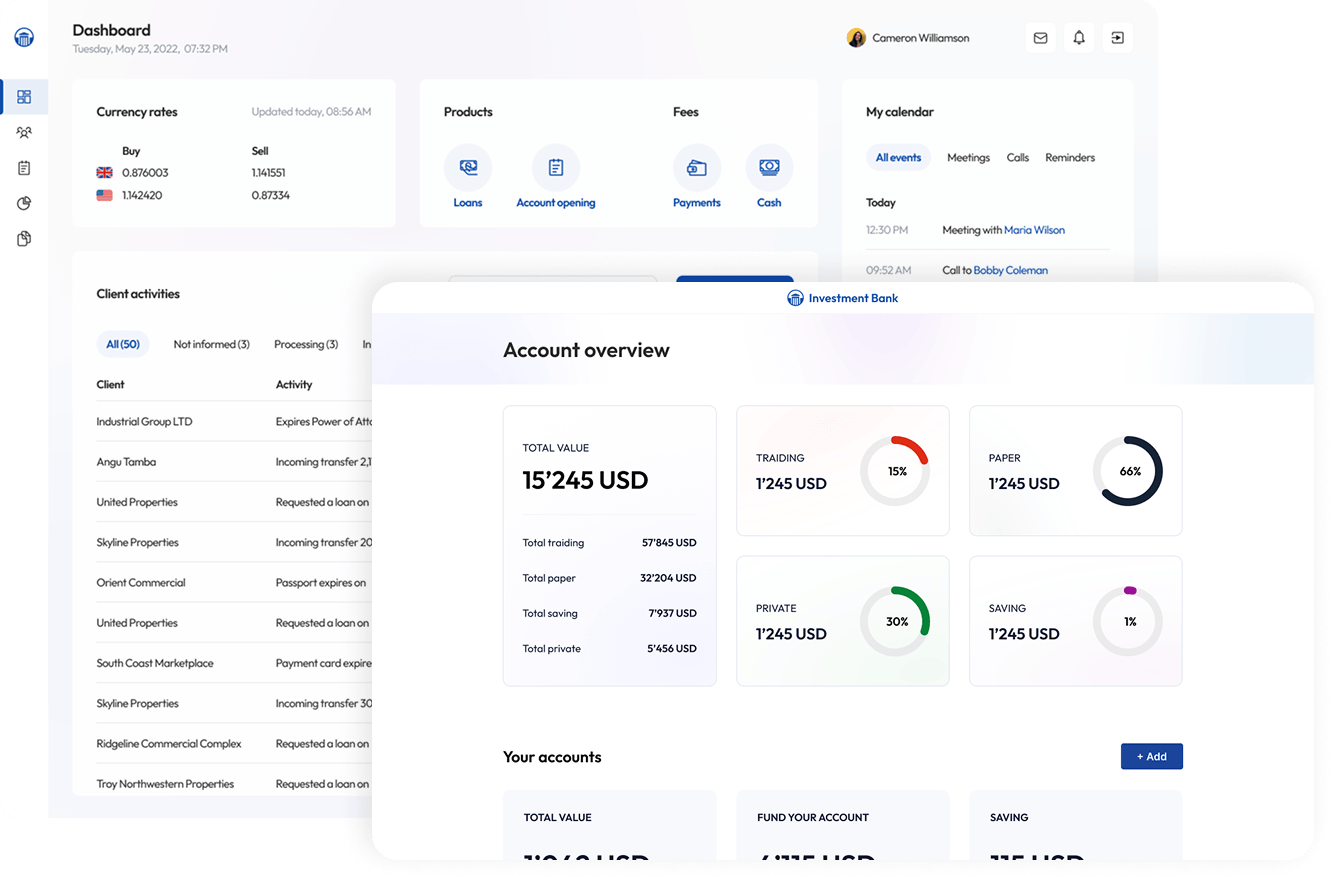

Banking-as-a-service

- API-driven core banking modernization

- Digital onboarding journeys

- Omnichannel mobile-first banking

- Personal finance management

- SME and corporate banking portals

Digital asset solutions

- DeFi protocol development

- Crypto payment gateways

- Central bank digital currency enablement

- Identity and credentialing on blockchain

- Asset tokenization platforms

Embedded risk solutions

- Usage-based insurance

- Parametric insurance platforms

- Claims automation with AI

- Embedded insurance

- Digital risk assessment tools

Cleveroad’s Fintech Software Projects

Challenges solved during the creation of a Cross-Platform App to Manage Micro-Investments and Savings:

- Developing from scratch a cross-platform Flutter app for micro-investments management

- Achieving compliance with local financial regulations, including SAMA requirements for security and reporting

- Implementing advanced functionality with multi-factor authentication and automated KYC verification

Challenges solved within the building of an Online Services Ecosystem for the European Investment Bank:

- Replace the outdated MVP with a custom eBanking software ecosystem for B2B and B2C customers

- Ensuring compliance with European financial regulations, including FINMA and FMIA, through secure architecture

- Improving UI/UX design to simplify account opening, resulting in user retention rate increased by 20-30%

Learn about Cleveroad’s expertise in Projects Portfolio.

in Projects Portfolio.

Show moreFinancial Businesses We Serve

Financial data vendors

Fintech startups

Credit unions

Payment processing firms

Insurance firms

Wealth management firms

Brokerage firms

Investment funds

Private equity funds

Our Clients Say About Us

CEO at AVFX

"Cleveroad successfully delivered our custom presentation solution from scratch, on time and with all the required functionality."

Automating FinTech Operations With AI

Computer vision

- Biometric KYC and facial recognition for digital onboarding

- Document scanning and verification (IDs, contracts, etc.)

- Fraud detection via image/video analysis (e.g., counterfeit documents)

Recommendation systems

- Intelligent product recommendations based on use patterns

- Personalized investment suggestions aligned with user risk profiles

- Adaptive cross-selling engines for banking, insurance, and trading apps

Forecasting & predictive analytics

- Market trend forecasting for investment and trading strategies

- Credit risk prediction and default probability modeling

- Demand forecasting for financial products (loans, insurance, etc.)

Natural Language Processing (NLP)

- Conversational chatbots and voice assistants for 24/7 support

- Automated compliance monitoring through document

- Sentiment analysis of customer feedback for decision support

Anomaly detection & risk intelligence

- Real-time anomaly detection in transactions to flag potential fraud

- Anti–money laundering (AML) monitoring with adaptive ML models

- Risk scoring engines for early detection of credit defaults

Generative AI for financial insights

- Automated report generation for investors and internal stakeholders

- Natural language query systems for instant access to complex data

- Personalized financial insights delivered directly to customers

FinTech software developers

from Cleveroad design solutions in line with industry rules, ensuring compliance and data securitySecurity & data standards

- DORA

- ISO/IEC 27001

- GDPR

- KYC & AML practices

- ePrivacy Regulation

- PCI DSS (incl. PCI Secure Software Standard)

Trading methods & workflows

- Central Limit Order Book (CLOB)

- IOI / RFQ / Quote workflows

- EMV

Digital identity & signatures

- SES

- UETA

- QES

- ESIGN Act

- AES

- UNCITRAL Model Law on Electronic Signatures

Financial regulations

- MiFID II

- SAMA

- PSD2

- BSA

- FINMA

- GLBA

Certifications

ISO 27001

Information Security Management System

ISO 9001

Quality Management Systems

AWS

Select Tier Partner

AWS

Solution Architect, Associate

Scrum Alliance

Advanced Certified, Scrum Product Owner

AWS

SysOps Administrator, Associate

Flexible Engagement Models We Offer

IT staff augmentation

Problem to solve:

Extend your team with the required tech expertise

Value delivered:

Expand your tech capabilities with the required IT experts

Fully manage specialists’ work as they are in your in-house team

Scale your team with a single developer or a full-stack unit

Dedicated team

Problem to solve:

Hire a development team for your FinTech project

Value delivered:

Get a pre-assembled, self-managing development team

Maintain direct communication for progress updates

Adjust team size flexibly based on project needs at any time

Custom development

Problem to solve:

Receive end-to-end FinTech development services

Value delivered:

Develop a tailored software solution aligned with your needs

Ensure a smooth development from idea validation to release

Build a scalable, high-performing product for long-term success

Industry Contribution Awards

70 Reviews on Clutch

4.9

Award

Clutch 1000 Service Providers, 2024 Global

Award

Clutch Spring Award, 2025 Global

Ranking

Top AI Company,

2025 Award

Ranking

Top Software Developers, 2025 Award

Ranking

Top Web Developers, 2025 Award

Ranking

Top Staff Augmentation Company US, 2025 Award

Cleveroad as Your FinTech Development Company

Expertise with advanced technologies

Our team applies the latest technologies to deliver innovative financial solutions. We integrate artificial intelligence into FinTech products for predictive analytics, fraud detection, customer personalization, and process automation, helping businesses gain a competitive edge

Proven track record in FinTech delivery

With 13+ years of domain experience and dozens of successful FinTech projects, we know how to address industry-specific challenges. Our portfolio includes custom payment solutions, trading platforms, and mobile banking apps, proving our ability to deliver reliable products on time.

Best practices and compliance with industry security standards

We build FinTech solutions fully aligned with the latest global regulations and security standards such as GDPR, PCI DSS, SEPA, PSD2, and other domain-specific requirements. Our approach ensures financial data safety, system reliability, usability, and seamless interoperability

Full-cycle FinTech development coverage

We provide full-cycle FinTech software development services that cover every stage of the process, from Discovery and UI/UX design to MVP development, delivery, improvements, and ongoing support, ensuring scalable products that grow with your business goals

- Outsourcing grants cost-effective access to top-tier FinTech expertise and qualified talent

- On-demand tech experience: from FinTech mobile app development to AI integration

- Much lower software development process cost

- Your in-house staff can focus on more critical tasks, such as financial management

- Chatbots

- Robo-advisors

- Fraud predictions

- Risk assessment and lending

- Better insurance recommendations

- Improved analysis of investments

- Lending software(loan origination and commercial loan)

- Banking software(online banking services and mobile banking apps)

- Insurance software(CRMs and software for agencies)

- Investment management software

- Payment processing software(payment apps)

- Personal finance software

- RegTech(risk management and fraud detection)

- FinTech solution grants valuable tools for automating workflows and making them more efficient

- Companies can receive valuable customer insights for smarter decision-making

- The client base can be increased thanks to additional interaction with the financial facility