Banking Software Development Services

- Building secure, compliant banking platforms tailored to your business

- Implementing secure payment flows and core banking integrations

- Enabling real-time analytics to support data-driven banking decisions

Featured partners

Banking Software Services We Offer

Banking software development services that help businesses streamline internal operations and bring innovations improving the customer experience

Banking software development

Development of custom banking solutions from scratch with a focus on security, regulatory compliance, performance, and long-term stability across core banking workflows

Code audit for banking systems

Comprehensive assessment of banking software codebases covering security posture, regulatory alignment, architectural risks, and technical debt, with tailored recommendations.

Core banking system modernization

Reengineering legacy banking systems to meet modern standards while ensuring data migration safety, backward compatibility, and uninterrupted regulatory compliance during transition.

AI integration for banking platforms

Integrating AI models as controlled extensions of banking systems to support decision-making, automate processes, and reduce manual workload with explainability and auditability in mind.

Banking Software Solutions We Provide

Our experts deliver robust solutions to cover diverse banking sector needs, from core processes optimization to secure customer-facing apps

Core banking systems

Online banking platforms

Mobile banking applications

Open banking

Banking CRM systems

Banking analytics platforms

Neobank platforms

Core banking systems

Centralized systems that manage core banking operations, accounts, and transactions while supporting product logic, long-term stability, security controls, and regulatory compliance

- Account and ledger management

- Transaction processing and settlement

- Product configuration and lifecycle management

- Regulatory reporting and compliance support

Online banking platforms

Web-based banking platforms that allow customers to manage accounts and perform transactions while accessing banking services through secure digital channels

- Secure customer authentication and access control

- Account visibility with detailed transaction history

- Payments, transfers, and scheduled operations

- Customer self-service and profile management features

Mobile banking applications

Customer-facing mobile applications that deliver everyday banking services with high usability, strong security controls, and real-time access to financial data

- Balance checks and payment operations

- Push notifications with event-based alerts

- Biometric authentication and secure session handling

- In-app customer support and communication tools

Open banking

API-based solutions that enable secure data sharing and third-party integrations in line with open banking standards and regulatory requirements

- Account data access and retrieval APIs

- Payment initiation and transaction execution APIs

- Third-party integration, orchestration, and monitoring

- User consent handling and access control management

Banking CRM systems

Customer management systems designed for banks to centralize client data, manage interactions, and support personalized service across multiple channels

- Unified customer profiles and identity management

- Interaction tracking with case handling workflows

- Customer segmentation with targeting capabilities

- Integration with core banking and operational systems

Banking analytics platforms

Data analytics platforms that help banks monitor performance, assess risk exposure, and support decision-making using operational and customer data

- Financial and operational performance dashboards

- Risk assessment with behavioral pattern analysis

- Reporting tools with interactive data visualization

- Regulatory insights and compliance analytics support

Neobank platforms

Digital-first banking platforms that support the launch and scaling of neobanks through modular architecture and compliance-ready infrastructure

- Digital onboarding workflows with KYC support

- Account management with card issuance capabilities

- API-driven architecture for ecosystem expansion

- Scalable infrastructure with cloud-native readiness

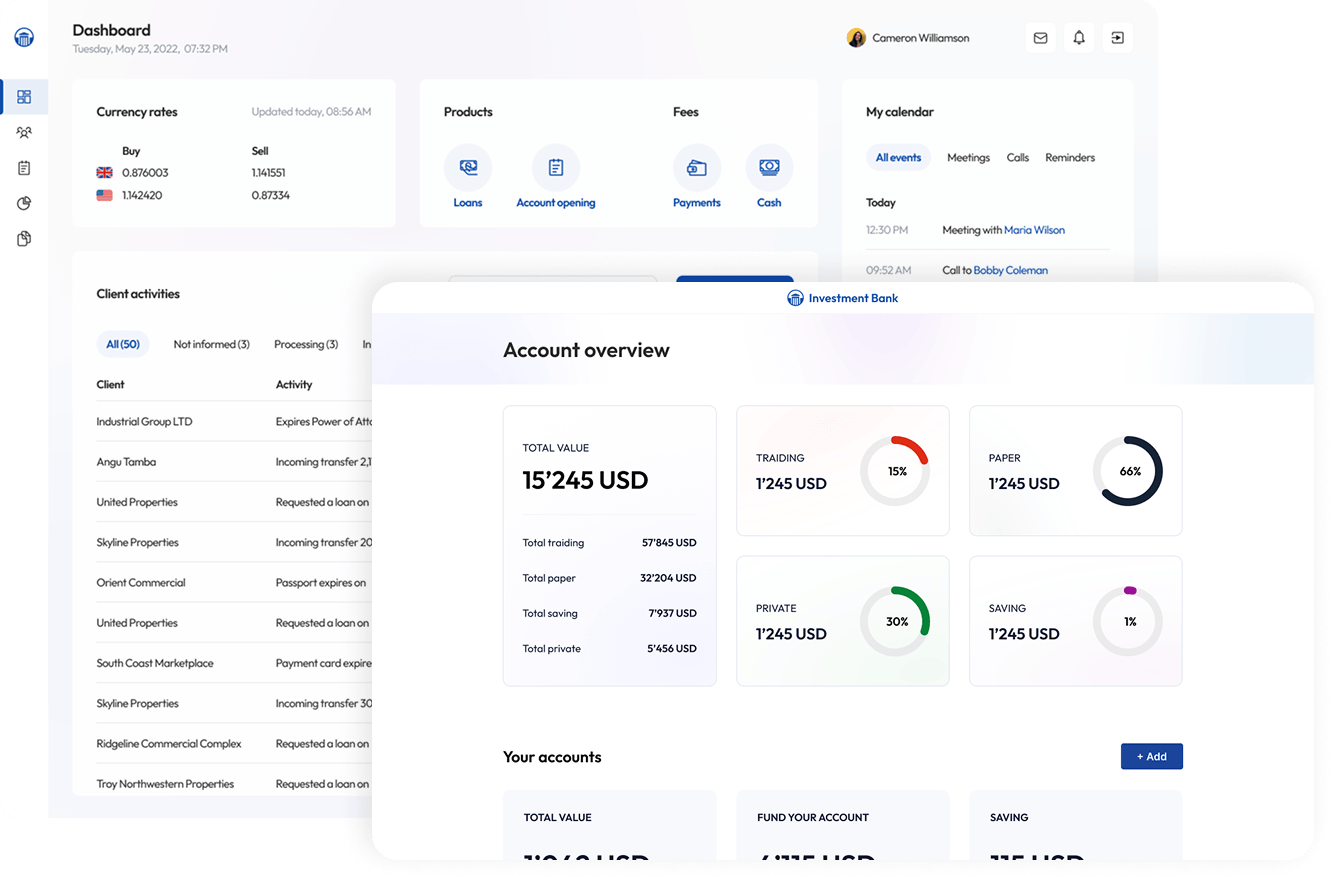

Banking Solutions We’ve Delivered

We individually approach each solution, find the best ways to implement it, and help the client optimize time, budget, and efforts

Switzerland

Fintech

Challenges solved during the development of an eBanking platform for a Swiss investment bank:

- Replacing an outdated MVP with a scalable eBanking ecosystem that covers the needs of B2B/B2C clients and the operators' teams

- Improving onboarding UX through clear sign-up, KYC verification, and digital account opening to boost retention

- Ensuring compliance with Swiss banking regulations, including FMIA and FINMA guidelines, under an existing license

Learn about Cleveroad’s expertise in Projects Portfolio

in Projects Portfolio

Show moreOur Clients Say About Us

CTPO of Penneo A/S

"Cleveroad proved to be a reliable partner in helping augment our internal team with skilled technical specialists in cloud infrastructure."

AI Technologies that Streamline Banking Operations

Applying proven AI technologies in banking software development allows to improve service quality and workers' efficiency

Computer vision

Biometric KYC and facial recognition

ID and document verification

Fraud detection via image analysis

Conversational AI and chatbots

24/7 customer support chatbots

Account, card, and payment inquiries

Onboarding and status notifications

Natural Language Processing (NLP)

Compliance document analysis

Transaction text classification

Internal knowledge search

Fraud and anomaly detection

Transaction fraud monitoring

Behavioral anomaly detection

AML alerts and risk scoring

Forecasting & predictive analytics

Credit risk and default prediction

Liquidity and cash flow forecasting

Customer churn prediction

Recommendation systems

Personalized product recommendations

Savings and investment suggestions

Cross-selling banking services

Tech Stack We Use for Banking Software

The technology stack we use for banking software helps deliver compliant systems faster while keeping development costs predictable

Mastercard

VISA

Apple Pay

Google Pay

SAP ERP

Oracle ERP

NetSuite ERP

Fis Global

Ellie Mae

HubSpot

Pipedrive

Salesforce

Addepar

401Go

Advisor360

SEON

SAS

IBM QRadar Platform

React.js

Vue.js

Bootstrap

Tailwind CSS

.NET

.NET Core

C#

Node.js

Express.js

NestJS

PHP

Google BigQuery

Amazon Redshift

Microsoft SQL Server

PostgreSQL

MySQL

Redis

Swift

Objective-C

Alamofire

Moya

Java

Kotlin

JUnit

Mockito

Espresso

Flutter

React Native

Python

R

Java

TensorFlow

PyTorch

Scikit-learn

XGBoost

LightGBM

Apache Spark

Hadoop

Amazon EMR

Jupyter

PyCharm

VS Code

MLflow

Kubeflow

Docker

Certifications

We keep deepening our expertise to meet your highest expectations and build business innovative products

ISO 27001

Information Security Management System

ISO 9001

Quality Management Systems

AWS

Select Partner Tier

AWS

Solutions Architect, Associate

Scrum Alliance

Advanced Certified Scrum Product Owner

AWS

SysOps Administrator, Associate

Our Expertise in Banking Regulations

Cleveroad’s banking software developers build solutions compliant with domain-specific regulatory requirements and security practices

Security and real-time data protection

- DORA

- ISO/IEC 27001

- PCI DSS and PCI Secure Software Standard

- APRA CPS 234 Information Security

- FFIEC Cybersecurity Guidance

- MAS Technology Risk Management

- FCA PS21/3 Operational Resilience

Payments and digital identity

- PSD2

- ESIGN Act

- EMV

- UETA

- eIDAS Regulation 910/2014

KYC, AML, and financial crime

- FATF Recommendations

- EU AML Directives and AML Package

- Bank Secrecy Act

Privacy and data protection

- GDPR

- ePrivacy Regulation

- GLBA

Flexible Engagement Models We Offer

We provide banking systems development services within various collaboration options to match clients’ resource needs

IT staff augmentation

Problem to solve:

Extend your team with the required tech expertise

Value delivered:

Expand your tech capabilities with the required IT experts

Fully manage specialists’ work as they are in your in-house team

Scale your team with a single developer or a full-stack unit

Dedicated team

Problem to solve:

Hire a development team for your Banking soft project

Value delivered:

Get a pre-assembled, self-managing development team

Maintain direct communication for progress updates

Adjust team size flexibly based on project needs at any time

Custom development

Problem to solve:

Receive end-to-end Banking development services

Value delivered:

Develop a tailored software solution aligned with your needs

Ensure a smooth development from idea validation to release

Build a scalable, high-performing product for long-term success

Industry Contribution Awards

70 clutch reviews

4.9

Award

Clutch 1000 Service Providers, 2024 Global

Award

Clutch Spring Award, 2025 Global

Ranking

Top AI Company,

2025 Award

Ranking

Top Software Developers, 2025 Award

Ranking

Top Web Developers, 2025 Award

Ranking

Top Staff Augmentation Company in USA, 2025 Award

Why Choose Us as Your Banking Software Development Company

We provide end-to-end banking software services, focused on secure architecture and long-term compliance readiness

Proven experience in the banking domain

We bring over 15 years of experience in building and updating software for banks. Our team has delivered core banking and online platforms, mobile banking solutions, open banking integrations, CRM systems, and analytics platforms operating under real regulatory and operational constraints.

Compliance-driven development approach

We design and deliver banking software with compliance embedded into system architecture from the outset. Our experience covers frameworks such as GDPR, PCI DSS, PSD2, DORA, ISO/IEC 27001, and regional supervisory requirements, supporting audit readiness.

End-to-end banking software services

We cover the full scope of banking software delivery, from IT consulting and code audits to custom banking development and platform modernization. Our services also include system integration and controlled AI implementation, enabling banks to work with a single technical partner.

Expertise in complex banking ecosystems

Most banking platforms operate within complex ecosystems that combine legacy core systems. We help banks modernize these environments while preserving business continuity, maintaining data integrity, and reducing operational and regulatory risk during change.

- Define business goals and regulatory scope, including which banking operations and financial services the software must support.

- Identify users, roles, and required integrations with existing banking systems or core banking platforms.

- Engage a software development company to assess risks, validation approach, and overall development process before full financial software development starts.

- Core banking systems for accounts, transactions, and ledger management

- Online banking platforms for secure customer access through web channels

- Mobile banking applications that extend regulated banking services to personal devices

- Open banking APIs and integrations for controlled third-party access and data sharing

- Banking CRM systems to manage customer interactions and service history

- Banking analytics platforms for reporting, insights, and regulatory support

- Neobank platforms designed for digital-first banking models under licensing constraints