Broker Research Platform for Financial Analytics Services

A web-based SaaS solution for tracking, launching official feedback loops, and evaluating brokerage services

Industry

FinTech

Team

10 members

Started in

2021

Country

USA

About a Project

Our customer is a US company providing consulting, research, analytics, and technology services for financial institutions. It needed a SaaS web-based platform for tracking, launching feedback loops, and evaluating services from brokers in terms of business value and cost. The company couldn’t create the solution with an internal team and turned to Cleveroad for it.

Goals set to Cleveroad

Design and develop an MVP of needed SaaS oriented on the European Union financial markets.

Create a software solution that allows the customer to sell SaaS services to brokers, asset managers, and hedge funds.

Increase platform capabilities and enrich the MVP solution through a long-term partnership.

Solutions we've delivered

Creating a web-based solution that covers brokerage research and supportive business processes. Ensuring the solution's compliance with MiFID II rules for using such software in the EU.

Design and build a SaaS platform that automates all business processes related to the target client audience. It includes a Voting web app, Commission Manager, Event tracker web app, and Service Provider Portal.

Continuous integration of the complex ecosystem of several portals for parties taking part in broker services tracking and evaluation. Delivery of new functionality in the frame of ongoing tech partnership with the customer.

Results for the Customer

The software platform was successfully delivered; an MVP version development allowed the customer to reduce the time to launch and start using the solution as soon as possible.

The solution allows all categories of target buyers to perform their duties within the platform so that the customer can provide paid SaaS services to these clients, receiving income.

The customer received full technical support, which allowed them not to expand the internal tech team and achieve better cost-effectiveness in the platform's maintenance and scaling.

Business Challenges

Our customer provides brokerage research and advice services and collaborates with Subject Matter Experts (former brokers, asset managers, and portfolio managers) who work as business development specialists and product owners. The company wanted to expand its scope of presence in the EU financial market, but it lacked the team's tech capacity. So our customer turned to Cleveroad as a reliable and experienced software vendor who could:

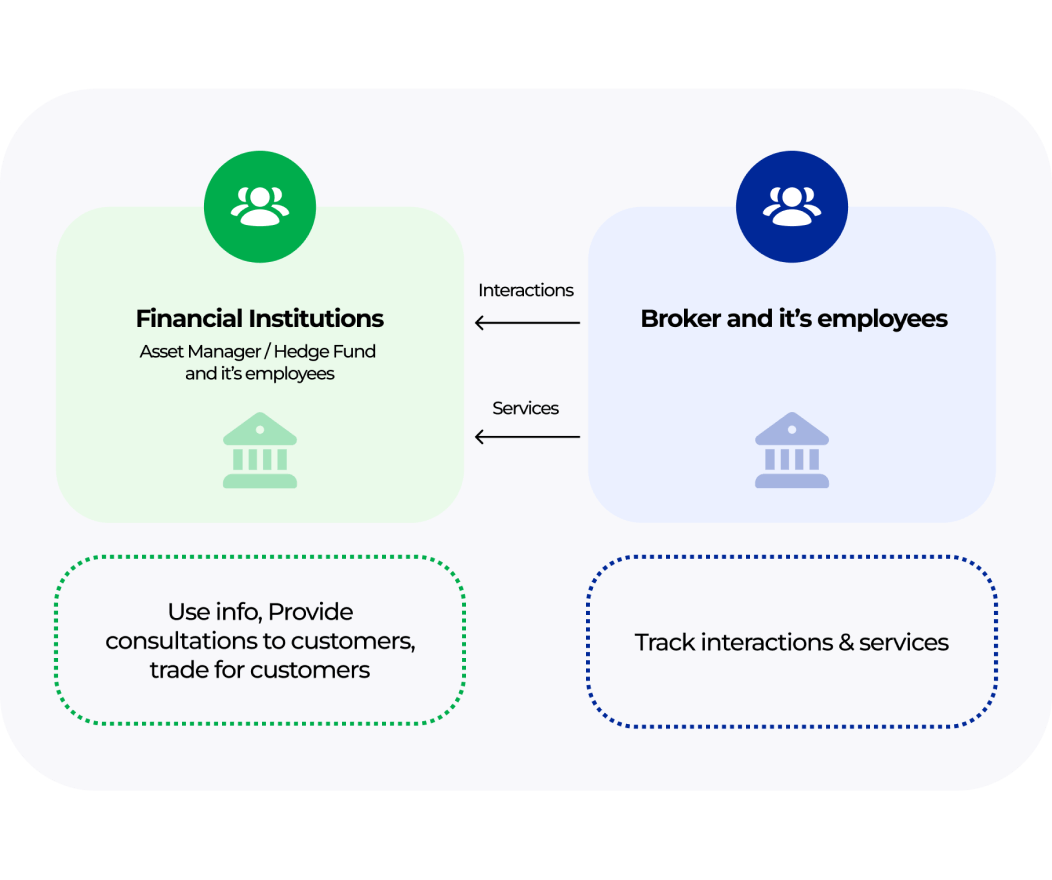

Deliver a SaaS web-based platform for tracking, launching official feedback loops, and evaluating services from Brokers in terms of business value and cost to pay. The solution should cover providing users with services and interaction for various financial institutions, typically Asset Managers and Hedge Funds.

Ensure the software’s compliance with financial regulatory requirements. Since the target market is European, and the consulting company already has customers there, the platform must satisfy MiFID II rules for financial institutions, such as asset managers, hedge funds, and investment banks with asset management services.

Provide the customer with further custom software development, maintenance, and tech partnership to make a system fitting the industry, its regulations, and each company client's workflow well. At the same time, all added functionality and modules must be flexible and scalable.

Project in Details

Business Architecture

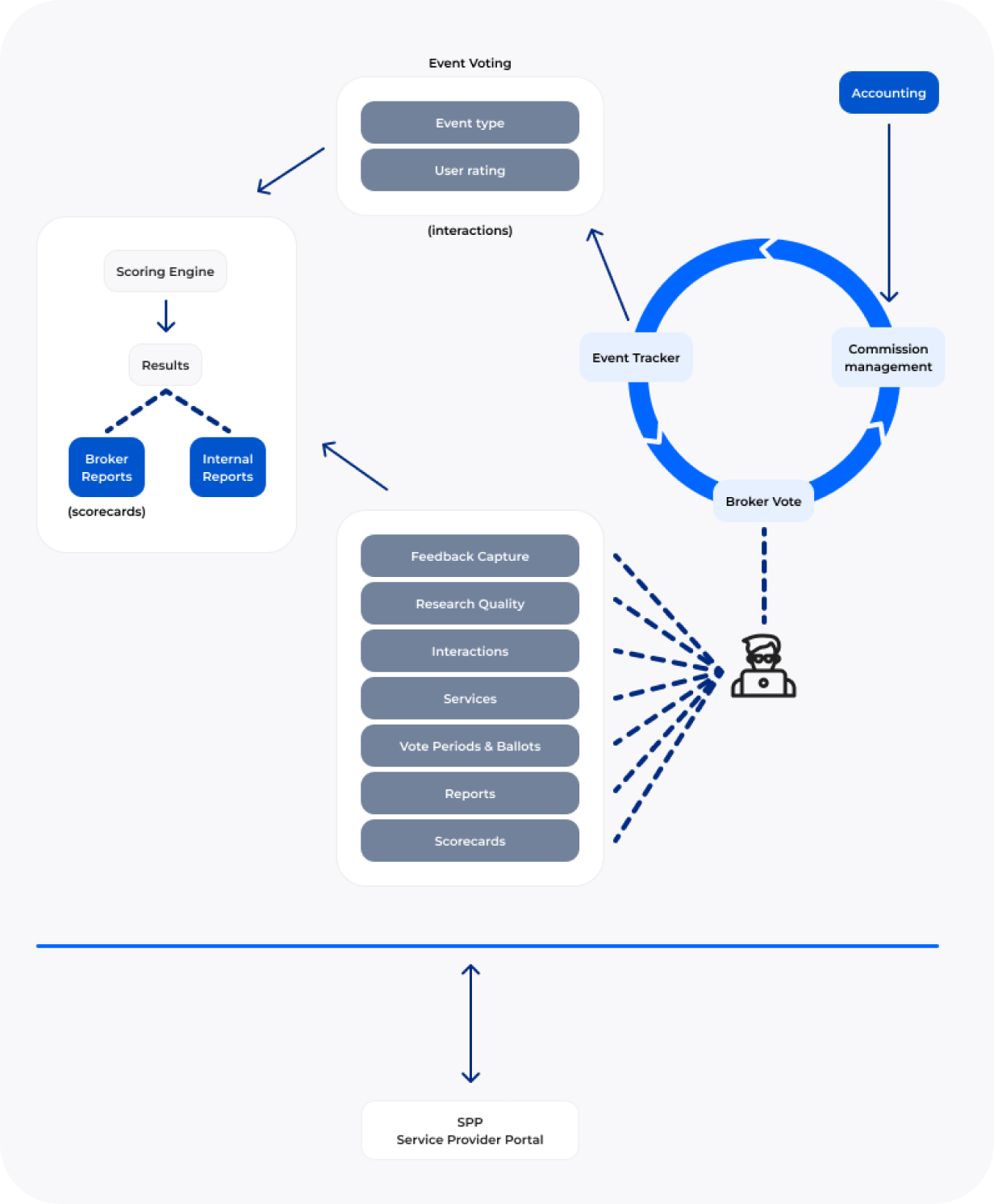

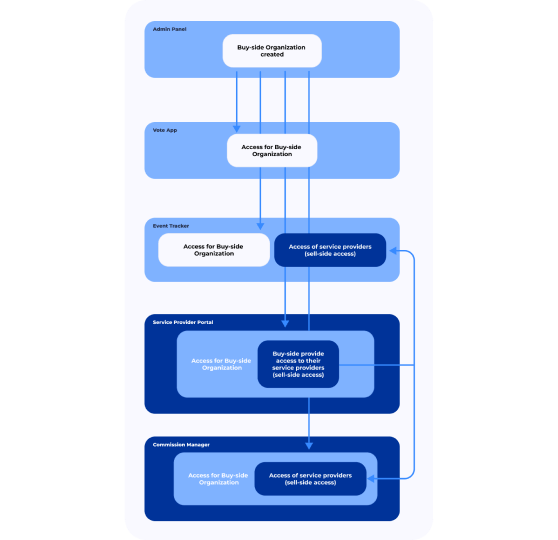

- An entire platform consists of web applications that may be used as standalone solutions or one complex solution of integrated apps. The core modules are the Voting web app, Event tracker web app, Commission Manager, and Service Provider Portal. The system has a convenient admin panel for Organizations' onboarding and management and basic user management to cover the SaaS model. View the full list of major features related to Broker Research Platform.

- The core modules, except the Service Provider Portal, can be used by the buy-side. They are financial institutions, typically asset managers, hedge funds, or similar. These apps are used for automation and transparent organization according to MiFID of the research services' consumption from Brokers, Brokers' review, defining their value and budget allocation for their services.

- The Service Provider Portal (SPP) is used by the sell-side (Brokers and researchers). Its integration with the buy-side ecosystem allows the transparent exchange of information between research services consumers and producers. It is possible to push the list of events (interactions) from the SPP to the Event tracker and Vote app, monitor the services tracked on the buy side, and get evaluation results with scorecards stored and available in the SPP.

Product Essentials

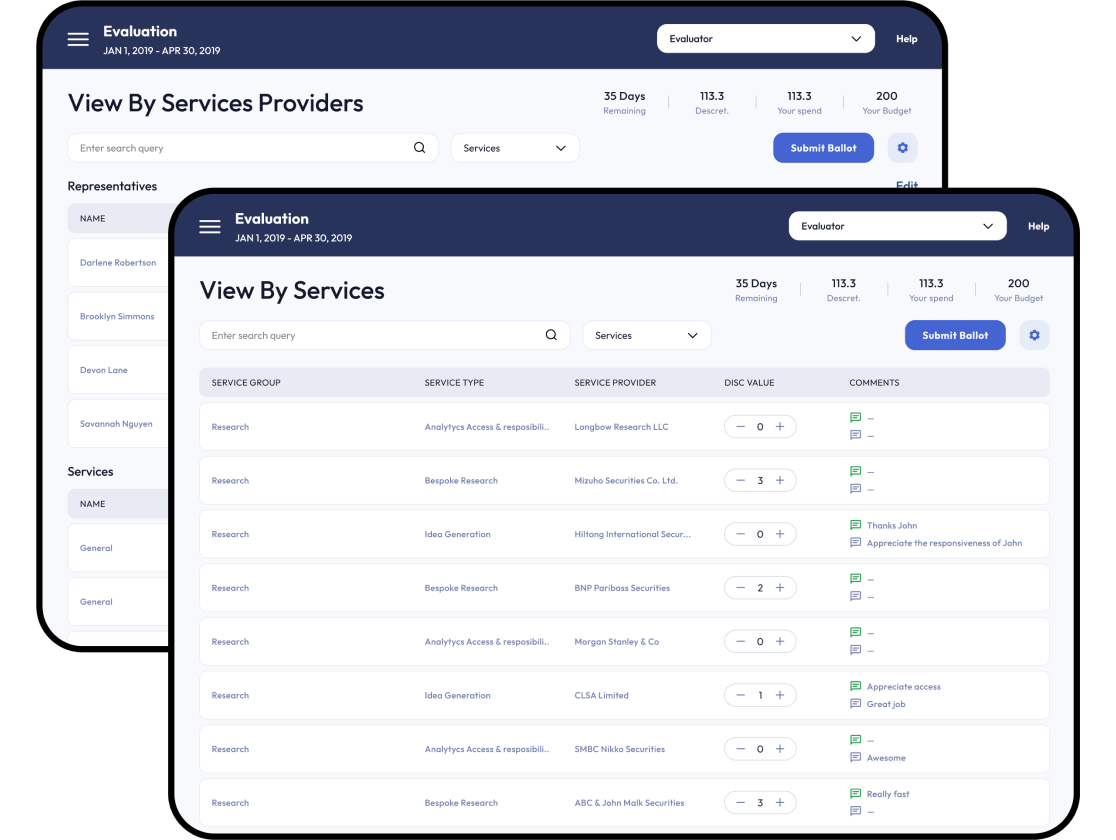

The Vote app allows management to evaluate the activities performed within a voting period. It represents a period in the past when buy-side financial institutions were consuming research services and interactions with brokers (sell-side service providers). There is an ability to include or exclude voters (the buy-side employees) and service providers in this period. While the votes are not cast, the system sends reminders by email and SMS.

The Scorecard logic is built flexibly, allowing users to select the exact templates and use needed logotypes depending upon the specific pair of "buy-side and sell-side organizations." Generation of a scorecard per each Service Provider is available by clicking on a button or automatically when the feedback period status changes to "Scorecard validation." There are also options to set "pending/final" status for scorecards and send them when the feedback period status changes to "Scorecard distribution."

CSV and PDF reports are available to buy-side and sell-side organizations as part of the voting process. This activity is performed via the Vote Platform and Service Provider Portal respectively. There are the informing reports about Interactions, Services, exact Voters, and exact Service Providers that took part in the Voting. It's possible to filter this data and export required information in CSV and PDF (iText) formats. The main scorecard report in PDF format is shared from the buy side to the sell side at the end of the Voting Period.

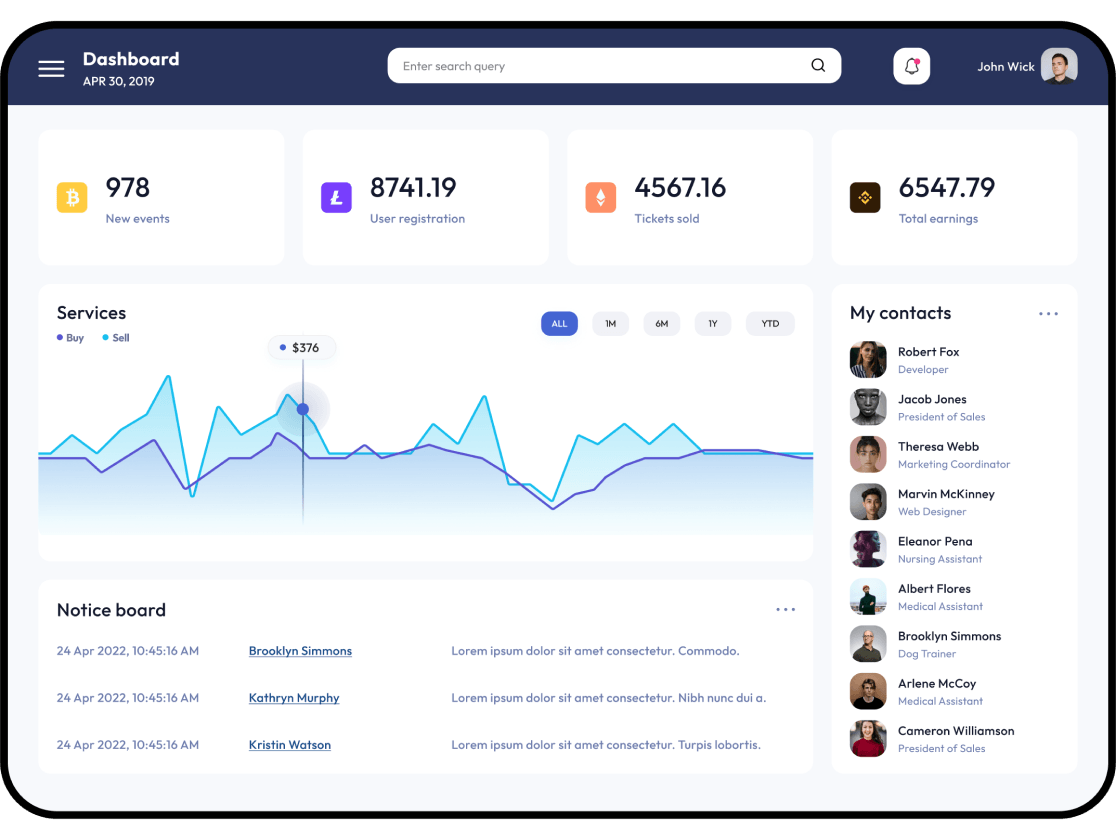

Events management and tracking are performed within the app designed for these purposes. The events managed are Researches that require specific interactions between the sell-side and buy-side: conferences with live streaming, meetings, calls, or presentations. They are mostly related to Interactions; however, some Services can also be included.

There are two modes within the solution: for buy-side organization, which “consumes” Interactions and Services, and for sell-side, which provides them. The application allows the customer to organize events, prioritize them, schedule, manage the attendees, as well as send automated emails.

Other Events functionality includes the activity dashboard, budgeting, invoices, payments, SSO, etc. Integration with the Vote Platform and Service Provider Portal enables the smooth flow of the held Interactions and Services to the voters’ ballots for further brokers’ review. In the future, strategic partnerships will extend the system into a more prominent planner.

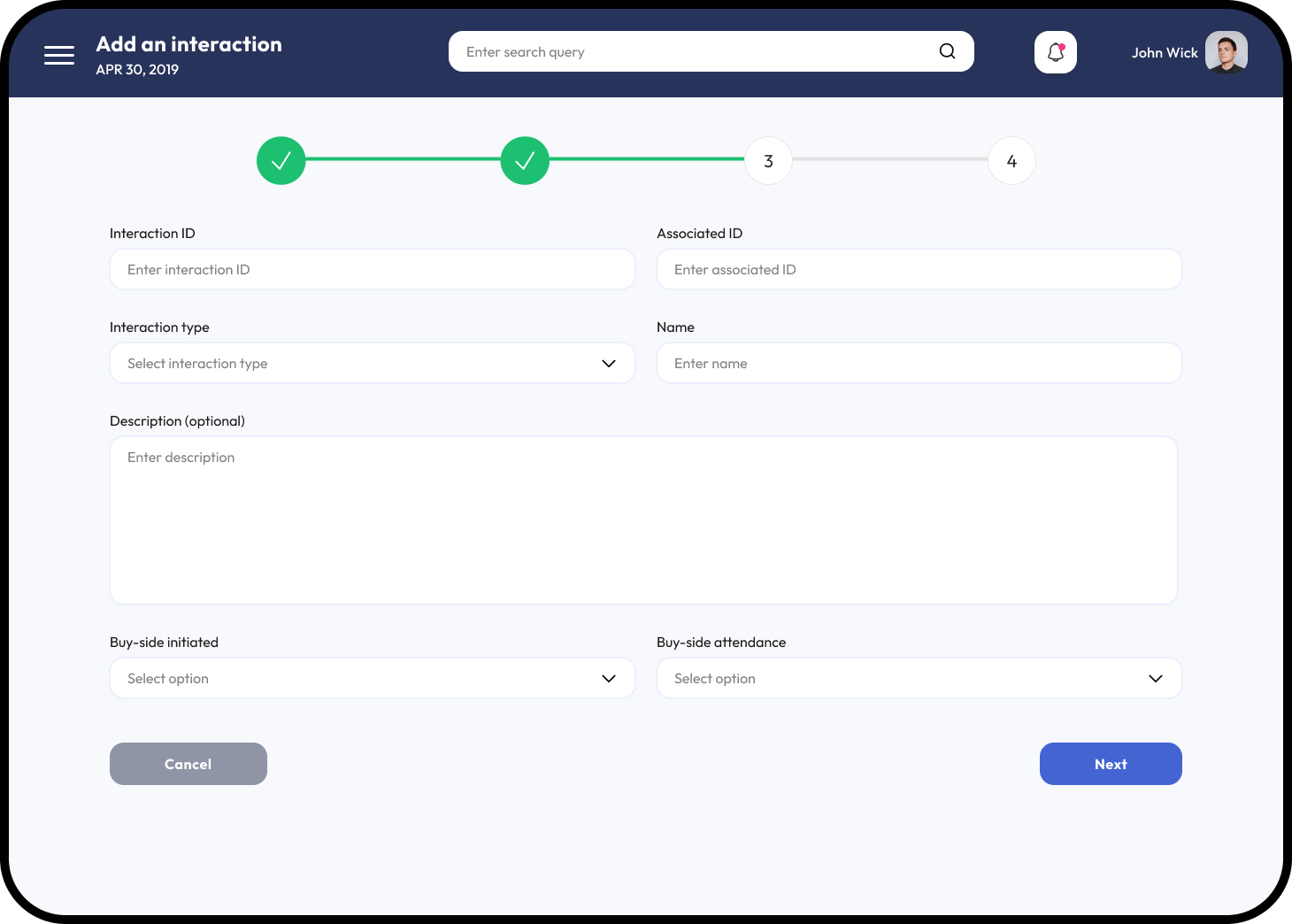

Interactions & Services workflow is aimed at Broker review and evaluation in the Vote Platform. Based on the evaluation results, the budget allocation is defined with the help of the Commission Manager.

Interactions appear in the Vote Platform when buy-side users create them directly (UI and CSV upload) or via integration with the Events Tracker or the SPP. In the voting app, interactions are rated as part of a voting period, and the exact broker who organized the interaction also gets points from the voters in financial institutions. In the case of SPP, the workflow includes defining Vote Platform parameters to allow entering the platform. Not corresponding interactions are rejected and throw an error to sell-side users when trying to publish them on the sell-side from SPP.

The Services flow is required to highlight the difference between a one-time type of research service (Interaction) and a continuous service provided long-term. The difference in Services flow is that Services can be additionally set up on the buy-side Organization level as a template to reuse in multiple vote periods. This feature’s application depends on the users’ needs and their exact cooperation model with service providers.

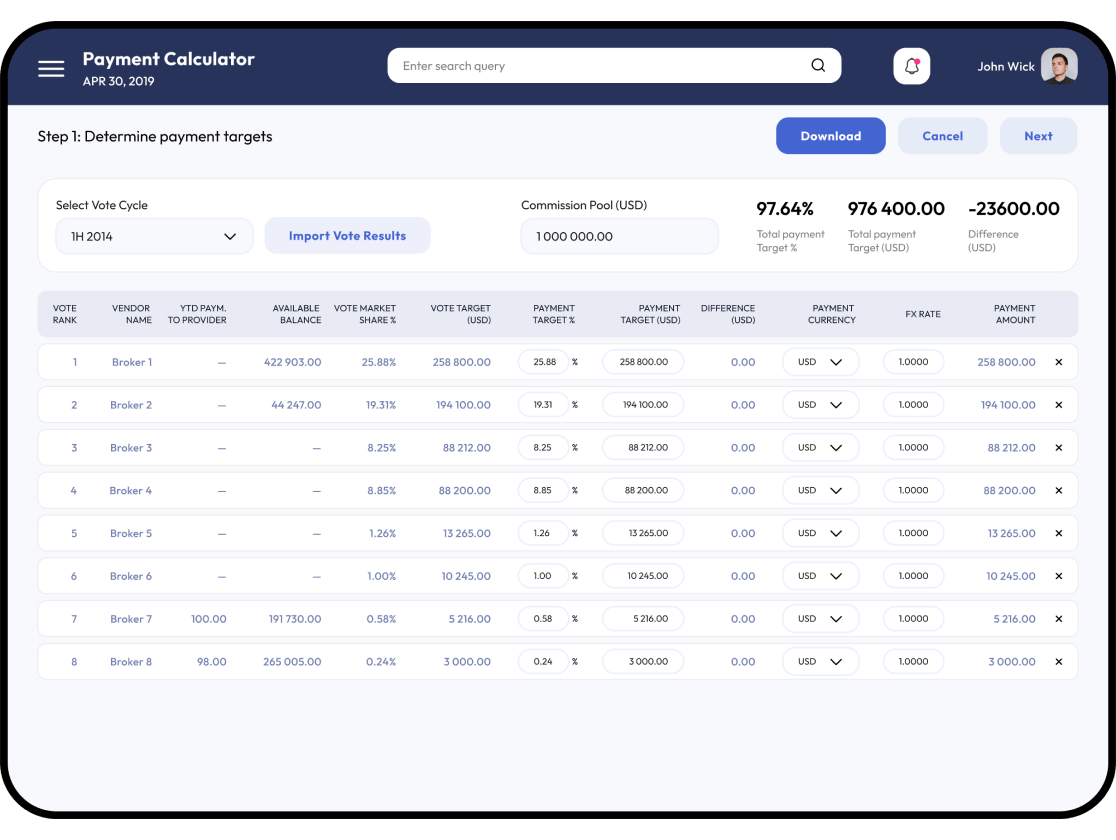

The Commission Manager (for Asset Managers & Hedge Funds) is synchronized with voting data and allows the system to track research budgets. The goal of this module is the virtual aggregation of commission credits, efficient management of Commission Sharing Agreements (CSAs), and eligible research payments across CSA brokers.

Retrieval of research evaluation results to allocate budget is supported through integration with the voting platform. It allows users to keep a historical record of interactions with research providers. Due to this module, sell-side firms can also automate the management of their clients’ CSA software to enhance their cost-effectiveness and view direct CSA activity (balances, payments, trade reconciliations, etc.).

The Reconciliation form compares "cash book" and "bank statement" transactions recorded in the system and on the bank side. Matching transactions are recorded in the form. Adjusted bank statement balance allows users to add missing into the rec form from the cash book. In turn, adjusted cash book balance is for adding missing into rec form from bank statements. After comparing the adjusted totals, the system defines errors (unreconciled amount) and adds sums to correct mistakes. Rec journal entries are automated but can be performed manually by selecting bank transactions.

The Admin Panel is designed to be straightforward and standard. It allows the customer to manage its clients from the buy-side organizations (Asset Managers, Hedge Funds, etc.) as well as users and service providers.

Organizations’ functionality includes their creation and setting them active and inactive. The managed Organizations are created in all the modules: Voter app, Event Tracker, Commission Manager, and Service Provider Portal.

User management is available for all users created on the Organization level. In addition, some Organizations may pay for special support services, so there’s a functionality of “login on behalf of a user.” Super Admin and Admins can CRUD users-employees who should provide their formal feedback for brokers' research services.

The Service Provider Portal is the part of the system where buy-side firms onboard their service providers (brokers, the sell-side firms). That’s how the ecosystem allows effective information exchange between research consumers and providers.

Technology stack

Tech stack was chosen and used considering customer needs, platform's business logic, and the EU financial market requirements

Web Architecture

Frontend

Backend

Data visualization framework

Infrastructure

⠀

Development in Detail

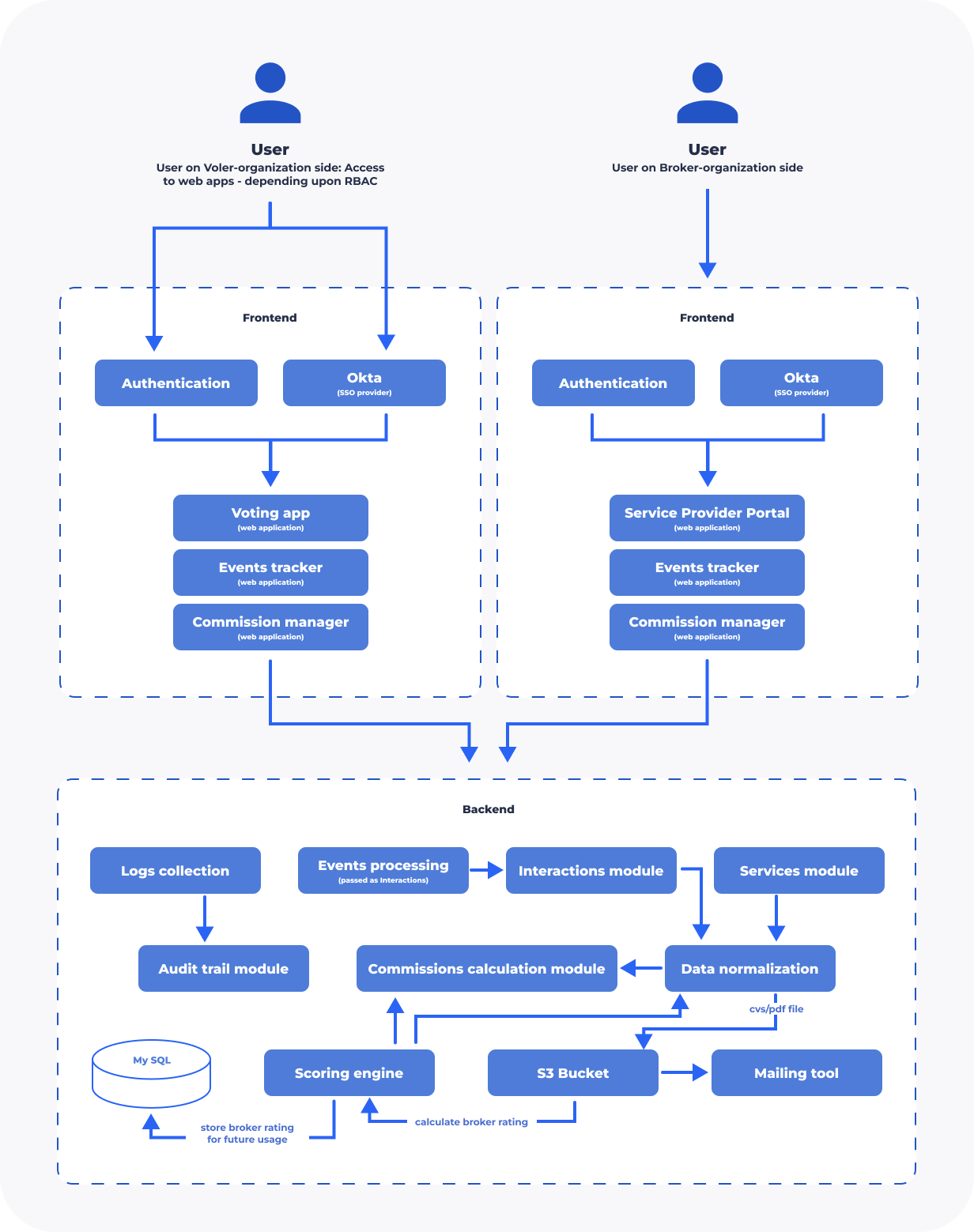

- On this project, our team deals with continuous integration, as the new platform is a complex ecosystem of several portals for different parties taking part in broker services tracking and evaluation. Our solution provides for using all applications as standalone solutions or as part of a common platform of integrated apps.

- Single Sign-on was offered to resolve the needs of our corporate users. We've decided to integrate it with the biggest SSO provider Okta, which allows us to implement a wide range of SSO approaches, such as Microsoft, Google, Confluence, and others. The platform also supports role-based access control: user roles with Super Admin and Admins permissions.

- Data visualization implies that data grids should be one of the most flexible components inside each data platform. So we've decided to use the AG Grid framework to bring flexible and powerful enterprise-level tools to our end users.

- Logs and audit trails were one of the major requirements of the MiFID II regulation. Therefore, we've implemented an ability to collect all necessary historical data related to daily usage of the overall platform, which is split by organizations and users.

Results Obtained

A SaaS oriented on the EU financial market

The Cleveroad team has successfully developed an MVP that allows the customer to start using the SaaS platform in the shortest time. The collaboration was very efficient: the percentage of changes and defects was lower than 5%, which helped us to provide the client with maximum value while staying within the planned budget.

Ability to sell SaaS services to EU clients

A web-based solution we’ve delivered covers brokerage research and supportive business processes performed in the European Union and is built to comply with MiFID II. It allows all users from the target audience brokers, asset managers, and hedge funds to use the software freely and increases customer engagement.

A long-term partnership to enrich an MVP

Our service quality was the ground for a long-term, still-lasting collaboration. New project scope (such as the mobile app for voters) is already planned, its creation has started, and further cooperation has begun. Partnership with us allowed the customer to avoid expanding the internal team and ensure a high ROI from a strategic perspective.