Online Services Ecosystem for Managing Auto Insurance

Software solution for the insurance providers for simplifying and accelerating the processes of reconciling car-accident-related issues.

Industry

Insurance

Team

14 members

Launched

2020

Country

USA

About a Project

Our customer is a US-based car insurance company that provides a fully-digital approach to auto insurance for individuals. But, its current solution was obsolete, inefficient, and didn’t allow the business to scale. The customer wanted to build new quality car insurance management software and needed a reliable IT provider with hands-on experience in insurance software development.

Goals set to Cleveroad

Create a completely new system for vehicle insurance that allows insurers and their employees to offer personal car insurance services supported by flexible policy types

Replace the legacy car insurance web app with a new responsive platform to streamline communication between policyholders and managers

Build a mobile app for the company's clients to deliver better insurance experience and profit from the rendered services.

Solutions we've delivered

Creation of a modern car insurance management system from scratch. An integration of a unique vehicle insurance app functionality allows users to easily manage policies, simplify the claims filing process and get personalized recommendations based on user behavior

Development of a fully functional web app that is customer-friendly and allows users to do policy management, conveniently file claims and recoveries, deal with reinsurance or check product configuration. The easy app interface allows the users to easily navigate the flows of the claims procedures ensuring quicker data processing and payments settlement.

Development of a customized and resilient mobile solution optimized for Android and iOS. Integration of the subscription-based premium features to ensure stable income.

Results for the Customer

The newly-developed platform that matches the business requirements and allows the client to receive profit by offering car insurance online

The client received a powerful web app capable of providing them with cost-saving and operational performance-enhancing opportunities. Moreover, through auto insurance ecosystem use, our client could improve their brand, facilitate online connections, enhance user experience, and align value streams.

A full-fledged mobile application containing a premium subscription mode is available in Google Play and AppStore to attract new clients. It allowed our customer to raise the target audience, retain the existing clients, and earn profit within the subscription business model

Business Challenges

Our client, a US-based motor insurance provider, offers services to meet the demands of their customers looking for qualitative auto insurance. They intended to create new, high-quality vehicle insurance administration software as they understood that their current business procedures and approaches might not be suitable for the fast-paced digital world. So our client needed an experienced tech partner to:

Enhance management of automotive insurance claims. Receive a customized platform for auto insurance, including the functionality that enables streamlining and enhancing the claims process to increase productivity and quicker processing times. Moreover, our software system allows claims adjusters to upload, store and retrieve documents safely online while offering real-time access to the claims pipeline for managers and supervisors to track progress and allocate resources wisely.

Integrate a revamped web solution to change its client engagement model. Introduce a new web application to resonate with the core business process and satisfy end-users expectations about the new solution. It was necessary to build a user-friendly and modern software platform, allowing the provider to solve various insurance problems of their customers quickly and efficiently.

Increase the value for the current company’s customers through a mobile app experience. Develop a mobile application from scratch to increase the online presence of our client’s business. The mobile app is intended to automate business operations, offering quick and qualitative car insurance services to their clients.

Project in Details

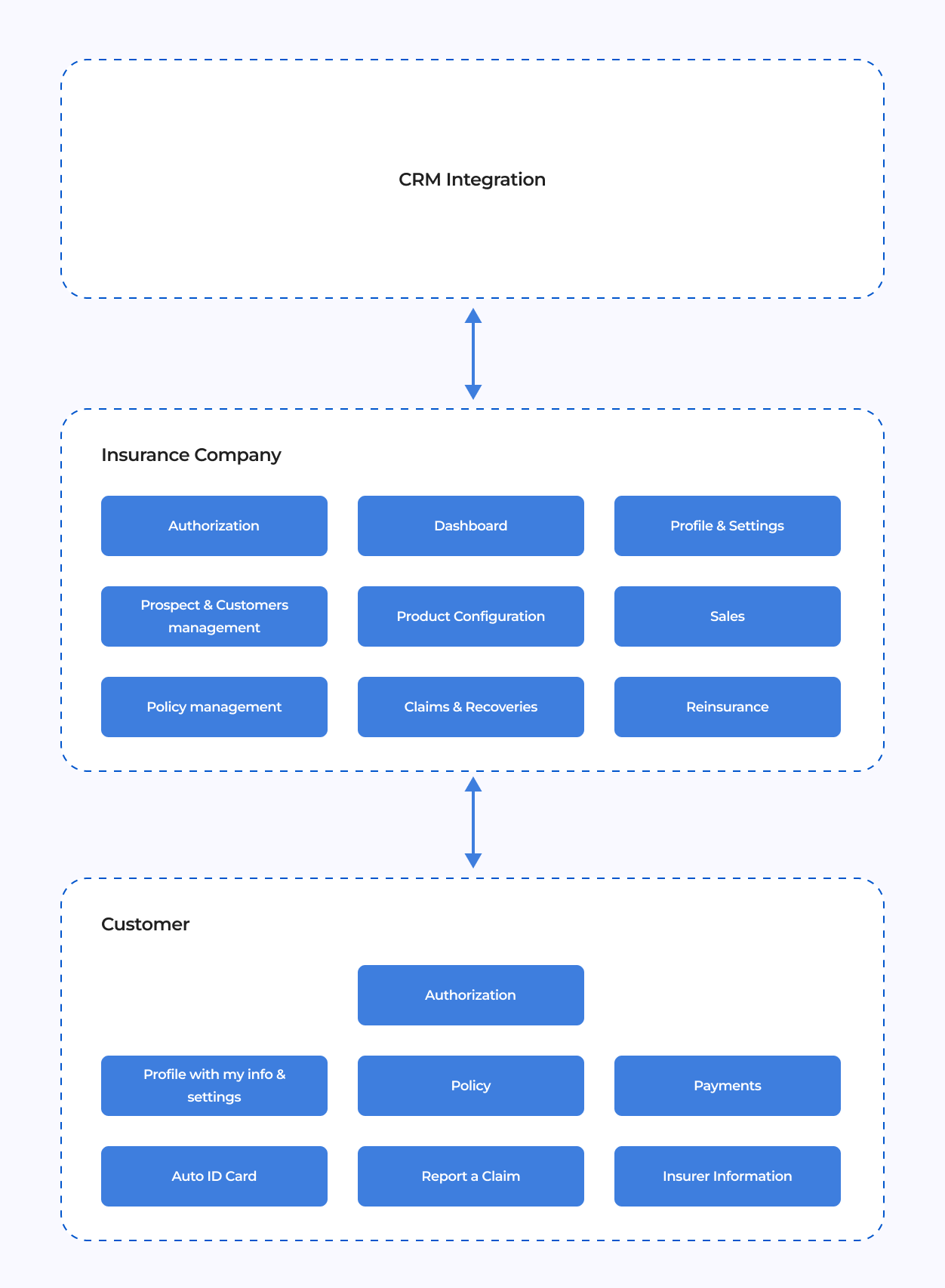

Business Architecture

- Our team had to create a car insurance web app from scratch for our customer’s company to better manage the users’ claims concerning vehicle insurance issues. The web app has policy management, claims and recoveries handling, and reinsurance functionality. Moreover, the company staff can handle prospects and customer management, sales, and product configuration settings.

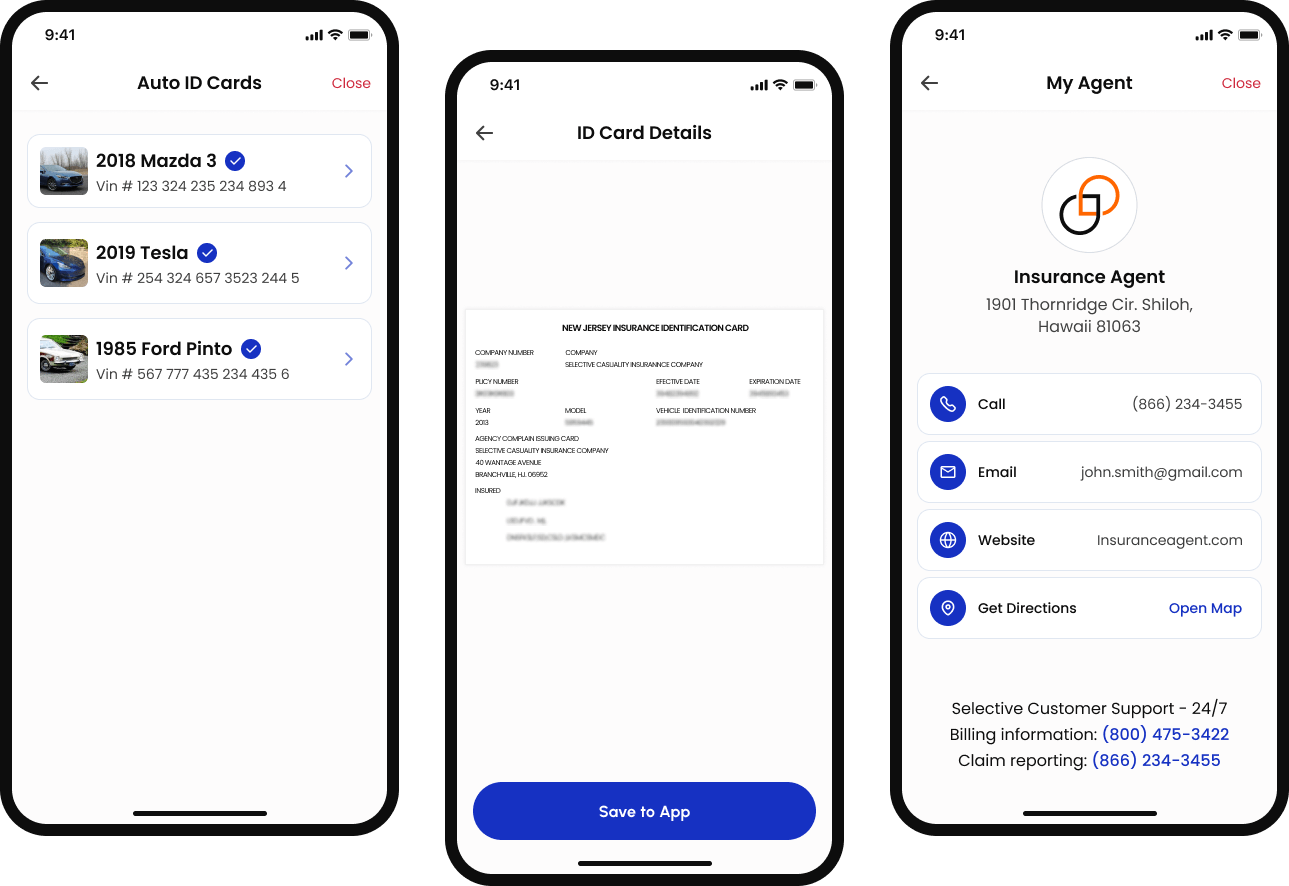

- Cleveroad team also designed and delivered a custom mobile app for end-users. It’s aimed to streamline the claim processing flow, deepen the bond between the company and their clients, and increase client satisfaction through interaction with an easy-to-use mobile solution. The users can perform different procedures through the delivered app, like checking Auto ID card, insurer information or policies, making payments, or reporting claims. The mobile app for end-users was created both for Android and iOS platforms.

- We integrated the newly created system with the customer’s existing CRM. It was required for better customer data management, allowing flawless synchronization of customer data since the CRM served the app like a centralized info repository containing user contact data, policy essentials, or history of communication. Moreover, a CRM implementation offers practical client interaction and support. It ensures a smooth customer experience by providing precise and rapid help, addressing issues, and quickly resolving concerns.

Product Essentials

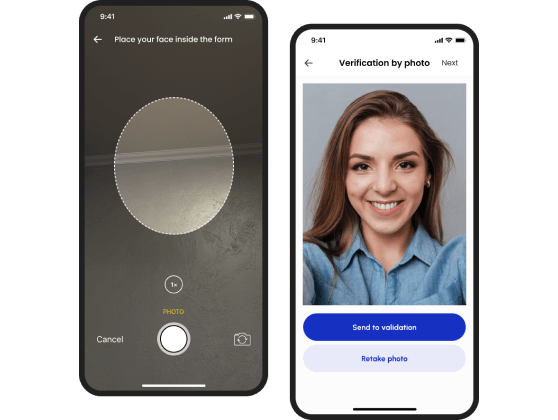

Know Your Customer (KYC) check is one of the core features of the car insurance system. It is essential to retrieve and verify primary client data. This procedure is necessary for our client to ensure their customers are proven and secure.

The Intrusion Detection and Prevention System (IDPS) integrated into the car insurance solution we’ve developed detects and prevents suspicious or malicious network activity, using techniques like network or host-based systems to stop unauthorized access, malware, and security threats.

The insurance procedures of our client were streamlined for digitization by combining them into a single application and finishing with a digital sign certification.

The digital sign functionality in the vehicle insurance software developed by our team provides a quick and safe electronic signature of insurance-related papers. It reduces physical documentation expenses and environmental effects while enhancing the ease of usage, security, and compliance.

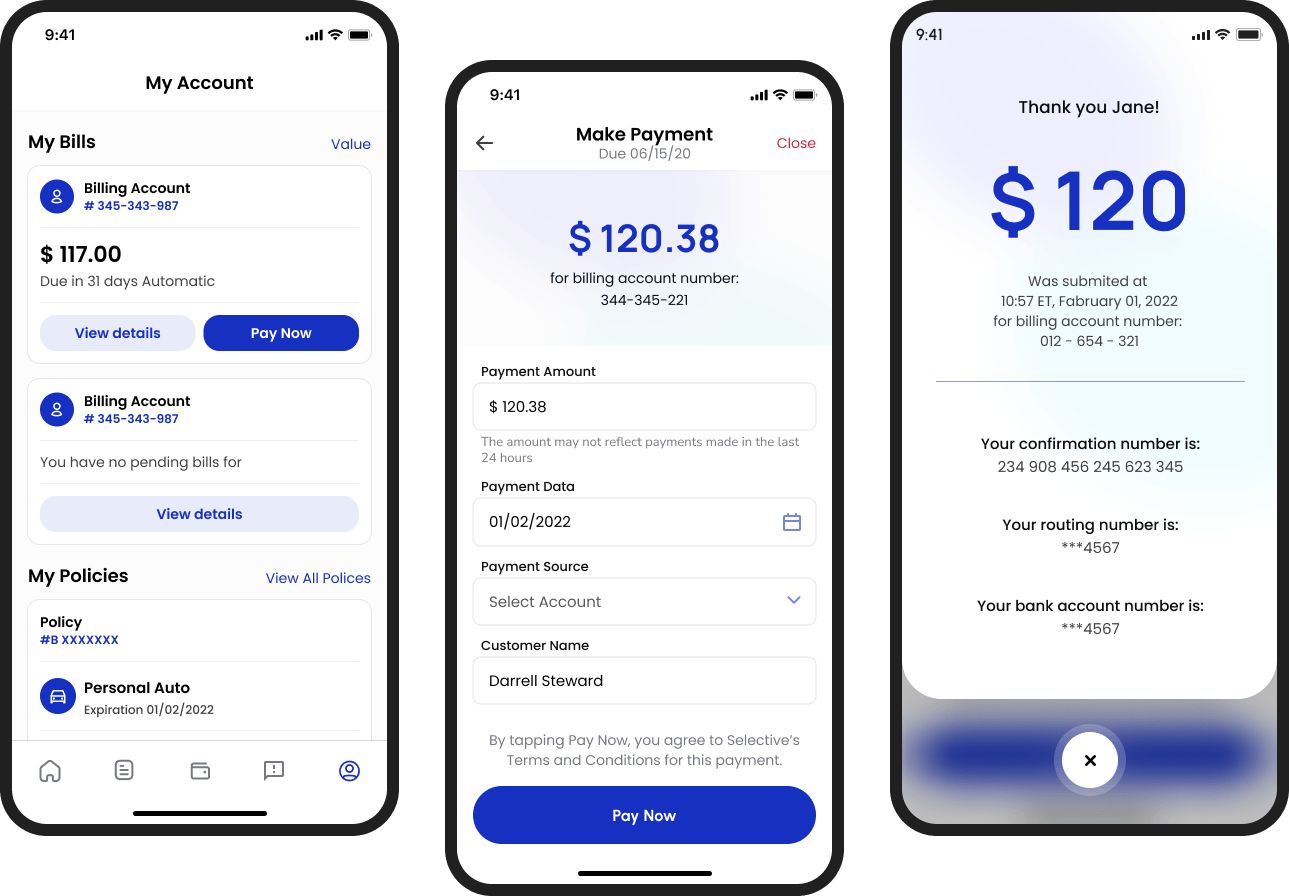

Due to this functionality, the company’s clients can track and input information about their policies, including those from other insurance companies. Additionally, the pay for policy feature consolidates all relevant data, increasing its usefulness.

Furthermore, customers can easily browse and access details from their accounts and pay policy bills instantly. This functionality also makes it easier for policyholders to pay their premiums on time by giving them a simple online payment alternative.

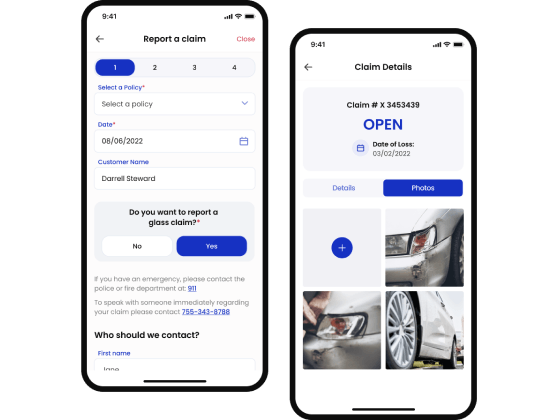

Customers can file a claim in case of an incident. The management of this process falls under the responsibility of the insurer. Both parties have the option to have real-time discussions regarding specific details.

The system is equipped with triggers that automatically send emails regarding claims processing and management. Such a process is made more accessible through integration with a map provider, as it allows for quick identification of the incident location.

The company’s clients can access a mobile application made for them. In the convenient and intuitive digital environment users can get access to the services and get their vehicle insurance. There is also no reason to search for physical copies since the information on policy certificates, insurance evidence, and car registration is instantly accessible through the mobile app

Accessing insurance company information and contact details can be helpful regularly. The application includes all the necessary standard features for car insurance allowing users to seamlessly communicate with their insurers, effectively handle their policies and claims, and receive timely reminders for their insurance operations.

Development in Detail

- First, we organized two phases within the project before the Development: Solution and Discovery phase. During the Solution stage, our team processed the data received from our client, and offered them a rough estimate for the future car insurance management system creation and form a proposal. In the Discovery phase, we provided our client with the following deliverables as the detailed feature list for the upcoming vehicle insurance solution, design concept, UX map and others.

- The Cleveroad team also integrated the car insurance management system with the customer’s existing CRM. Such integration was needed for effective customer data management so the company can centralize all the client information and automate administrative tasks. Moreover, to make sure our integrated software components work together perfectly, we've put together a Quality Assurance plan that includes integration testing.

- Our team has created a web app for our client’s insurance company. A web app for a car insurance provider offers customers an easy way to handle their insurance requirements online. Processes are streamlined, customer satisfaction is raised, and insurance operations are more effective.

- We��’ve provided a mobile app and a web app for the company’s clients to offer them a seamless user experience in operating with insurance services provided by our customer’s organization.

Technology stack

Tech stack was chosen and used considering customer needs and the solution's business logic

Web Architecture

Frontend

Backend

Mobile Architecture

Cross-platform

KYC provider

Digital signature provider

AWS infrastructure

Results Obtained

Engaging new clients with the car insurance system

The client received a convenient custom car insurance system competitive enough to easily conquer new customers’ trust and boost user retention rate. Our tech partnership with the customer keeps going to support the current product to ensure the high-quality of their services. This collaboration ensures that the system will further be up-to-date, safe, and performing at its best.

An instant and easy connection with service

We’ve developed a seamless and user-friendly customer mobile app for managing car insurance needs, including policy details and claim status. Due to it, the client can offer their services to customers on the goal whenever they need it the most. These services can now be accessed through smartphones or tablets, eliminating the need for physical office visits during set business hours.

The solution ensuring routine flows automation

The integration of the car insurance platform allowed the customer to automate their routine company flows to reduce paperwork. They could save more time, rearranging it for other valuable business tasks, like client relations and strategic planning. Our car insurance system also helped the client boost operational efficiency, reduce human errors, and enhance customer satisfaction.